Outstanding Commercial & Industrial Loans (a proxy for bank lending to small and medium-sized businesses) have been increasing steadily for the past three years, and are now only a few billion shy of their pre-recession high. This likely reflects increasing confidence on the part of banks and businesses, and as such it points to continued economic growth.

Banks continue to expand their lending activities to business, although the rate of increase in business lending (see second chart above) has slowed down a bit over the past year.

It's true that banks are lending far less than the Fed's super-abundant provision of bank reserves would normally allow. Thanks to the Fed's Quantitative Easing programs, bank reserves have increased almost $2.3 trillion in the past five years. Theoretically, this would have allowed bank lending to increase by about 10 times as much, or $23 trillion. But that hasn't happened, mainly because a) banks are not willing to increase their lending willy-nilly, and b) businesses are not willing to borrow excessively. In short, the Fed's QE efforts have failed to result in an explosion of new money because the private sector remains quite risk-averse. In fact, as I have argued many times over the past several years, the Fed's QE efforts have been primarily directed at satisfying a risk-averse world's craving for safe assets, rather than expanding the money supply.

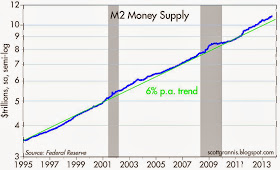

As the chart above shows, M2 (arguably the best measure of the U.S. money supply) has grown only slightly faster in recent years than its long-term average growth rate. Most of this above-average growth can be attributed to a significant increase in the demand for money. Today, 65% of M2 is held in the form of bank savings deposits (just over $7 trillion, up from $4 trillion at the end of 2008), with the remainder held in the form of currency (10.6%), checking accounts (12.8%), small time deposits (5%), and retail money market funds (6%). With savings accounts paying almost nothing in interest, it's reasonable to assume, therefore, that the vast majority of the increase in money supply has been demand-driven. It's not the interest rate on money balances that is attractive, it's the risk-free nature of bank savings deposits that is attractive.

What's holding back the economy is not a shortage of money, it's a shortage of confidence. Bank lending by itself can't create growth, since growth only results from getting more output from a given amount of inputs. Bank lending can facilitate growth, of course, since many worthwhile enterprises might otherwise be unable to access the private debt markets. If confidence were higher and if banks and businesses were less risk-averse, we arguably might have a much stronger economy. But at least the ongoing increase in bank lending is a step in the right direction. Confidence is slowly returning, and risk-aversion is slowly declining, and those are essential ingredients for a stronger economy in the years to come.

The decline in the price of gold (see chart above) is another way to see how risk-aversion is slowly declining.

You write, “confidence is slowly returning, and risk-aversion is slowly declining” ...Yes this is true,

ReplyDeleteAnd you write, “and those are essential ingredients for a stronger economy in the years to come”, .... This would be true, but a strong economy is not in the works, it is simply not going to happen, as the growth that has come since 2008, has been due to central bank policies of credit liquidity, specifically QE1 through QETernity, and POMO, as well as banker provided credit liquidity for speculative leverage invesment which has resulted in a fiat asset crack up boom, which is always followed by spectacular crash, often called a Minsky Moment.

You write, “The decline in the price of gold (see chart above) is another way to see how risk-aversion is slowly declining”

This is incorrect, the decline in the price of gold is due to investors using credit margin “to go all in” and buy risk assets such as the following:

Solar Stocks, TAN, with year-to-date performance of 152% gain.

Social Media, SOCL, with year-to-date performance of 60% gain.

Nasdaq Internet, PNQI, with year-to-date performance with 53% gain.

Biotechnology, IBB, with ETF, year-to-date performance with 50% gain.

Internet Retail, FDN, with year-to-date performance with 47% gain.

The US Dollar’s dramatic fall lower is seen in the chart of the 200% ETF, UUP, trading parabolically lower, as currency traders bought the Major World Currencies, DBV, such as FXB , FXF, FXS, FXE, FXA, FXC, and FXY, and Emerging Market Currencies, CEW, such as BZF, ICN, which can be seen in the trading of these financial instruments in their Finviz Screener.

With the strong trade in Euro-Yen currency carry trade, that its the EUR/JPY, FXE:FXY, and the Australian Dollar-Yen currency carry trade, AUD/JPY, FXA;FXY, coupled with the strong surge in risk free lending, seen in the chart of the short term credit ETF, FLOT, which is translated into a parabolic rise in World Stocks, VT, it is reasonable to perceive that peak fiat money has been achieved, and that Major World Currencies, DBV, an Emerging Market Currencies, CEW, will be trading lower, as investors pivot from risk-on investing to risk-off investing, deleveraging out of risk assets.

The result will be a loss of confidence and a strong economic downturn.

The price of the Gold ETF, GLD, seen in Finviz Chart, ... http://tinyurl.com/nrehus ... shows it to be in breakout at 127; it is likely to fall lower, as it is will trade lower with falling currencies and with falling commodities, before it soars as people safe assets; in a debt deflationary environment, that is interest rate rising environment and in an enduring currency value falling world, especially one characterized by authoritarianism, it and diktat will be the only assets of confidence, that is the only things people will trust in.

Nice post. QE? Well, one thing I noticed: The Fed has done about $3 trillion in QE and bank excess reserves increased about 2.2 trillion.

ReplyDeleteSo, even if one assumes that the QE went into bank reserves---and I am not sure about that---it did not all go into reserves. You still have $800 billion out there somewhere.

I hope we are in a virtuous cycle here, pertaining to C&I loans. Many banks, probably all, make business loans against collateral. That usually means real estate.

With real estate values reflating, C&I borrowers are able to offer more collateral and borrow more.

You know, so much of what happens at banks is tied to real estate. And if real estate plummets---well, check out Japan 1990---present, or check out the USA 2008---present.

A momentary policy that targets steady mild inflation may be ideologically incorrect, but as a practical matter....if you can keep real estate value from plunging you will avoid serious recessions or worse...

Given the news about the Fed's $13 billion shakedown of JPM, why would any bank do anything other than collect deposits for 0.05% and lend short term at 2%?

ReplyDeleteYou wonder why economic growth is anemic while the administration chokes the banks...

Banks don't lend out a penny of their reserves, ever. There's a good paper on this by Paul Sheard, S&P Chief Global Economist, titled Repeat After Me: Banks Cannot And Do Not “Lend Out” Reserves.

ReplyDeleteWatch for "Abenomics" to gain traction in the US -- the Bernanke QE's were mostly used to fill the vaults at "too big to fail" banks -- these banks need the cash to cover the reality of commingled accounting between their client accounts, and the banks trading accounts -- once the world figures that out, the newly formed "bank reserves" will be required to cover withdrawals and restore credibility with banking clients -- in the mean time, "Abenomics" has the potential to give the illiquid "too big to fail" banks some cover in order to sustain their "true" reserve realities (all the client money at "too big to fail" banks is gone -- poof!) -- again, watch for Abenomics to rise in America, probably with the support of the "too big to fail" bankers along Wall Street.

ReplyDeletePS: Follow the link below to learn about "Abenomics"

ReplyDeletehttp://www.bloomberg.com/quicktake/abenomics/

If my companies experience is any indicator, health insurance cost increases will be huge. The question must be asked - How harmful could this be to the economy. Could it actually cause a recession? Coverage is now mandates for physicals [we used to pay $100, now Blue Cross pays the Dr. $400 in actual payments - who do you think pays for this? Us in higher premiums. Same goes for expanded psychiatric care, birth control, maternity, etc. etc. etc. Our premiums went from $250 to $550 per month [family of 5] due to these changes. Now Blue Cross cancelled our plan [high deductible]. New plan will likely be $800 month. I've never seen such an impact to our discretionary income in 15 years in business.

ReplyDeleteScott,

ReplyDeleteIt seems that AG Holder backed by the president of the united states is going all out on the banks and it's just the beginning.

Regardless if this is justified or not, could it have any material impact on the economy?

I have a certain opinion that they will cut costs in any way possible and tighten landing, I'm just not sure how to quantify it. Common sense says it will, is it possible for you to quantify it?

Thanks.

Hi M Miller, you have to understand that saving Federalism from itself (including its sponsors from the military-industrial complex, the medical establishment, Wall Street, and Federal workers) will require all available resources and dollars from Main Street simply to power Federalism for a few months -- the Federal appetite is that large -- you can expect income taxes, Social Security, and Medicare to devour 100% plus of your income in the near future -- nothing less than all of Main Street's limited wealth will satisfy Federalism's appetite -- at this point, nothing can stop Federalism, which always gets her way -- that's just the way it is in America -- anyone who is not part of the military-industrial complex, the medical establishment, Wall Street, and Federal employment has been disenfranchised from the benefits of our nation -- again, Federalism needs all of Main Street's wealth and productivity to save Federalism from itself -- the movie, "Hunger Games" is the new model of economics in America -- the "districts" live in poverty and hunger, while providing anything and everything Federalism needs to remain prosperous -- the people wearing the strange costumes living in the center are beneficiaries of Federalism -- the disenfranchised in America no longer have a voice in our nation's future -- most Americans should be terrified of military-industrial Republican and big government Democrats who intend to pillage and loot Main Street into oblivion...

ReplyDeleteRoy, re the administration's war on banks: Unfortunately the Obama administration has been beating up on banks for a long time. The market is aware of this, however, and it is reflected in very low multiples for the large banks (~10). Banks are aware of this, and that is why they have not been lending willy-nilly and why they have been accumulating excess reserves. So this has already had a depressing effect on the economy; it's not new. Will it get worse? That is the question. I'd like to think it won't.

ReplyDelete