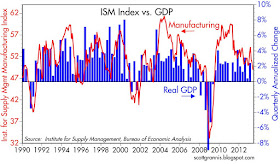

Today's ISM manufacturing report was weaker than expected, and is consistent with economic growth in the range of 1.5 - 2%, which is the pace of growth that has prevailed for the past three years. Manufacturing helped power the recovery in the first few years, but activity has moderated in the past year or so in a pattern that is fairly typical in the middle phase of economic expansions.

The May ISM manufacturing index came in at 49, below expectations of 51. Although this signals that slightly more firms reported that conditions had weakened from the prior month, this does not suggest that overall economic activity declined. As the chart above suggests, a reading of 49 is consistent with economic growth of 1.5 - 2%.

The prices paid component was neutral, suggesting that firms are not experiencing significant inflation or deflation pressures.

The employment component was also neutral, suggesting no future pickup or deterioration in manufacturing activity. For the most part, firms are not expecting any meaningful change in the environment.

The softening of activity in the U.S. manufacturing sector is offset to a degree by some marginal improvement in manufacturing activity in the Eurozone.

Construction spending in April rose a modest 0.4%, on top of modest upward revisions to the past few months' data, leaving total spending 4.3% higher over the past year. Nothing to get excited about here.

Construction spending represents about 40% of the broader "domestic private fixed investment" category, which includes equipment and software. Fixed investment has rebounded in the past three years from extraordinarily depressed levels, and this tracks well with the decline in the unemployment rate.

It's steady and (disappointingly) slow as she goes. Business confidence and willingness to invest needs to improve a lot more if we are to see any meaningful improvement in the economic outlook. So far there is no sign of that.

The Fed needs to be far more assertive in increasing aggregate demand. That shows up over and over again. Weak demand growth, and dead inflation.

ReplyDeleteDoes it get or obvious than this?

I agree Benjamin, but the future of the US is not going to be based on the US consumer, who is essentially become irrelevant -- sales of military arms overseas for example, enhances Federal revenues -- also, Wall Street banking deals on the global economy are good for Federal revenues -- the Federal government no longer needs the US consumer to make its revenue targets -- what the US needs is hard currency deals with foreigners -- accredited investors have a place at the global economic table -- everyone else should be under cover or running for their lives...

ReplyDeletePS: Hunger Games is the new economic model in America -- most Americans are destined to live in the "districts" -- watch for a new guilded age in Washington, DC under the Federal "Hunger Games" economic design for America...

ReplyDelete