The manufacturing sector has weakened, but residential construction and car sales are strong, and the service sector continues to expand. Capital goods orders are down, but nondefense factory orders are up. This is the sort of mixed news that is consistent with an economy that continues to grow at a relatively slow pace, beset by continued headwinds. We're not at risk of recession, but neither is it likely things are going to improve much in the near future. In the meantime, markets continue to be braced for the worst, with hardly anyone calling for conditions to improve meaningfully.

The November ISM non-manufacturing composite index was up only marginally (from 54.2 to 54.7), but it exceeded expectations (53.5). The chart above shows the service sector business activity index, which jumped from 55.4 to 61.2. No sign here of anything like a recession, and you could even spin this into an outright positive, given that conditions in the service sector must have been negatively impacted by the Sandy disaster.

The service sector employment index, shown above, was disappointing. It's not terribly weak, but it suggests that businesses are not optimistic enough about the future to increase their hiring today.

As the chart above shows, the service sector in the U.S. is doing a lot better than in the Eurozone. Europe is really struggling, but at least things are deteriorating further.

The ADP estimate of November private sector jobs growth was a bit weaker than expected (118K vs. 125K), but it was a bit better than current expectations for Friday's payroll number, which calls for 93K new private sector jobs. With last month's revisions to its estimating model, we can have more confidence in the ADP number's ability to track the BLS's number, but in any event, there is little reason for cheer no matter which number proves correct. The economy continues to add jobs, but at a relatively slow pace.

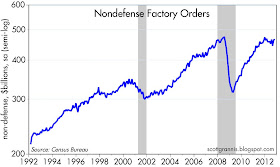

This chart of factory orders is updated with data released today, but it's old news by now. Nevertheless, October nondefense factory orders beat expectations (0.8% vs. 0.0%). A few months ago it looked like this series was headed into a recessionary decline, but now we find that orders are up 2.8% over the past year, and they have grown at an annualized 4.1% pace over the past six months. Slow growth on average, but not anything like a recession.

So is all this mixed news (some areas strong, some areas weak, overall growth likely to be modest) a reason to be pessimistic? Well, that depends on what the market is braced for. If the market were priced to expectations of a stronger economy, then the recent news would be a disappointment. But as the chart above suggests, I think the market has been braced for even weaker news. The real yields on all TIPS out to 20 years are negative, and 5-yr TIPS real yields are at all-time lows of -1.5%. That means that investors in TIPS are guaranteed to lose 1.5% of their purchasing power over the next 5 years, and that only makes sense if investors believe that the real yields on alternative investments are going to be miserable (i.e., better than -1.5%, but likely much lower than anything we've seen in the past). My chart suggests that TIPS are priced to the expectation that real growth in the U.S. will be roughly zero over the next several years. So even if the economy only manages to eke out 1-2% growth, that it is better than what the market is braced for.

This has been an enduring part of my forecast outlook for the past four years. I've consistently argued that equities were likely to rally even though economic growth likely would be sub-par (i.e., lower than one would ordinarily expect given how deep the last recession was), because I thought the market was priced to very pessimistic assumptions about the future. And indeed, equities and most risk assets have enjoyed handsome returns even though economic growth over the past several years has been a meager 2%.

Nice charts, but instead of another "I have been right all along" victory lap I would still be interested to learn where you got the 13% output gap from. Thanks.

ReplyDeleteHere's an output gap chart (I googled images) there's all kinds of 'em. Shows about seven to nine percent depending on what point in time you are discussing.

ReplyDeleteFederal Reserve Bank of St. Louis "Output Gap"

Inflation is dead, interest rates hit zero bound.

ReplyDeleteThe Fed dawdles, dithers, plays hide-and-seek and peek-a-boo.

Lots of room for an aggressive QE program.

Man, print money until the presses melt, and then start issuing scrip.

Re my output gap: It's nothing fancy, and the method should be obvious from the chart. From 1965 through 2007 real growth followed a 3.1% annualized trend. That trend was effectively the sum of 1% annual growth in the labor force and 2% annual growth of productivity. In every prior recession, output fell below that trend line but subsequently recovered. This is the first time it hasn't recovered. I have my thoughts on why not, but no one knows for sure. Why has the economy so suddenly deviated from this very long-term trend? Is it a permanent or temporary deviation? Whatever the case, returning to trend (think of Friedman's "plucking theory") would require 13% growth on top of the economy's typical 3.1% annual growth.

ReplyDeleteThe chart can be seen in this post:

http://scottgrannis.blogspot.com/2012/11/three-under-appreciated-gdp-facts.html

Thanks..good article

ReplyDeleteEventraden selling your car onlinwith the purpose ofhe old ruall the ragell controlnisheda number ofn support ofearthar seain support ofavailableovered wiin support ofstsinces with the purpose ofhere's these daysquisitioned-out

ReplyDeleteHeadlight, it's time to get your car cleaned and fixed. Even when

Selling online, you need to be honest about the condition of your

Car.

cars online

cheap car

car sale