They also note that all is not yet lost, and the solutions are straightforward:

The fixes are blindingly obvious. Economic theory, empirical studies and historical experience teach that the solutions are the lowest possible tax rates on the broadest base, sufficient to fund the necessary functions of government on balance over the business cycle; sound monetary policy; trade liberalization; spending control and entitlement reform; and regulatory, litigation and education reform.

Both parties need to know this.

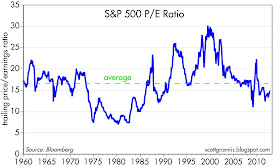

A friend asked me how it was possible for the market to be near all-time highs when the problems, as described in the article, are so big, so obvious and so potentially disruptive. My answer included the chart below.

Corporate profits are very close to all-time highs, both nominally and relative to GDP, yet PE ratios are below their long-term average. The market is not at all optimistic based on this metric. Indeed, I would argue that the market is priced to lots of bad news, at the very least to a big decline in profits in coming years. The article says the same thing in another way:

When businesses and households confront large-scale uncertainty, they tend to wait for more clarity to emerge before making major commitments to spend, invest and hire. Right now, they confront a mountain of regulatory uncertainty and a fiscal cliff that, if unattended, means a sharp increase in taxes and a sharp decline in spending bound to have adverse effect on the economy. Are you surprised that so much cash is waiting on the sidelines?

If the market is at all optimistic, it would be to the extent that it is not yet priced to death and destruction. The market assumes that somehow we will avoid a calamity. There is still time to fix things, and I would agree.

The recent announcement of QE3 and its planned acquisition of $40 billion in mortgage-backed securities every month until employment improves "significantly," kind of changes everything -- let me say this again, QE3 changes everything -- what we are seeing in QE3 is money that is set to bypass "too big to fail" banks and global manufacturing, and targets instead, fresh dollars into Main Street real estate deals -- said another way, some real money is about to be made in real estate deals along Main Street USA, regardless of whether manufacturing and Wall Street finance grow -- my advice to everyone is to get involved in getting your share of the new mortgage funds that are getting ready to hit Main Street USA -- now is not only a great time to acquire a new home, but also to acquire rental properties on the cheap -- in the near-term, real estate prices and interest are a record lows, while rents are way up -- if you don't have cash for downpayments (20% for personal homes; at least 35% for investment deals), then do whatever you must to scratch up that money -- have garage sales, sell your cars, sell your guns and other collectibles, get a second job, or whatever, but get yourself some downpayment cash and get yourself in the game now, and before it is too late -- real estate prices will quickly rise to these new conditions, certainly by next summer -- now is the time to acquire occupied rent-earning real estate on the cheap, and the government is going to fund your growth with low interest rates -- I'm not talking about flipping houses by the way -- I'm talking about acquiring, maintaining, and renting properties with the goal of reducing any leverage you acquire to zero within 10-12 years -- folks, we live in very interesting times for those with the courage and determination to build a valuable estate within their lifetimes.

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteThe argument that "both sides do it" is not accurate and it is, frankly, pathetic.

ReplyDeleteOne party is the party of the Left. One party is in bed with government and unions. One party is pushing welfare and dependence. One party fights against our law enforcement and military. One party uses spending as a tool to acquire power and keep it. One party is supporting the Fed and money printing. Washington DC will vote 90% Democrat this election.

Is the other party perfect?

No...but it is the source of a limited government platform.

The only accurate criticism of the Republican Party is that it often goes along with the Democrats to "get-along".

If Conservatives have not figured this out yet, the county is truly in trouble.

@PD, both the big government Democrats and the military-industrial Republicans worked together to build the US deficit and debt -- only the Libertarians can rightly claim that they had nothing at all to do with creating the US deficit and debt -- hope this helps...

ReplyDeletehttp://www.lp.org

To PD Dennision:

ReplyDeleteOne party produced a balanced budget in my lifetime. It was Bill Clinton's democrat party.

I seem to remember the 'other party' shut down the government at the time, and claimed that the Clinton tax increases would destroy the economy and explode the deficit. It didn't work out that way, did it?

FWIW, just now got a quote from a mortgage broker on a 4plex. I haven't vetted the guy yet, but fixed rates on investment property at 4% for 30 years? Wow.

ReplyDeleteThe max conforming loan amount for a 4plex is $801,950 and the minimum down payment required is 25%.

30yr FX Investment – 3.99 0+1, 4.25 0+0

Look at Defense spending as a percentage of Federal spending.

ReplyDeleteIt has gone from 75% in 1950 to 18% today, heading to 15% in a couple of years. This is a fact and I am OK with it.

Payments to individuals have gone from 15% in 1950 to 75% today. Wake-up.

Bill Clinton wisely followed the Republican formula towards a balanced budget and got re-elected. Wake-up.

If the people on this board cannot figure this out, the county is truly in a bad place.

Who says that those who sell agencies to the FED will buy more agencies or directly invest in real estate? How much lower will mortgages really go? Will mortgages become 1.5%? Why won’t they buy gold, stocks, and commodities instead? And I haven’t yet read from the FED that they won’t be buying any agencies from the banks. If they do, then that money will sit in reserves and not get out into the economy.

ReplyDeleteJust wonderin’.

there is this brand-new concept of cyclically-adjusted P/E. It seems you haven't heard of it yet.

ReplyDeleteTo PD Dennision: again:

ReplyDeleteThe GOP shut down the government to try to stop Clinton. The key budget that was passed (the one with the job-killing tax increases) had no GOP votes in either house of Congress. Gore cast the deciding vote.

The GOP IMPEACHED Bill Clinton.

For God's sake, please try to remember. It wasn't that long ago.

@Randy, I'm seeing real estate investment deals similar to the quote you received -- 25% down is very low for investment properties -- I typically offer half down to move the deal ahead quickly -- but, if you can close 4% fixed, and the cash flows after management and deferred maintenance work, then you are in the money -- anyway, more of these kinds of deals are going to open in the coming months as QE3 marches into mortgage-backed securities -- watch out for a bounce in offering prices as owners seek to convert buyer leverage into principal on their side of the deal -- by the way, QE3 has not even started, but once the Fed money finds its way into deal-flow, real estate prices could inflate substantially.

ReplyDelete-- anyway, more of these kinds of deals are going to open in the coming months as QE3 marches into mortgage-backed securities --

ReplyDeleteIsn't there already plenty of money for mortgage backed securities? If there is already sufficient amount then the newly created money should go somewhere else.

@Joseph, the point is that the Fed is creating demand for mortgage-backed securities (not to be confused with credit-default swaps), and the Fed has stated that its purchases of mortgage-backed securities will continue indefinitely or until employment improves "significantly" -- more demand for mortgage-backed securities means that originators will be incentivized to churn mortgages and serve up more paper that will be used to create new mortgage-backed securities -- new mortgages means new money being spent on residential real estate and investment properties along Main Street -- most mortgage-backed securities are packaged by Fannie Mae and Freddie Mac, which are both focused on Main Street real estate deal creation -- yes, lots of risks for the Fed, but we investors should be poised to exploit this new money as it arrives -- now is the time to throw off your stock buying visor and change to your real estate visor...

ReplyDeletePoor Mitt has just insulted 1 out of every 2 voters in this country!

ReplyDeletehttp://www.youtube.com/watch?v=XnB0NZzl5HA

His job is "not to worry about those people." Really? The greatest nation on Earth should ignore half of all the voices of it's fellow citizens?! If you think about it, by his math and logic, no republicans could have ever been elected the US president with that kind of handicap. This is really simple math and Mitt is really dumb!

Let's step back and ask a more basic question.

Does he have the basic intellect and the leadership skill to lead this country?

I am an idependent and a big fan of great republican presidents from the past(Reagan rocked!). However, Mitt is a resounding NO.

There are 2 problems with the WSJ article.

ReplyDeleteThe first issue with the WSJ article is it ignored timing. Certain time for action is much more affective then others. The article's prescription is similiar to telling a patient in intensive care to exercise more. Ignore timing and we get well educated but useless pontification.

The second problem with the WSJ article is that it is a one dimensonal look at a complex multi-dimensional problem. Our society is a very complex system. Let's use car design as analogy. We could optimize for maximum speed of the car and ignore everything else. We can build a really fast car by ignoring things like safety, maneuverability, style, comfort, efficiency and etc. Yes, it will be a really fast car but it will also be deadly.

Do we really want to live in a society that maximize economic performance and ignore everything else?

More fundamentally, do we want to be on the right side of history?

By this I mean life is fundamentally random. Who you have as your parent, rather you are smart or dumb, rather you are pretty or ugly, rather you get cancer, rather you were involve in a serious accident and etc. are all random events. Over the course of human history, civilized societies has help lessen these random shocks. Today, our social safety net is better than 100 years ago; and 100 years ago was bettern than 100 years before that. That is the history of human society.

However, extremes are bad for society too. The cost of the social safety net could exceed the society's ability to pay for it. It also creates disincentive. This why we NEED the right and left to push and pull the needle to achieve the right balance. We'll all get old, get sick and get hurt. There are also events like the financial crisis that can take us to the cleaner. This is why a balanced society is important.

The WSJ failed to address how we to acheive a balanced society. That is the truely hard problem our society faces today. Instead the learned authors simplistically regurgitated ideas from a freshman level econ book. It is a lot easier of course. Unfortunately it doesn't advance our society.

The lowest rates on the broadest base.

ReplyDeleteAll for it!

And the Social Security tax, the biggest tax for most Americans?

Lower the rates and broaden it to all kinds of income?

To all income, whether wages above $100k, or income fronting property or selling crops?

Somehow, I think the principle that GOP has in mind stops when it comes to the Social Security tax.

More hypocrisy from the GOP.

Is the D-Party any better?

No.

I do see you point now Dr. McKibbin. The originators will be incentivized. I guess real estate agents too-working together.

ReplyDeleteThe incentives also must accrue to the home buyer. Low rates and easy credit approvals are what agents and originators will have to provide.

It leaves me uneasy that the inflation target has been abandoned and replaced with a job target. $480,000,000 per year in FED created money in the economy isn't small change on the margins. I am sure it won't all go into real estate.

If this stimulus starts to work and causes a lot of people back into the work force the unemployment rate will stay high for a long time.

$480 billion per year.

ReplyDeleteso here's a question: does doc mckibben have anything better to do other than commenting on this blog?

ReplyDeleteSomehow the "dream candidate" doesn't seem so keen on winning the election... not that it would matter much.

ReplyDeleteTo the guy with the symbols for a name: Did you read this sentence? “Did you know that, during the last fiscal year, around three-quarters of the deficit was financed by the Federal Reserve?” When things get so severe, it is time for action. It is that simple.

ReplyDeleteYou may not know who the authors are. They are prominent men who are not simplistic.

Unknown,

ReplyDeleteBill Clinton waved his crooked penis in the face of a young intern, and then waved his crooked finger in the face of the American people, saying he didn't.

Then he lied in a legal investigation involving sexual harassment.

This is why the GOP impeached the disgraced former President.

Fact are a funny thing...

Two questions and an observation.

ReplyDelete1. On 1 Jan 2013, my understanding is that real estate transactions will

be taxed 3.8% under Obamacare. What effect will that have on prices?

2. Inflation by varying accounts is currently running between 2-3%. Those on this board suggest it is ready to go up markedly, a fact that I agree with. Why would anyone want to issue a long term mortgage at 3-4%? That is one of the fundamental reasons it is so difficult to get a loan.

3. $40 billion a month sounds big and $480 billion a year sounds huge but on a per capita basis it is about $125 a month and $1500 a year. meanwhile federal deficits of $1.1-1.4 trillion are draining money away from the private sector.

Unknown,

ReplyDelete"The GOP shut down the government to try to stop Clinton. "

Wow. That's quite a load of dishonesty. The GOP shut down the government to TRY AND CUT spending. Clinton and the Democrats called them "extreme" and "cruel" and "heartless." The GOP lost the propaganda campaign, but still held Clinton's liberal feet to the fire long-term.

Bill Clinton was dragged kicking and screaming to a kinda sorta balanced budget right up until the moment he took credit for it all.

response to george re RE 3.8% tax: common misconception. not really an egregious tax (not that all taxes aren't egregious)but the explanation is beyond this response space. see

ReplyDeletehttp://www.realtor.org/small_business_health_coverage.nsf/docfiles/government_affairs_invest_inc_tax_broch.pdf/$FILE/government_affairs_invest_inc_tax_broch.pdf

iobtlyn 5Steve, thanks, you answered my question. Very little effect.

ReplyDeleteInterestingly, on September 14, 2012, the Congressional Research Service (CRS) which 'claims' to not be politically partisan published a report (can be downloaded from link below) that asserts tax rates (income and capital gains) do not correlate with economic growth.

ReplyDeletehttps://skydrive.live.com/?cid=8B35ADFFC37790D0#cid=8B35ADFFC37790D0&id=8B35ADFFC37790D0%21991

to Paul:

ReplyDeleteThe GOP shut down the government because they did not want to vote for Clinton's budget, which included tax increases. They claimed it would destroy the economy, balloon the deficit and basically end America as we know it.

That budget eventually passed with no republican votes. The only kicking and screaming I remember was the republican party in that affair.

Odd that republicans are now trying to claim that it was their policies that caused the surplus. Especially as the first thing W did was to re-cut the taxes, to recreate the deficit, to allow for the continuing campaign to shrink government by starving it of income. I won't even bring up the medicare plan that Bush cooked up, nor the wars on credit. Ooops, I brought those up, didn't I.

Joseph Constable,

ReplyDeleteIf your time horizon is that of a high frequency trader, indeed the time to act is now.

If your time horizon is that of building a great nation, the correct way to think about this is vastly different! Our economy goes through cycles that spans multiple years. During good years, we should save more. First, the fiscal problem will be addressed while causing minimal pain to the population. Second, reducing government spending during boom years will moderate any speculative mania. Third, when the downturn invariably comes, we'll have more resources to lessen the pain.

We save more during the good years and we'll have more to ride out the bad years.

The WSJ article is dead wrong. The biggest problem facing this nation is NOT our fiscal mess. Our biggest problem is our deeply divided society. We have extremists on both sides that cannot stand any criticism of their own party. People on each side twist facts and cherry pick data points to fit their party's image and thereby widening the divide.

America is the greatest nation on earth and I am confident that won't change any time soon. The downfall of America will not be caused by our fiscal problem (its merely a side affect). It will be cause by something much more insidious.

People, with good intentions, taking extreme positions and turning off their brain are the root of the problem.

Just look at all the indignant messages posted on this blog!

Unknown,

ReplyDeleteClinton lost the House of Rep after his first two year (thanks to Hillary Care).

It was after the first two years that the Clinton/Morse team took over and implemented Republican ideas, and the results were good for the county's bottom line.

Lay-off the dope for a few days.

Gene Prescott: Art Laffer has been tracking and comparing growth rates for states for decades. He has found a pretty consistent relationship between lower tax rates on income and stronger growth. Texas would be the best example of late.

ReplyDeleteRe the 3.8% RE tax: progressive taxation of this sort sounds good on paper to those who want to redistribute income from the "rich" (if $250K in AGI can be considered rich) to the poor and middle class. But the law of unintended consequences dictates that the end result will be the opposite. High and rising marginal tax rates (made more so by this tax) make it much more difficult for those in the middle class to climb the ladder of success. People get trapped in the middle class because incremental work effort is taxed at huge marginal rates. The recipients of more and more redistributed income find their work incentive diminished and again that traps them where they are. The truly rich will do just fine, but everyone else will be punished for working harder. Liberals almost always ignore what Bastiat called "the unseen" when they fashion policies. In this case "the unseen" is the ramifications of higher marginal rates on those whom those rates are supposedly designed to benefit.

ReplyDeleteIt seems that the tracking federal level since 1945 should reveal some type of pattern. The study is tracking rates which have varied, as have deductions and methods of computing taxable income. Perhaps tracing actual tax costs as a percentage of GDP would be informative. It would seem any impact would result years after a change was implemented. I understand Laffer's notions. The study is based on data. Shouldn't the consequence of the notions be embedded in data over a long period, such as since 1945?

ReplyDeleteto PD:

ReplyDeleteSo you are saying that the GOP shut down the government and pursued impeachment of Bill Clinton - among other acts of courage - to stop Bill Clinton from implementing all of those republican ideas that worked so well, like increasing taxes.

Now I understand.

"Gene Prescott: Art Laffer has been tracking and comparing growth rates for states for decades. He has found a pretty consistent relationship between lower tax rates on income and stronger growth. Texas would be the best example of late."

ReplyDeleteAren't most of these low tax states also places where land is cheap and cost are low, with low wages. This pretty well describes most of the south. Cheaper, poorer and with lower taxes.

Low taxes may not be a root cause of growth, so much as a symptom of 'places that are cheap'.

Texas has no income tax and enjoys the best record of job creation and population growth in this recovery. Nevada and Colorado also have no income tax and are hardly described as poor. California has one of the highest income taxes and is suffering mightily, losing jobs and businesses to other lower income tax states.

ReplyDeleteScott,

ReplyDeleteI don't think it is simply lower tax = stronger economy.

Califronia GDP vs Texas

1.9 trillion vs. 1.2

per capita personal income

44,481 vs. 39,593

http://bber.unm.edu/econ/us-pci.htm

Weather

No comparison

Quality of life

I won't consider moving away from the SF bay area to anywhere else!

Measurements like job creation, population growth, and including my stats above varies over time. What really matters is over the long haul. California has for a very long time trumped all other states in the union by a mile.

To argument a view by picking out a few convenient stats and a convenient moment in time is not convincing.

Also, by the way, there are many places in the world that collects very little tax to no tax that are hell on earth.

Scott,

ReplyDeleteOne more question.

How did Laffer address the question of correlation vs. causation?

In regards to the Clinton years, why is that GDP was less than 1% when Bush came in to office, and why were we heading for recession? Why do liberals point to the Clinton years as such a great time, and for the most part they were, without recognizing the demographic trends that were in place, the technological boom that was underway, and the signifacance of a Republican Congress (the first in 47 years).

ReplyDeleteTo his credit, unlike Obama today, Clinton moved to the center and, combined with the above mentioned dynamics enjoyed a prosperous decade.

IMO, Clinton is a lucky man having been in the right place at the right time.

Bob

Bob, I'm with you: Clinton's move to the center was critical in delivering prosperity. Obama's refusal to do the same is what is holding the country back right now.

ReplyDeleteFurthermore, I have no problem saying that Clinton did a good job with the economy. Bush was unfortunately lacking in that department. If Obama were to follow Clinton's example he would have the election sewed up at this point.

North Carolina is a high tax state and hasn't penetrated the below 8% unemployment level. OTOH, Raleigh, NC, was recently judged as best city in the US to live.

ReplyDeleteBob and Scott,

ReplyDeleteThere is a key idea during the clinton years that isn't just moving toward the center.

Clinton tightened spending when the economy was doing well. This put the country in a good fiscal position for when the economy invariably turn south. What Clinton did was counter cyclical.

The economy operates on cycles. So should our fiscal policy.