Friday, March 2, 2012

Mutual fund flows show investors are still very bearish

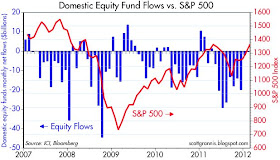

As the equity market moves higher, to new post-recession ground, many argue that investors are becoming too bullish, and this exposes the market to lots of downside risk should the economy stumble again. I've seen surveys that say bullish sentiment is relatively high, but surveys are one thing, and real money moving around is another. So I put together these charts, which compare the net monthly flows into and out of equity and bond mutual funds with the level of the S&P 500 index. The data on fund flows comes from ICI.

As should be quite obvious, retail investors haven't added more than a few drops to equity mutual funds for the past 5 years. Maybe $40-50 billion here and there, but that's nothing; since the beginning of 2007, investors have withdrawn a total of more than $470 billion from domestic equity funds. Withdrawals have been huge and relatively steady until last month, when net flows were close to zero. If retail investors were really turning bullish, we should have seen big inflows in the past several months, but we haven't seen any. To be sure, retail investors are typically slow to react to changing conditions. But all that means is that retail investors have yet to believe that stocks are worth buying. The upside in the equity market has all come from a change in the relative attractiveness of stocks; the economy has done better than expected, so those who still hold stocks have become reluctant to sell. And as we know, volume in this rally has been very light.

As for bond funds, inflows have been gigantic, totaling over $840 billion, and they are continuing, even though bond yields are close to generational and historic lows. But of course that's why yields are so low: investors are terrified of taking on equity risk, and are willing to accept extremely low yields in exchange for a modicum of security. The big flows in the markets are being driven by fear, not by greed.

Adding it all up, I would say that we are a long way from seeing over-priced equities. Let's wait to see many months or even a few years of inflows to equity funds before concluding that the guy on the street is too bullish.

Mutual funds are dead. People are buying ETFs instead. So only looking at MFs might be misleading.

ReplyDeleteGloeschi makes a good point.

ReplyDeleteI recommend ETFs before mutual funds.

In any event, one or two more years of corporate profits rising as they have, and the simple fundamentals will power a long-term secular rally.

There is also plenty of real estate in which rents cover the mortgage. Cheap, in other words.

Buy when everyone is scared--and people are still scared.

Company 401k’s don’t offer ETFs as an option. (There are exceptions). Employees are slowly changing their allocation from money market funds to mixed funds that have a higher bond allocation than stocks. Also, more are having their automatic payroll deduction go directly to their mutual bond/equity funds rather than into the money market fund first.

ReplyDeleteSlow economic growth doesn’t get people excited about stocks. But if we continue at plus 2 to 3 S&P points per day the market will be priced high very soon. We have gone 245 points in 5 months. In 5 more months that rate, 2.40 points per day, the S&P will be at 1615. What’s to complaint about?

I am buying mutual funds (on dips) in several trust accounts, both equities and fixed income.

ReplyDeleteAs Warren says, if you are going to be accumulating shares over the next ten years, would you prefer share prices to be languishing, or run up? Let other people's 'fear' or 'anxiety' be your ally. You pay dearly for a cheerful consensus.

Lots of equity bargains out there, but very few people with cash to invest (I suppose some cash is on the sidelines, but I doubt much) -- cash is in severe short supply right now, and so cash buyers can dictate terms -- sweet!

ReplyDeletethe ICI number accounts for all assets not just Mutual Funds.

ReplyDeleteEstimated Long-Term Mutual Fund Flows

February 29, 2012

Washington, DC, February 29, 2012 - Total estimated inflows to long-term mutual funds were $10.79 billion for the week ended Wednesday, February 22, the Investment Company Institute reported today. Flow estimates are derived from data collected covering more than 95 percent of industry assets and are adjusted to represent industry totals.

One of the things that becomes clear when reading this blog is the disconnect between certain economic metrics, once thought to be predictive, and expected response from the markets. Nothing seems so important now as confidence.

ReplyDeleteWith the latest financial meltdown still in view, some investors like me are looking for some rule changes to make sure it doesn't happen again.

When investment bankers, and the Republican Party, fight Dodd-Frank, they undermine confidence in financial institutions and markets they claim to support.

By the way, what the hell is "rehypothicaton?"

John,

ReplyDeleteExactly what part of Dodd-Frank do you think will "avert" another financial crisis?

The Volker Rule.

ReplyDeleteScott,

ReplyDeleteJust wondering if you have any comments on the noise that Stockman has been making lately.

http://www.businessinsider.com/david-stockman-youd-be-a-fool-to-hold-anything-but-cash-now-2012-3

Tom

Re: Stockman. I've had issues with Stockman ever since the 1980s. He never understood supply-side economics, and he still doesn't understand monetary policy. When he and Warren Buffett say we have to live with much higher taxes, I am sure neither one understands how our economy really works. They completely ignore the negative effects of too much government spending, especially too much income redistribution.

ReplyDeletehttp://www.ici.org/etf_resources/research/etfs_01_12

ReplyDeleteICI also posts ETF fund flows monthly - no great change there. I believe the younger cannot and chooses not to invest in stocks after all the scandals in the media - but the pursuit of money always wins out eventually.

Brent Leonard

http://www.mktsentiment.blogspot.com/

Scott,

ReplyDeleteI'd be interested in your take on whether the Volker Rule will prevent another financial crisis. It seems to me that Government intervention in the housing market encouraged the bubble and then when it burst, the mark to market rules drove the financial crisis as opposed to banks being able to engage in proprietary trading.

This comment has been removed by a blog administrator.

ReplyDeleteBill: I agree with you. The biggest source of the problems leading up to the last recession was government meddling in markets, not financial speculation. The problem was not a lack of financial regulation, it was a lack of fiscal and monetary responsibility.

ReplyDeleteI think it is not difficult to know how to select a mutual fund for a better profit from the investment. Once if you are aware about choosing a mutual fund wisely, it is further easy to keep your income growing.

ReplyDelete