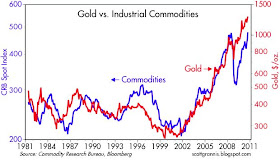

Commodities continue to rise, with gold making new highs again today, and non-energy industrial commodity prices (as measured by the CRB Spot Index) having essentially completely reversed their 2008 plunge. I've been highlighting rising commodity prices for well over a year as a good indicator of improving global economic health (most recent post here) and as a good indicator of the fact that monetary policy around the world is accommodative and therefore the risk of deflation is practically nil. Rising commodity prices are thus a good antidote to the doom, gloom, and deflation concerns that seem to be holding back so many investors who are content to leave significant sums in zero-interest-rate cash.

Before I proceed, this may be an opportune time to respond to a reader's request that I clarify the difference between contraction and deflation. A contraction refers to a shrinkage in the volume of economic activity, whereas deflation refers to a general decline in most if not all prices. These two conditions need not occur simultaneously, contrary to popular belief. In fact, it is quite possible for an economy to shrink even as prices rise; you have only to look at Argentina during its flirtation with hyperinflation in the 1970s and 80s to see this combination in action. This has relevance to the current situation in the U.S., since it seems that a great number of people are concerned that the dismal performance of, and the substantial "slack" that exists in the U.S. economy (all of which are summed up in the phrase "weak demand"), combine to almost ensure the onset of deflation. Deflation, in turn, is presumed to lead to a self-perpetuating economic slump, eventually ending in depression and deflation. What the deflationists ignore is the ongoing and impressive rise in gold and commodity prices, the 8 1/2 year slump in the value of the dollar (which means that most prices outside the U.S. have risen relative to our prices), the 2.5% annual inflation expectations embedded in TIPS prices, the negative real Fed funds rate, and the unusually steep Treasury yield curve, all of which argue strongly against deflation.

Instead, the deflationists believe that weak demand currently and prospectively will lead to falling prices. Weak housing demand has certainly led to falling housing prices, but weak demand shows up nowhere in the commodity markets. Some sectors of the U.S. and global economies are weak, and that weakness is reflected in falling prices, but that is not a statement that can be generalized. Some prices are falling, but lots of prices are rising, and since there is no evidence that money is in short supply, we have no reason to expect that all prices will fall in the future. Deflation, after all, happens only when there is a shortage of money relative to the demand for it, just as inflation happens when there is a surplus of money relative to the demand for it.

Deflationists also misunderstand the behavior of inflation following recessions. It is true that inflation almost always declines in the wake of recessions. But that's not because weak demand pulls prices down. It's because almost all recessions have been caused by very tight monetary policy. Very tight monetary policy—easily seen in the form of an inverted yield curve and a very high real Fed funds rate—first acts to disturb economic activity, then acts to bring inflation down. The lags are long and variable, of course, but today the Fed is more accommodative than ever before, and that is the biggest reason to ignore deflation risk.

Before worrying about deflation or even a decline in commodity prices, we would need to see at the very least some steps taken by the Federal Reserve to rein in the supply of dollars—either by withdrawing reserves from the banking system, or by raising interest rates and substantially flattening or inverting the yield curve. We would also need to see those moves result in a strengthening of the dollar relative to other currencies and relative to gold. I'm not holding my breath for any of these events to happen, and that's unfortunate since it means there is a lot of inflation uncertainty out there that makes it difficult for investors to have confidence in the future.

I am not saying that a lot of inflation is good for an economy or for the equity market. But right now the issue is not whether we have a lot of inflation or not; the issue is whether we have deflation or not. Once the market has overcome its fear of deflation, then it will be time to worry about how high inflation is likely to rise. For now, rising commodity prices are a direct reflection of declining deflationary and recessionary risks, and that is one of the factors driving the equity market higher.

scott sumner would say you are completely wrong. how do you answer that charge. i suspect you reach conclusions first then find data. this is the peril of tireless cheerleading.

ReplyDeleteThe rising prices of commodities is indicative of a seriously declining dollar valuation. The dollar is being deflated right before our eyes and that reality has not really settled in on Americans. I personally view the correction in the dollar as a good outcome, but then, I have been preparing for this for some time. Commodities and equities both look good in an environment where the dollar is declining in value globally.

ReplyDeleteScott,

ReplyDeleteNice Post!

Scott,

ReplyDeleteVery informative post. You write "the 2.5% annual inflation expectations embedded in TIPS prices." Isn't that expectation more in the neighborhood of 1.8%? Thanks.

I should have clarified my remark. I was referring to the 5-yr, 5-yr forward breakeven inflation rate. This is the Fed's preferred measure. You are referring to the 10-yr average breakeven rate, which is the difference between the nominal yield on 10-yr Treasuries and the real yield on 10-yr TIPS.

ReplyDeleteThe trendline on core CPI is headed into negative territory.

ReplyDeleteIf one considers Boskin's 1996 CPI study, we may be in deflation now.

Japan has struggled with deflation for decades, come what may in commodities prices.

So we know that a large economy can be in deflation, even though some global commodities go up in price (especially gold, an unimportant commodity).

Milton Friedman advocated quantitative easing for Japan, That is what the Fed should be doing now, and aggressively.

Otherwise, the performance of Japan will be revisited here in America. And you won't like it.

Japan's equity and property markets have fallen by 75 percent during their long mild deflation.

You want to hand your children assets that have depreciated by 75 percvent?

Not me.