Tuesday, August 24, 2010

Why deflation is not in the cards

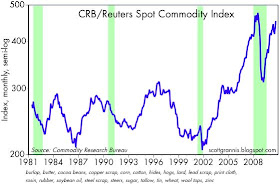

Deflation is when all prices fall relative to the unit of account—when the value of the unit of account rises relative to the prices of all goods and services. That is most certainly not the case today, as these three charts make clear.

Gold has risen steadily for the past 9 years against the dollar. Spot industrial commodity prices are only inches from making new all-time highs. And the dollar is very close to its lowest levels ever against a large basket of foreign currencies—which of course means that prices in other countries are historically high relative to our prices.

All you can reasonably say about prices today is that some prices are falling while many other prices are rising. We are seeing a lot of relative price changes, but we are definitely NOT seeing all prices decline. It is almost inconceivable that we could be on the cusp of an actual deflation when commodity and gold prices are soaring and the dollar is very weak against other currencies.

The closest we have been to an outright deflation was in the 2002-2003 period, and that's when the Fed first panicked at the prospect of deflation. Leading up to that period, we saw gold and commodity prices plunge, and the dollar soar against all other currencies. And the proximate cause of all that was a period of extremely tight monetary policy from 1995-2000. Today we have the exact opposite set of conditions. This is not a deflation.

I agree that deflation will eventually be overcome by the coming inflation -- as home sales continue to plummet and stubborn unemployment continues to dog the economy, fiscal and monetary policy-makers backed by the public will eventually reject austerity measures in favor of monetary expansion -- I would add that the inflation is no longer a risk, but rather is imminent -- everyone should be innoculating their estates for the coming inflation (even though it may be too late do so) -- the good news is that inflation is survivable by investors and can even be converted into profits -- the big losers in the coming inflation will not be those holding equities, but rather those who have retirement plans that are funded by government dollars -- as inflation kicks in, the cost of living increases will consistently lag inflation whereby a decade of even high single-digit inflation can erode a retirement plan by 50-75% -- the governemnt will simply not be able to fund cost of living increases in the coming years (or much of anything else now for that matter) -- in other words, inflation will eventually rout entitlements and reduce the size of the national debt via the inflation mechanism itself -- everyone should be preparing for inflation rather than deflation -- the government tends to get what it wants (the "unwritten" law of economics) and the government will not tolerate deflation any more than the people will -- that means monetary expansion and a likely overcorrection on the safe side including inflation -- keep in mind that inflation leads to recessions, while deflation leads to depressions -- the best way out of the Main Street Depression now imploding America is monetary expansion, and that's simply how things are going to turn out like it or not -- history stands in evidence -- more at:

ReplyDeletehttp://wjmc.blogspot.com/2010/06/deflation-or-inflation.html

By the way, anyone thinking that fiscal and monetary policy-makers are smart enough to "soft land" this economy without either deflation or inflation are naive -- there will be no soft landings from this crisis -- thank you for the opportunity to comment...

What everyone should be discussing is how to posture our affairs to exploit the coming inflation -- how do we make money during inflationary times...?

ReplyDeleteIn particular, consider the inflation from the 1970's -- what would have been the wise moves that investors could have made during the late 1960's and early 1970's that would have prepared to exploit that inflation -- I am asking from the standpoint of people and not the government, who stands to lose "big time" should an inflation come -- my vote is equity holdings and fixed debt instruments funded by reliable employment or dividends -- otherwise, get rid of the debt and hold equities (stocks, business, and high quality real estate) outright to be very safe...

ReplyDeleteThanks again for the opportunity to comment...

Here's a useful post regarding just what inflation "looked like" during the 1970's:

ReplyDeletehttp://wjmc.blogspot.com/2010/05/student-recently-remarked-to-me-that.html

The chart linked above is instructive for the future...

Jimmy Hoffa.

ReplyDeleteDodgers Playoff Hopes.

Enron equity.

Inflation.

Dead.

No deflation?

ReplyDeleteTalk to anyone in real estate.

It ain't a recession, it is a depression in property markets.

Doc McKibb,

ReplyDeleteI agree with much of what you say:

1) Losers in the coming inflation will not be those holding equities. (It certainly is not too late to get on THAT bandwagon...seeing as how no one is on it at present...I agree nevertheless)

2)Losers will be those with retirement plans funded with gov't dollars (hmmm, social security?..again I agree - plus those living on fixed incomes (bonds)).

3) inflation leads to recessions..yep. But there COULD be some pretty good economic times before that occurs, no?

4)No soft landings (OK I concede the POSSIBILITY of hard landings..but 'hard' is relative..and vague. It could take some serious time to play out.

5) Governments will not tolerate a deflation. Agreed. And as Scott has consistently pointed out, by definition we are not IN a deflation. Yet market participants are surely acting like we are (see LQD, TLT, etc., etc.).

I have been bullish on equities on this board for months and have had my share of criticism. I think there are numerous equities that will protect one from inflationary forces and I have pointed them out..BHP, VALE, RIO, POT, among many others including financials.

I have not seen specific suggestions from others...other than gold perhaps.

Incidently, POT is the recipient of a takeover bid (for cash) from BHP and is now in play. They plan to borrow the money for the tender...says LOADS about what these savvy businessmen think about current conditions.

I almost gagged on my lunch the other day when I heard a so called "expert" say he saw "inflation in some sectors of our economy and deflation in other." I may not be an expert but I can certainly discern between inflation/deflation and supply/demand.

ReplyDeleteWhile I agree on some points, I disagree about equities only because I believe we are headed towards a currency crisis/hyperinflation and that will route equities.

ReplyDeleteBuy VXX because volatility is in the cards...

According to the World Gold Council, demand for gold jewellery is booming in India.

ReplyDelete"Supply and Demand – Q1 2010Demand for gold is expected to be strong during 2010, driven by growing demand for jewellery in China and India as well as an increase in European and US investment in the context of continued economic instability, sovereign risk and the threat of a ‘double dip’ recession.

Demand in India and China will continue to grow, driven by jewellery demand, in spite of high local currency gold prices. In Q1 2010, India was the strongest performing market as total consumer demand surged 698% to 193.5 tonnes. In China, demand proved resilient; demand increased 11% in Q1 2010 to 105.2 tonnes.

This strong demand is despite high local gold prices, which on May 12 in India increased to Rs 56,032/0z, the highest level for the year, while at the same time in China prices reached an all-time high of RMB8,480/oz, suggesting that consumers in India and China are becoming accustomed to higher gold prices."

I frankly don't understand a 698 percent increase in demand for gold baubles, in India. If true, it answers why gold is going up--they are buying the stuff in India and China.

Chna and India are the biggest buyers of gold.

How do the investment fevers or traditional physical bias (they like property, gold--that which you touch and feel) of Indians and Chinese reflect on US inflation?

I would say not at all.

Egads, there are something like 2.4 billion Indians and Chinese--the days of explaining global markets in terms of US actions is rapidly coming to a close.

BTW, the bulk of gold demand is for jewellery and industrial purposes.

In other words, gold prices are being driven by Ms. Hindustan's necklaces, not Ben Bernanke.

Benj,

ReplyDeleteYour points are well taken. Doc McKibb's opening post, first sentence says, "...deflation will eventually be overcome by inflation..". The operative word there is EVENTUALLY. He places no time constraint on his prediction, which makes it easier to agree with his opinion. Eventually can be a long time...or not.

John-

ReplyDeleteFirst off, I enjoy your optimism and commentary. Great stuff. You showed shrewd insights into the fertilizer markets, and I won't even make an off-color joke about that.

Secondly, I think we have a chance here at a terrific. long-run non-inflationary bull run both on Main Street and Wall Street.

Just two things have to happen: Move towards balance federal budget, less regs. Maybe I add less taxes on equity, more on debt. And get the Fed into growth mode.

The last one worries me. The Fed is fighting inflation. Now we have the CPI under 2 percent, and the Fed says, "Well, it's still close to 1 percent. Why not go lower."

Egads! I can remember when anything under 4 percent was fine and dandy.

Do not confuse price stability with prosperity or morality.

Benj,

ReplyDeleteWe are remarkably close in our opinions. I believe it is possible the Fed will embark on another round of QE, only AFTER the looming elections. We are scant weeks away and they are quite sensitive to political charges of being partisan. They will avoid it, particularly if there is no compelling reason to act immediately...and I see none.

The election IMO has vast potential to shift market sentiment. I believe they will exercise patience and wait for the results to digest before making any drastic moves.

I am staying focused on November. These fluctuations in the low volumn waning days of summer are not, IMO, indicative of the true values of great American multinational companies...or, for that matter, quality industrial properties.

John-

ReplyDeleteThe mulit-nationals I think will fare well regardless. They are amazing organizations, seemingly able to profit even in the worst of times.

SoCal industrial properties are perking up--but faintly.

I realize hindsight is perfect, but Obama should have emphasized jobs, jobs, jobs, and not health care. The financial regs no one really seems to care about.

Obama should have concentrated on appointing some aggressive stimulus types to Fed board. Seats are vacant.

Well, I hope you are right.

One thing is true---if you listened to the hellhounds and naysayers at the bottom of any previous recession, you lost out bigtime.

What makes the doomsters think they are right this time?

Benj,

ReplyDeleteAnother mistake Obama has made IMO is the moratorium on deepwater offshore drilling in the GOM. He is killing 300,000+ jobs on a freakout reaction. The spill was bad but like an airliner crash, figure out what caused it and let the planes fly again. Hundreds of these wells have been drilled without incident. The regulators are onto the problems. Lets not kill an american industry because many of your constituents hate big oil. The rigs cost hundreds of thousands of dollars a day to work (or not work in this case) and they are not going to hang around waiting out a political haggle. Brazil and other places are willing to take them, and if they leave they won't be back for years, if ever. The industry will be effectivly killed, and with it billions of barrels of non-OPEC, non-Chavez oil. Not to mention the high quality, high paying jobs lost.

I have a friend from Louisiana who is a well connected attorney (and a democrat who regrets voting for Obama). He tells me the moratorium will likely be lifted in several weeks (probably timed with the election for maximum impact). We will see. But playing politics with such a thing strikes me as crass.

John, we agree that equities are the way to go forward and especially as a way to prepare for what I have been arguing will be inflation (sooner or later). In the meantime, home prices plummeting spells opportunity. Lot's of people prospered during the Great Depression, and especially during the mid to late-1930's. I am studying the Great Depression these days and finding some real pearls of wisdom. But, no one should be preparing for long-term deflation -- inflation is imminent, though it may take a few years before it picks up speed. Ironically, the government backed by the people will be the engine that will create the inflation (and the government always gets what it wants in economics). See my other links above for more, and thanks once again for the opportunity to comment on this excellent forum.

ReplyDeleteJohn-

ReplyDeleteI agree on offshore drilling--though I am not impressed that the industry had not created a rapid response team in case of deepwater blowouts. The blowout was a surprise, and how to respond was improvised. That did great work--but only after too long had passed. If you do not want the feds sticking their noses in...

Yeah, I am not an Obama fan. Politics? Sheesh, every Prezzy plays politics.

Some say the whole terrorism threat has been hyped for political reasons, and still is for budgetary-turf-bureaucratic reasons. The CBO says we will spend $3 trillion in Iraqistan before all is said and done.

That's three trillion dollars sucked out of the private jobs- and wealth-creating sector.

24 guys from Saudi Arabia armed with box-cutters....and we spend $3 trillion.