Wednesday, June 23, 2010

Putting commodity prices into perspective

This chart shows the entirety of the bull market in commodities which began in late October, 2001. The index shown is composed of very basic industrial commodity prices (e.g., burlap, butter, cocoa beans, copper scrap, corn, cotton, hides, hogs, lard, lead scrap, print cloth, rosin, rubber, soybean oil, steel scrap, steers, sugar, tallow, tin, wheat, wool tops, and zinc), many of which do not have associated futures contracts, and therefore are less likely to be influenced by speculative activity. From its time high last April, the index is down a mere 4.5%, and it is only 11.4% below its all-time high in July, 2008.

We can only speculate about the combination of forces that has driven commodity prices up 107% in just under 9 years (7.8% annualized). But the likely candidates would be: strong global growth, particularly in China and India and most emerging market economies; accommodative monetary policies from most of the world's central banks; and the inability of commodity producers to keep up with demand, following a period (from the mid 1990s to the early 2000s) in which very tight monetary policies had severely depressed demand for commodities.

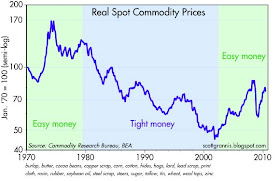

To explore the possible contribution of monetary policy to today's commodity prices, I offer the following chart, which plots the same CRB Spot index in real terms (using the PCE deflator).

The three periods shown in the chart correspond to major monetary policy eras: the easy money of the 1970s, which led to sharply rising inflation and a commodity booms; the tight money that began with Fed Chairman Volcker and ended in the wake of the dot-com disaster; and the easy money that has characterized monetary policy since the Fed began to worry about a weak economy and deflation risks in 2003. One thing should be obvious, and that is that today's prices are relatively cheap from a long-term historical valuation perspective. Prices haven't yet recovered to the levels that prevailed in 1970 (and prices were relatively flat from 1960 to 1970). The other obvious point is that monetary policy can have a major impact on commodity prices.

In any event, I don't see the rationale for why there is necessarily a commodity price bubble, or why there should be a bursting of the bubble. From a long-term perspective, commodities might be considered to be still in the early stages of a recovery from very depressed levels. Julian Simon, if he were alive today, would argue that commodity prices in real terms should have a strong tendency to decline over time, since man cleverly invents new and more efficient ways to extract commodities, and more efficient ways to use commodities. But even if you believe this, today's price action is not anomalous.

Interesting that a tight monetary policy period ends in an enormous credit fueled equity boom/bust...

ReplyDeleteDon't forget the huge role of Freddie and Fannie in creating a massive boom in home loans.

ReplyDelete