Monday, June 21, 2010

Dollar weakens against the yuan

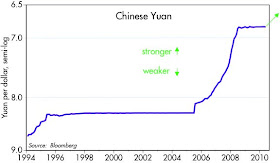

Most observers are cheering China's decision over the weekend to allow its currency to once again appreciate against the dollar (top chart), and I agree that it is probably a good thing, if for no other reason than that it reduces the risk that U.S. politicians will screw things up by starting a trade war with China.

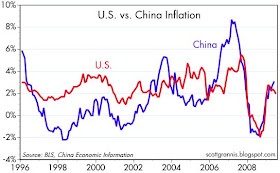

But it's also a good thing for China itself, since a stronger currency reduces the risk of higher inflation, which was already uncomfortably high and rising (second chart). A stronger currency will also lead to higher Chinese living standards, since the purchasing power of Chinese incomes will rise in proportion to the yuan's rise against other currencies.

But instead of focusing on the stronger yuan, I think the real focus should be on the dollar. What the Chinese are doing is withdrawing their support of the dollar—effectively voting against the dollar. They were buying dollars and otherwise accumulating reserves in order to keep the yuan pegged at 6.83 to the dollar. If they hadn't taken enforced the peg, then presumably net capital inflows would have driven the yuan higher at the expense of the dollar. So now they will buy fewer dollars and allow the yuan to rise. (I made some more extensive comments on the history of the yuan's link to the dollar here, but in rereading the post I note that my conclusion—that the Chinese would only revalue if the dollar weakened further, which it hasn't—was wrong.)

The Chinese decision also highlights the dollar's fundamental weakness. Being pegged to the dollar meant that China experienced the full effects of U.S. monetary policy. Rising Chinese inflation is strong evidence that the Fed has been too easy, and that the dollar has been too weak. Chinese inflation is like the canary in the coal mine for U.S. inflation—monetary policy acts faster in the Chinese economy because it is much smaller and more dynamic. Plus, trade is much more important to the Chinese economy than it is to the U.S., so changes in the value of the yuan, which have been primarily driven by changes in the dollar's value, flow through to the general price level faster in China than they do in the U.S.

By revaluing against the dollar, China will experience a tightening of monetary policy. And, by reducing the demand for dollars, China's action will result in a further easing of U.S. monetary conditions. Therefore, inflationary pressures in China will diminish, while they will increase in the U.S.

I doubt that this decision will prove to be of great benefit to U.S. exporters, but it should be of some benefit on the margin since a stronger yuan will make all imports cheaper for Chinese consumers. One collateral effect of this is that Chinese demand for commodities will strengthen, and that is likely to push commodity prices higher over the long run.

China's decision is likely to be detrimental to U.S. consumers since the prices of Chinese imports will tend to be higher than otherwise. But that is just another way of saying that what really happened today is that U.S. monetary policy has effectively become easier—through a weaker dollar—and that will eventually increase U.S. inflation. Higher U.S. inflation, in turn, will tend to drive Treasury yields higher.

At the very least, this decision adds to the reasons why deflation is not a serious risk. And to the extent that deflation is not a risk, that brightens the outlook for the U.S. economy, and, in turn, for risky assets in general.

Scott,

ReplyDeleteVery good post. You explain the relationships well.

There seem to be two points of view making the rounds re the appreciation of the yuan:

1. It is a cynical ploy to placate the US just prior to the G20 meetings. They have little interest in allowing meaningful increases in the value of their currency and remain 'manipulators'.

2. This is the initial move that will gradually increase the value of the yuan to a more realistic level and will serve to improve the balance of trade between China and the rest of the world.

In other words, some believe it and others do not. I think I know, but in which camp are you?

For those who are inclined to think Chinese consumers will be consuming more over time, I would suggest consideration be given to the fertilizer companies as possible ways to benefit from the trend. One of the first things people do when experiencing a standard of living increase is diet improvement. This means more consumption of protien (meat). Protien production requires more grain (feedstock) which in turn requires more fertilizers for increased grain production.

A stronger Yuan means lower prices for meat. Add income increases from the recent labor unrest and it appears there may well be an increasing demand for many consumer goods.

A large fertilizer company that exports to China is Canadian Potash of Saskatchawan (POT-NYSE). It is currently down 25% from its April highs and offers IMO a good entry point for aggerssive investors willing to accept volatility.

Another company is Agrium (AGU-NYSE)

Disclosure: I am long POT @ $110 a full 10% above the current price. POT- $99 6/21/2010

I can see the logic behind the cynical point of view, but in the end I think this move makes sense for China. Allowing the yuan to appreciate means keeping inflation in check. Low and stable inflation and a strong currency are essential ingredients to a strong and prosperous economy. Doing the right thing is always a good thing. If doing the right thing means placating G20 politicians, then that's good too.

ReplyDeleteAs always, China fascinates. They are not a free market, but rather a fascist-mercantile state with some private-sector elements.

ReplyDeleteIn that, I agree with Scott that imports may or may not go up due to a cheaper yuan--trade is controlled anyway. They will import as much as powerful groups inside want to import.

We can only hope that China matures politically and economically, and chooses freedom and free enterprise more often.

Scott,

ReplyDeleteIt seems that the market lost enthusiasm for this as the day wore on and the dollar is now trading higher. Why the reverse in sentiment?

Fear contributes to s stronger dollar. I don't know what the source of fear was today.

ReplyDeleteScott, you should be president of the Fed. and John POT makes a lot of sense

Bill,

ReplyDeleteThere are many millions of moving parts in the market. It is impossible to consistently predict hour to hour moves. If anyone tells you they can, grab your wallet. If they truly can, why do they need you (or anyone)?

I think some of the announcement was for public consumption ahead of the G20 meeting. However, I do believe the arguments for allowing an appreciation are compelling for China. It will be very slow and entirely on their terms but I do think the story will persist and it is on balance positive for our markets. China must continue to evolve. Their system is inherently unstable. Allowing a more robust consumer to emerge amid a lower inflation environment will lend much more stability to their system.