Wednesday, May 19, 2010

Spread update: not much to worry about

Expanding on the theme of my prior post, here is a quick look at the current state of swap and credit spreads. As is the case with most "risk assets," we see a modest correction in credit markets. US swap spreads have moved up, but from very low levels to levels that are easily within the range of "normal." As the second chart shows, the rise in US swap spreads has pretty much followed the rise in euro swap spreads, suggesting some degree of contagion from Eurozone credit concerns; after all, if a large European bank should go belly up, it would surely be of concern to its US counterparties. But as my friend Mike Churchill reminds me, euro swap yields (as shown in the third chart), have been falling consistently throughout the developing Greek crisis. In other words, the rise in euro swap spreads has been driven mainly by a collapse in government yields, which is more a sign of investors seeking safety than it is of investors fleeing the market in general. Funding costs for most qualified borrowers have been declining all year, so the rise in swap spreads does not pose any threat to economic activity.

Meanwhile, 10-yr US swap spreads are trading at a mere 6 bps (vs. 28 bps in Europe), which is still quite low from an historical perspective. Consequently it would appear that the market is thinking that this is a near-term problem, not an enduring or structural problem.

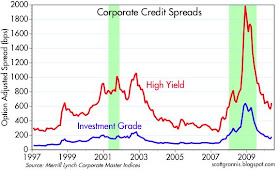

Corporate credit spreads have also moved up, as shown in the fourth and fifth charts, but so far the correction doesn't appear to be significant or particularly disturbing. If we assume that swap spreads continue to be leading indicators for spreads in general (as I have been arguing since October '08), and given that swap yields are still declining, then there is little reason for alarm. The market is certainly uneasy, but that seems more likely due to a case of nerves rather than to anything concrete.

I am beginning to think that the bears really need a big european bank failure or an investment house to get in trouble if their case is going to take us down much further. It still may happen but every day that goes by with nothing but the euro dropping a penny or so and the buyers are going to start taking stock and the fat, fat premiums in puts are going to be sold. The spreads on the sovvies are pretty stable and if that continues with no more catastrophe news (NEWS NOT RUMORS) then we are going to get a big bounce in this market. I still think its going to take a few weeks to heal from this even if no more bad news develops but there are some very good stocks out there RIGHT NOW that are cheap and they're not going to stay that way unless there are some NEW reasons not to take them.

ReplyDeleteJohn: Ditto.

ReplyDeleteThat said, I wonder if Americans ar not becoming "sissies."

We are scared of possible carcinogens at incredibly remote odds; of terrorist attacks that kill but a minute number compared to auto accidents or ordinary gun shootings every year; and of slight quivers on Wall Street.

Solid earnings should set things right, but today's fragile investor confidence needs a lot of hand-holding.

Moody's Baa yield is 6.06...end of 1st qtr was 6.31

ReplyDeletescott- i agree this "blip" is nothing to worry about, but trying to get a sense as to why this "blip" shows a recovery?

ReplyDeletehttp://scottgrannis.blogspot.com/2010/05/housing-market-recovery-underway.html

to me they are both a change in the bottom (spreads in one, housing in the other) and until proven otherwise are not a meaningful change to risk levels or to a housing recovery.

CPI is down today. Down, not up.

ReplyDeleteBrodero,

ReplyDeleteJust like the spreads. The Baa yields are still not saying the economy is tanking. Europe as we know it NOW is not the game changer the bears want us to believe it is. Maybe in a year or two it cracks again but I'm thinking if it doesn't do it this week or very early next, the market rallies. I still think these values are not going to hold unless we get more bad news than we have had so far.

The weekly unemployment number this AM was up slightly and the futures are off indicating a down open. I would note that this is relatively unrelated to the Europe issues and reflects continued fear among futures traders.

ReplyDeleteI am a VERY amature economist and I am not privy to the entrails of the data but I would expect that many companies that are experiencing better business conditions are bumping up against the upper ranges of productivity improvements and will soon need to begin hiring again, if only modestly.

John,

ReplyDeleteYou should probably start your own blog rather than answer everyone's responses as if it were your blog.

Just a thought.

Spreads wider anyone? Of course the market will chase yields with short rates at zirp. This is a re-run of 2002 - 2008. Everyone chasing yield to add perf yet the debt situation is probably worse rather than improved.

Public,

ReplyDeleteThank you for your suggestion. I will so consider when asked to do so by the blog host.

For those of you who might be interested, Exxon (XOM) is at a price barely, barely avove the March '09 lows.

ReplyDeleteI am a buyer this AM at 61. Small, but a buyer.

I think equity investors are toughening up. Just finished the Barton Biggs book on the markets during WWII. Equity investors back then had to be tough. Not so from 1985 to 2008 (except for an occasional low scale war in the Mideast and 9-11). Since the Panic of 2008 and 2009, the equity investors have become a tougher bunch. The weak ones all left. There has been absolutely no equity buying from the public, just net selling since Oct 2008. I think we need to get used to this, but the tougher equity investors are seeing great long-term opportunities.

ReplyDeleteBy the way, what's with all the hedge funds publicly announcing on CNBC yesterday that they are derisking. As we've seen with Bill Gross, that makes no sense to telegraph things unless you have already de-risked and are actually buying. But it pushes the market down.

I, for one, look forward to John's observations, and of course, SG's commentary. I think the point of a comments section on a blog is to have conversations.

ReplyDeleteConversations usually require different points of view, otherwise they become monologues.

I very much welcome and appreciate intelligent discussions.

ReplyDeleteMr. Miller,

ReplyDeleteI think your obsevations on the heggies on TV have merit. IMO it is classic position pumping. It has become something everyone does. I'm not saying its wrong. Like you, I'm just saying know what it is.