Friday, May 28, 2010

Deflation and inflation are alive and well

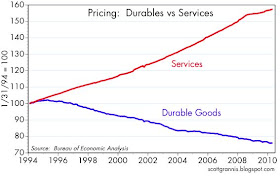

Over the past 16 years the U.S. has experienced a unique condition: the persistence of both inflation and deflation at the same time in two major sectors of the economy. This chart compares the behavior of two of three major subcomponents of the Personal Consumption Deflator: one covers the price of services, which in turn is largely driven by the inflation component of labor costs (and here I note that the PCE deflator rose 40% over the period covered by this chart), and the other covers the price of durable goods (e.g., cars, computers, appliances, TVs, equipment). (The third subcomponent is nondurable goods.) Never before, since the data were first collected in 1959, have these two price indices moved in opposite directions.

What this chart is saying is that consumers' purchasing power, when it comes to manufactured goods, has effectively increased by a lot, mainly because wages have been rising in both real and nominal terms, while the cost of durable goods has been falling. A simple example: for $1000 today you can buy a computer that can do things that not even a computer costing $1 million could do 16 years ago. The widening gap in this chart is a graphical representation of prosperity, where an hour's worth of labor buys more and more things. The difference between these two lines amounts to an increase in consumer purchasing power of a little over 100%, which in turn is solely due to a change in relative prices. The change in relative prices, in turn, is due primarily to the increased productivity of labor. The average worker today (and around the world) is able to produce far more than ever before with a given amount of work. In short, this chart is showing us just how much more valuable labor has become relative to things.

Chinese imports undoubtedly play a key role in this massive and unprecedented divergence of prices. Thanks to the hugely increased productivity of Chinese workers, U.S. consumers can now devote a greater and greater share of their income to things other than durable goods. (Unfortunately, healthcare and government would appear to be absorbing much of this increase.) Currency fluctuations have nothing to do with this, by the way: the dollar has fallen in real terms, relative to a trade-weighted basket of currencies, by about 5% over the period of this chart, so that would have the effect of increasing somewhat the price of imported goods.

The next time you find out that repairing your watch or your computer or your pocket digital camera costs almost as much as buying a new one, remember this chart.

Uh ... forgot to mention cell phones, web access. Those are new services available at the point where the chart changed.

ReplyDeleteInteresting graph....Thanks for posting!!

ReplyDeleteScott,

ReplyDeleteDo you still think the market will increase 10-15% this year or is the concern of a return to low growth or perhaps a double dip recession too great? I saw that the ECRI index keeps falling and indicates pretty slow growth for the rest of the year.

Redbud: You make a good point—what is it that triggered the change? It was a monumental change, after all. What could have been big enough to produce it? Cell phones don't count as services, but the emergence of the web was certainly a big deal. I note that 1994 was the beginning of the era of very low inflation in the U.S. The Fed started tightening policy in earnest in February of that year, and continued all the way into 2001. The dollar started a major strengthening trend in 1995, peaking in early 2002. China was doing very well by 1994, and that year began a policy of stabilizing and strengthening the yuan, which in turn brought inflation way down.

ReplyDeleteDoes anyone have other suggestions?

Bill: I'm still quite optimistic about the market's prospects for the rest of the year. I don't see any sign of a double-dip recession, and I think the market is overly concerned about weakness and ignoring the signs of strength.

ReplyDeleteMr. Grannis, the appearance of Mosaic in 1993, the forerunner of Netscape, allowed folks to use the web. Web service went from about $10 a month for dialup to about $40 a month now for broadband. Web usage has grown parabolically.

ReplyDeleteWhile a cell phone is a product, the phone bill must be a service. A landline went from $15 or so to a minimum of $40 (with no long distance), and cell phone service is even more expensive. I pay $200 a month for service on two smartphone, $30 a month for the ipad 3G network, $40 for broadband for computers, and $40 for the land line (no long distance). Compare my current $310 a month to be "connected" to my $15 phone bill in 1993.

Scott,

ReplyDeleteI would suggest the NAFTA accord that reduced tarrifs on trade between Canada, Mexico, and the US. Although it has been criticized by many I believe it served to reduce inflation in all three countries.

Two years ago, I had to replace a vented gas-powered water heater. This cost more than double the original water heated due to new safety regulations. No doubt the cost of the new style water heater has come down since they are now popular. Tell me, has the cost of a water heater gone up 10% per year or has the cost of a water heater gone down 10% per year?

ReplyDeleteConsider the Toyota Camry. The lowest invoice price of a Camry has gone up 1.5% per year since 2005.

I just replaced a $125 lawnmower with a $150 lawnmower. I always buy the smallest, simplest gas powered mower. Deflation? Oh yeah, there is probably some safety doodad that prevents me from cutting off my big toe.

Something is wrong with the way durable goods inflation is computed.

My property taxes go mostly for the local schools. They are up 60% in the last 8 years and we just passed a new levy to prevent massive cuts. In OH inflation in property values cuts the millage so this increase is not related to property values. That gives 6% inflation in services.

I will grant that service inflation is higher than durable goods inflation but both inflation rates are understated.

One reason that durable goods prices have fallen is the hedonic price adjustment for computers and electronics in general. Since $1000 today buys about 100 times the computing power it did 10 years ago (for the sake of argument), the government needs to somehow take into account the fact that your money goes much further when it comes to buying a computer. Your dollar buys more, therefore the unit price of what you are buying has fallen. And in the case of computers the price has fallen by orders of magnitude.

ReplyDelete1989 was a fall of Iron Curtain. That was that monumental change I think. The big deep effort has shifted from military area to a civil area and a production capacity was redirected to consumer's pockets, as a military source of demand has shrinked. It took couple of years (1989-1994) to play out.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteThis comment has been removed by a blog administrator.

ReplyDeleteAbsolutely correct, in fact, there's usually not much room for cost compression in services. More importantly, certain segment of the service industry (health care and education) have exhibited extremely rapid rise in costs.

ReplyDeleteIf memory serves, inflation in each segment is in excess of 10%. that is why all though the total wage package of Americans have risen, their net wealth has not since virtually all additional revenues (direct and indirect) have been spent on additional health and education (eg in late 2009, the health insurance industry increased premium by more than 25%)

HAHAHA. China began a policy of stabilization in 1994? The 1990s were low inflation? HAHAHA. China had been devaluing its currencies for years and in 1994 trashed its currency by an overnight 50%. The 1990s were the highest inflation rates in American history. That is what led to the stock market bubble and people believing financial experts such as yourself actually knew what was going on. The stock market bubble had nothing to do with invention. It was Wall Street throwing money off into the economy at a massive rate due to massive fraud. Anyone with a heart beat was taken public. And Wall Street minted massive profits for its endless fraud.

ReplyDeleteThe beginning of the end of the status quo is nigh. We are due another dump within 60 days that will rival the first dump and take us down within a stone's throw of the March 2009 bottom. We'll eventually take that out as well.

Enjoy living in your bubble while you can.