Tuesday, April 6, 2010

Oil price update

There's a wealth of information in these charts. The main message is that when energy becomes expensive, the US economy reacts by figuring out ways to become more energy efficient.

The first chart focuses on recent price action. Today's price of $87/bbl. is about eight times higher than it was in early 1999, but it is almost one-half of what it was (briefly) in 2008. Talk about volatility!

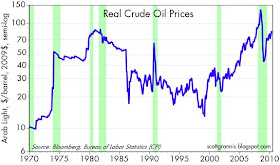

The second chart puts prices into a long-term, inflation-adjusted context. In this view, today's price is a bit less than the prices that prevailed in the early 1980s price shock, and we pay a lot more in real terms for oil than we did at any time prior to 1974. Oil today is "expensive" from a long-term historical perspective.

The third chart shows US oil consumption. Notice how consumption declines following periods when oil prices in today's dollars exceed $50/bbl or so. Also note how oil consumption accelerated in the 1990s when real prices averaged about $25/bbl. Oil is expensive at today's prices, and that is likely to constrain demand.

The fourth chart shows oil consumption per unit of GDP, which has fallen almost 60% since the first spike in oil prices. That's a textbook case of how people find ways to use less of something when its price becomes expensive. Today the US economy uses about the same amount of oil as it did in the late 1970s, but the economy is 125% larger! As a result, the US economy is far less dependent on oil, all without firing a shot at our OPEC "oppressors." (And by the way, if we are dependent on OPEC for a large portion of our oil purchases, they are just as dependent on us for a large portion of their income—it's a two way street with advantages and disadvantages for both parties.)

The fifth chart shows how much the typical consumer's budget is spent on energy. Consider that despite the approximately seven-fold increase in the real price of oil from 1960 to today, consumers spend about 25% less of their income on energy.

What is the upshot of all this? I think oil prices are still relatively high, and that is likely to result in continued conservation efforts. I don't think prices are high enough to cause a serious problem for the economy, because energy costs are not consuming an unusually large share of consumers' budgets. But I'm guessing that if prices rose above $100/bbl (roughly equivalent to $3.50-4.00 for a gallon of gas) then we would see a significant slowing in growth as a result, and frustrated consumers.

This further suggests that in order for a cap and trade scheme or a carbon tax to yield significant declines in our consumption of hydrocarbon fuels, policies would have to be geared to push the price of oil to at least $100/bbl. Meanwhile, however, our economy has done a tremendous job of becoming more energy efficient thanks to the workings of our free market system coupled with the magic of price signals, and it is likely to continue to do so if left alone.

why the switch from oil to energy in chart 5?

ReplyDeleteExcellent! Thanks, Scott!

ReplyDeletesep: very devious answer: because that's the only way the BEA breaks it out on a quarterly basis. But oil represents at least two-thirds of consumer energy expenditures as a rule of thumb.

ReplyDeleteScott,

ReplyDeleteIf you overlay the five year gold chart on top of the five year Oil chart it tells me oil is going to continue it's upward trend.

I'd love to hear your take on this.

regards

Dave

But if you look at a 40 year chart of the ratio of oil to gold prices, oil is somewhat expensive relative to gold. The average has been about 18 barrels per ounce of gold, currently it is just over 13.

ReplyDelete"The main message is that when energy becomes expensive, the US economy reacts by figuring out ways to become more energy efficient."

ReplyDeleteLOL! The main message is that when energy becomes expensive the US economy goes into recession!

In the early-mid 1970s the lower 48 peaked in oil production and the US became a net oil importer. Up to that point we produced virtually all our energy needs domestically, and up to the peak every year more was produced, so there was never a need to pay much attention to energy efficiency. During the embargo only about 5% of the oil supply was curtailed. Yet that was enough to wring the first easy to achieve efficiency gains out of the consumption of oil.

It is interesting to see that even though the barrels/unit GDP has declined the overall consumption has increased until around 2005 when it plateaus (curiously coinciding with the beginning of the global peak in crude oil) only to recede somewhat along with the recession of the economy. When it comes down to it the overall consumption of the resource is what counts as regardless of our "energy efficiency" we are continuing to use more and more until we are forced to "conserve" by a recession.

I would suggest that, in the light of cornucopian fantasies of unlimited petroleum (including natural gas) supplies, and the cluelessness of our political and opinion leaders, consumers in the US will continue to consume more overall until forced to do otherwise by more recessions... rinse and repeat.

It is not an insignificant fact that worldwide overall consumption follows the same pattern, and since we get our energy resources on a global market it is global consumption that calls the tune with regard to availability and price.

If the global supply of energy resources, particularly fossil fuels, is at, or past, peak (on an "undulating plateau" if you like) then increasing consumption overall spells problem, which, if waved off with more cornucopian fantasies, begins to spell p-r-e-d-i-c-a-m-e-n-t

John,

ReplyDeleteNot just natural gas. Last week Obama pulled a massive head fake by announcing he was going to allow some off shore drilling (that had already been approved by Bush last year anyway.)

The real news is he cancelled leases up and down the East Coast and in parts of Alaska where there are estimated tens of billions of barrels of oil.

There are, as usual, many issues with the supposedly massive amounts of natural gas and oil we have, in theory, within our borders. Also as usual, it is understanding the scale of the issue that is important.

ReplyDeleteWhenever you see the words, "end our independence on foreign (or imported) oil" a red flag should automatically come up. When you hear that our (theoretically) huge reserves of natural gas will end our dependence on oil the same should happen.

First, as you folks should know, oil trades on a global market. If we discover some oil on our continental shelf it effects the global price not just the price in NYC or Chicago. But also it must be noted that the oil that we may have in offshore lease blocks is only theoretically there, and only theoretically recoverable.

Let's say that 20 billion barrels are discovered somewhere. This would represent a little over a year (around 500 days at today's rate of consumption in the US, and remember everyone wants to get the economy growing again) because 50% recovery rate is a very optimistic yield, and it would be some years off at which point global depletion will have eaten up the gains. Global depletion is now estimated to be between 6% and 7% annually. You do the math. Remember it is not the reserves that are important, it is the flow-rate, the rate of production, that is important, as well as the quality of the product, that will determine whether it is extracted or not. And after a certain point it doesn't matter what the price is you won't get any more oil out of a particular hole in the ground.

Natural gas is not a liquid fuel. It can be converted to a liquid but that takes energy to do which reduces the net energy an economy has to utilize. Same with coal to liquids. And converting gas to liquids will increase the consumption of natural gas so your idea of how long the reserves will last will have to be adjusted.

There is a stopwatch running with regard to dealing with the depletion of energy resources. If a solution is to be found we need to dispense with wishful thinking and technofix assumptions and see what the parameters are. It takes time to do things like change out the entire vehicle fleet of millions of vehicles to operate on natural gas. Who will pay for that conversion?

I feel very ambiguous about new oil exploration. We can use our time energy and money looking for new drops to fill the bucket or we could use those resources to transform the economy (whether this is done by government or private enterprise is not the issue for the moment) into an economy that operates on a different energy base than we have up to now. This however requires recognition of the problem by the Players at all levels of the game. Right now the consequences of the decline of fundamental energy resources is not one most of the Players are interested in dealing with. This in spite of various entities such as the Department of Defense, the Department of Energy, and the International Energy Agency waving red flags and warning of severe consequences if this basic fact of the world as it is is ignored. I also have an innate reluctance to exhaust a resource of such value thereby leaving future generations with little or none, particularly in a future which must rely on much much less energy-dense resources.

It isn't running out of oil that is the problem, it is a question of when inability to produce enough energy becomes the problem.

Douglas-

ReplyDeleteActually, it is easy to convert natural gas to liquid fuel--it is called methanol.

A company named Methanex does that, and sells methanol for $1.10 a gallon, as we speak. You can look it up on their website.

Back in the day, methanol was used to run Indy 500 cars, before switching (for pc resaons) to ethanol.

Methanol has about half the BTUs of gasoline, so $1.10 a gallon is "really" about $2.20 a gallon, in terms of BTUs.

We have in the USA epic supplies of natural gas, and we are just starting with shale gas drilling. We do not know how large the supplies could grow from these already incredibly large levels.

Remember, just 10 years ago no one even said we had shale gas. Now it dwarfs "conventional" supplies.

It maybe the $1.10 a gallon price of methanol would come down with economies of scale.

Methanol is easily used in existing cars, although some fuel lines may have to changed out. It is a safer fuel to use than gasoline.

Methanol can be used in higher-compression engines.

A fascinating option for the future is the PHEV-methanol car. Such a car would completely eliminate oil demand, while cleaning city air. (The free market completely fails when it comes to pollution, so this is an interesting option).

If the free market is left to work, we may see such PHEV-methanol cars sooner than you think.

It is one reason I think the doom crowd has the wrong perspective. Man is innovative; man adapts. Sometimes inertia sets in, whether by government or large private-sector interests.

But the price signals cures a lot (not in military hardware, but in free markets).

Scott-

ReplyDeleteOil expensive re gold.

That is because gold is an unimportant yellow metal, and oil prices re manipulated by a cartel, and on the NYMEX.

The charts also tell me that economic growth is limited by our ability to gain efficiency over time.

ReplyDelete"..we could use those resources to transform the economy (whether this is done by government or private enterprise is not the issue for the moment) into an economy that operates on a different energy base than we have up to now."

ReplyDeleteBy "we" and "transform" you mean Obama and his cabal of incompetents, socialists, and Chicago thugs? Just let them seize assets so they can magically "create" green jobs. No thanks, I'd rather let Exxon keep their own property and do what they do best by opening up leases in places like the Chukchi sea and ANWR where massive oil quantities are available. Companies like A123 Systems will in turn do what they do best and we'll "transform" our energy mix.

Benji,

ReplyDeleteI agree with you on that, but we need to stretch the transition time as long as possible to reduce the pain in getting there.

Obama just made it that more difficult last week when he shut down most of the drilling plans that Bush allowed last year when he rescinded the moratorium.

Paul-

ReplyDeleteI am a greenie-weenie, for reasons stated: The free market completely fails when it comes to pollution. He who can excrete most cheaply wins, in a free market.

That being said, I totally endorse offshore drilling. It has proven out very safe.

It was quite a scene when another Bush--the Florida Governor--vowed a couple years back that oil would never be drilled off of the Florida coast. He in fact won a total ban.

And Scott Grannis says it is okay when Newport Beach bans high-rise beach condos. How about a casino in Calafia Beach?

Everyone becomes a greenie-weenie when the rendering plant is proposed for their neighborhood.

The greenie-weenies might have second thoughts with the right royalty sharing mix and $4 a gallon gas. Or they might curse the Saudis while driving alone in their Chevy Tahoes.

ReplyDeleteBesides, offshore drilling is good for the environment.

I am extremely skeptical of those who want to take us to a 'new' energy future. Maybe in 50 years. But we need an energy bridge to that future. We are sending an awful lot of money to people who don't much like us. I know the money can be recycled but I just think we are so much better off running our country on a lot higher percentage of local energy. Its just my intuition.

ReplyDeleteI am also skeptical of those who question the viability of the technology. I have ridden on busses in NYC that run on LNG. A YEAR AGO. Cummings Engine has LNG engines coming off production lines as I write this, albeit in small numbers.

Millions of delivery trucks burning diesel and gasoline make daily runs and come back to the barn every night. IMO no way should they be burning imported oil.

Maybe someday...someday.