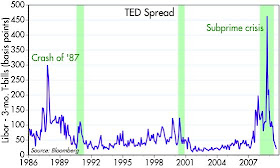

The TED spread (the difference between 3-mo. LIBOR and 3-mo. T-bills) has completely normalized. Currently it's 19 bps (it's close cousin, the OIS spread is down to 14 bps), which is the same level that prevailed during much of the 2001-2003 period. Easy money and weak growth expectations, coupled importantly with strong confidence in counterparty risk, is what drives the TED spread to these relatively low levels.

If growth expectations weren't so weak, then the market would be expecting the Fed to raise rates soon, and 3-mo. LIBOR would rise; bill yields would be trading at least as high as the funds rate, if not a bit more. Instead, LIBOR is trading at 0.32%, just a smidge above bills which are at 0.13%. If counterparty risk weren't so strong, then LIBOR would be trading well above bills, because lenders would be wary of lending on the LIBOR market and would instead prefer to give up yield in order to get the safety of bills.

So the market has a dim view of the economy's ability to grow, which can also be seen in the recent selloff in the stock and corporate bond markets. But at least we have overcome the very significant problem of counterparty risk. That was really at the heart of the meltdown last year. On balance I'd say this adds up to good news.

No comments:

Post a Comment