Sunday, September 27, 2009

Monetary policy update

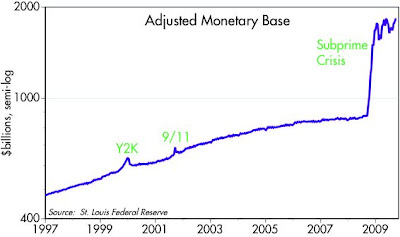

As the first chart shows, the Fed has continued to practice "quantitative easing" to the max, as of the most recent data (Sep. 23). The monetary base today is essentially as big as it's ever been. The second chart, which comes to us courtesy of the Wall Street Journal, shows what the Fed has been buying in order to expand the monetary base. As the chart shows, the Fed has been gradually winding down things like TALF, Commercial Paper Facilities, and Central Bank liquidity swaps, as it has been gradually expanding its holdings of Mortgage-backed Securities, Agencies and Treasuries.

Interestingly, Treasury holdings today are almost the same as they were in late 2007. They fell last year as the Fed frantically sought to satisfy the world's demand for Treasury securities. When its holdings of Treasuries became seriously depleted, quantitative easing became the only remaining remedy. By the looks of things (a weak dollar, $1000 gold, rising commodity prices, and an expanding economy) they have done at least what the market was asking for, if not more.

This massive expansion of the monetary base, fueled these days by direct Fed purchases of Treasury, Agency, and MBS, remains the most potent argument in favor of a significant rise in inflation in coming years. That it has not yet shown up as higher measured inflation is probably due to the long lags that occur between monetary policy actions and when they finally impact the economy. Nevertheless, these two charts are among the most important things to keep an eye on.

Many, including most Fed governors, fear that an early reversal of quantitative easing, which would undoubtedly require higher short-term interest rates, might jeopardize the economy's nascent recovery. I think it makes more sense to worry about what might happen if the Fed waits too long. I seriously doubt that this economy is so fragile that it can't support short-term interest rates of at least 2-3%. I really worry that an inflationary error from the Fed at this point, which would weaken the dollar and undermine confidence in the U.S. economy, would do far more damage. Far better to pursue a path that builds confidence in the strength of the dollar, rather than gambling everything to boost the economy. Monetary policy was never designed to be a tool for raising or lowering the economy's growth rate.

Soooo, in light of the monetary base chart in today's post, why won't we see the blue, red, grey, and green bars soon shown in Friday's post?

ReplyDeleteIt would take many years, I believe, before things could get as bad as they were in the early 80s.

ReplyDeleteWhat the Fed is doing is potentially very inflationary, but it's not guaranteed to be inflationary.

Clarification: the Fed would need to make a series of mistakes over an extended period before inflation got to double-digit levels.

ReplyDeleteHow can this action weaken the dollar? Every other country is engaging in the same behavior. Even China. Is any other country not? All currencies should be devalued. However, against what? Commodities? China has so many commodities stockpiled their demand must ease soon. The have no where to keep putting it. Global factories are running well below capacity and the consumer shows no sign of pausing de-leveraging. I see a much greater possibility of deflation. About summer 2011 seems right. There may be bubbles forming (China residential real estate) but these are small anomalies.

ReplyDeleteYour point is well taken, since every currency has fallen vis a vis gold, the ultimate standard. But when all currencies are devalued against gold, then it makes no sense to expect deflation. Currency weakness is where inflation starts.

ReplyDeleteBefore I go any further, your blog is fantastic. I have been reading for about 18 months now. Love it. Your level headed analysis last from October 2008 to April 2009 helped give me confidence (and knowledge) to make money. I have never written before because I had always agreed. Now, however, I still think you are over reacting in regard to inflation. Gold is a commodity. I believe, just like other commodities there is also an excess capacity in gold right now. Even if gold gains in price relative to currencies, what will it buy... oil? There is plenty of oil. So there might be a gold bubble but it would be an anomaly. Inflation may start with currency weakness but I cannot see a path where it continues as long as there is so much excess capacity and slowing consumer demand. The only demand right now is being created by the governments themselves and that will not last. Should end about 2011.

ReplyDeleteI think you're too hung up on demand as the driver of inflation. That's Phillips Curve thinking, and there is precious little evidence that inflation works that way.

ReplyDeleteI learned about inflation the hard way, living four years in Argentina in the late 1970s. The currency literally collapsed against gold, the dollar, commodities and real estate. Inflation averaged about 7% a month. Yet the economy was in a deep recession most of the time. I recall that industrial production per capita fell by about 50% from the mid 70s to the mid 80s. There was really no demand, yet prices soared because the government was printing money to pay its bills.

If the Fed continues to buy lots of mortgages, we will end up with too much money regardless of how weak the economy might be. That will produce inflation, no question.

Ok, All currencies will be devalued. We are headed for global inflation. Commodities will be plentiful but expensive. What should and investor in Argentina have done in the 70's. Remember the option to invest in other currencies is off the table in this case. So that answer must remain in Argentina.

ReplyDeleteEven if the Fed makes a mess of things, that is no reason to think that all currencies are going down the drain. But if we are on the verge of a major reflation in the U.S., then the obvious investment choices would be tangible assets, since they would almost certainly perform better than nontangible assets and financial assets. Invest in commodities (still cheap in real terms by historical standards) and real estate (now a lot less expensive than just a few years ago) and art (also a lot cheaper due to the recession).

ReplyDelete'inflation is always and everywhere a monetary phenomenon'--Milton Friedman

ReplyDeleteWhy do policy makers and economists think this natural law has been repealed? It hasn't.

Inflation is a hidden tax on savings and investment, yet we allow politicians and their appointees to create it. Find and elect honest candidates ASAP. Only you can prevent inflationary fires.