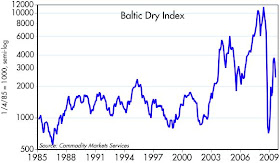

A reader questioned why I highlighted the Baltic shipping indices when they supported the bull case, but have neglected to show them now that they have collapsed. Well, here they are. The way I interpret the Baltic indices, which have indeed dropped from their highs of early June, is that a) they are typically quite volatile, b) their recent volatility is within the range of past volatility, c) they are still way above the levels of late last year when global trade ground to a halt, and d) they are still at levels that in the past have been consistent with relatively strong global trade. So I see nothing in the Baltic charts that leads me to think that the recent decline in these indices reflects any major problem with global trade or the global economy.

As for the Harpex Index of shipping, which I have cited before, it is still moribund, trading flat since late June. I don't understand this index enough to know what to make of this, but as I have said before, it looks to me like it has bottomed.

A few months ago I saw a news video where the interviewer was attacking Brian Wesbury for his bullish positions. The line of attack was that the market was down 150 points that day -so he was wrong the market was recovering. It was irrelevant that the past several months had seen something like, at that time, a 30%plus gain. I am always amazed at how people can take a fragment of data in the attempt to prove a point (usually the bearish point).

ReplyDeleteIf I recall correctly, you recently turned 60. According to my data the S&P500 traded between 13 and 16 in 1949. At 1030 the index is about 68 times higher than the year of your birth and that does not include dividends. Is that too long-term a perspective?

60 years might be just a tad too long...

ReplyDeleteScott-

ReplyDeleteGreat pics of Hawaii. The Baltic is a price index, not a volume index so the volatility is not necessarily an ironclad indicator. Prices have rebounded in general due to a modest recovery in trade finance (letters of credit) and the Chinese stimulus package. But there remains volatility based on new ship deliveries and other factors like port congestion. I think you have been spot on in interpreting what the general trend means and ignoring the short term movements. When paired with other indicators of the volume of seaborne trade, your analysis holds up in my opinion, and critics that hone in on a short term down trend in the Baltic are playing "gotcha".

Donny: excellent points as to the source of Baltic volatility. Makes sense to me.

ReplyDeleteScott,

ReplyDeleteWhen I first brought up the fall of the Baltic Dry Index a couple of weeks ago, I was perplexed and concerned. But then I noticed that the prices of commodity continue to rise like copper, nickel etc. I recently read that there are 1,000 new ship being deployed and also China maybe decreasing import of some commodities to try to negotiate better pricing. China iron ore negotiations ia still on going with BHP and Rio Tinto.

Your analysis of BI makes sense to me. Is the glass half-full or half-empty is a subject of life long debate. But you do not need to be Albert Einstein to see the BI is holding above its 90's highs and even with the pull-back is above many of it's 21st century levels. Volitility is purhaps the most over used word within the Economic and Investment community. The spike up and pull-back is no mystery. China is becoming the GS of the east. They stockpiled raw materials when prices were colapsing in Q4 2008 through Q2 2009(Drybulk ships)and stop in June. Yes, a ton of new ships coming online increase competition. But also true a ton of old ships need to be sent to the scrap yard. I've always wondered what the MPG is on a super-tanker.

ReplyDelete