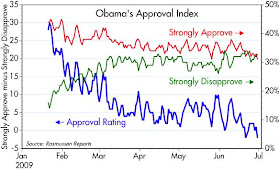

Rasmussen Reports has a daily tracking poll which shows that Obama's overall Approval Rating has dropped from 30 to -2. The Approval Rating (blue line) is the difference between the percentage of respondents who Strongly Approve and the percentage who Strongly Disapprove of the job he is doing as President.

Rasmussen Reports has a daily tracking poll which shows that Obama's overall Approval Rating has dropped from 30 to -2. The Approval Rating (blue line) is the difference between the percentage of respondents who Strongly Approve and the percentage who Strongly Disapprove of the job he is doing as President.Note that the main reason his approval rating has dropped is that the number of people strongly disapproving of his performance has risen significantly. His star appeal has waned somewhat, but the bigger story is that more and more people feel pretty strongly that he is not doing a good job.

I view this as a positive for the outlook, since it means that his ability to continue pushing a radical left-wing agenda is diminishing daily.

In Spanish there is a saying which describes this: El que mucho abarca, poco aprieta. It's not easy to translate, but it goes something like this: "He who tries to take on a lot ends up not doing very much." In a word, it would be "overreach."

Just imagine where Obama's approval ratings would be without all his MSM bootlickers.

ReplyDeleteScott, given Roger Altman's column in today's Wall Street Journal, http://online.wsj.com/article/SB124631646572370703.html

ReplyDeletecould you post your graph showing the relationship between tax revenues as a percentage of GDP and recessions?

There should be another category: "I now admit I was duped into believing the Hope and Change bullshit." Sadly there are many libertarians in that category. they were penny wise and pound foolish with their freedoms. Economic freedom is just as precious as our other freedoms. Piss it away and the others will follow.

ReplyDeleteNice to hear such great news. Congressional elections are just 16 months away -- plenty of time for the dems to reach a crest of unpopularity.

ReplyDeleteI imagine that Obama's rush to make changes comes from his realization that he doesn't have much time to institute them as his popularity wanes.

This comment has been removed by the author.

ReplyDeleteMore in relation to the cap-and-trade post but relevant to this as well.

ReplyDeleteA good article @ the prudent bear about Britian and subsequent policy mistakes that have led to its steady decline.

Will we see the same policy mistakes here?

http://www.prudentbear.com/index.php/thebearslairview?art_id=10245

"Analogies abound today. In Britain, the 1986 Financial Services Act opened the City of London to international competition without adequate protection for British institutions battered by the economic chaos of the previous decade. Consequently, Britain's unique capability in financial services has effectively been lost, and that business is likely to migrate increasingly away from London in the decades ahead. In the United States, the Waxman-Markey "cap and trade" energy bill, before the House of Representatives earlier this month, would almost certainly be a similar mistake, crippling U.S. industry against international competition for a goal that is still not scientifically established with any precision."

"Those who cannot remember the past are condemned to repeat it," said George Santayana. In the case of the enormous human advance of the Industrial Revolution, understanding how the past happened enables us to avoid mistakes that would prevent further such advances today.

THIS IS ALL OBAMA'S FAULT!!!!!!!

ReplyDeleteWith the state poised to issue billions in IOUs in lieu of cash this week, California's budget crisis could create serious headaches for some private vendors and local governments.

The deciding factor could be California's banks. If they're willing to honor the registered warrants, or IOUs, then the problem becomes manageable for the scores of small businesses and local governments that rely on dollars flowing from Sacramento. They'll be able to cash the IOUs.

But if the banks resist, billions in state payments will be effectively delayed – putting renewed stress on a state and region already suffering from a deep recession. One Rocklin company, a temp firm that relies heavily on state business, has already laid off five workers in anticipation of a cash squeeze.

http://www.sacbee.com/topstories/story/1987906.html

Welcome to Alstry's world.....where basic economic principles are no longer relevant.

Great economic web site....again

ReplyDeleteway too much politics....how about

Chicago purch managers and Consumer

Confidence.....anu comments on the

jobs hard to get minus jobs plentiful index

I don't pay much attention to the regional purchasing managers indices. Tomorrow's ISM index is the one to focus on, as well as car sales. I'll also post on the Challenger job cuts. I've posted on consumer confidence before, and not much has changed since then.

ReplyDeleteScott,

ReplyDeleteI valued your column for the thoughtful good-news economics. But I can get political opinion (with a better signal-to-noise ratio) elsewhere. Sadly I bid you goodbye and good luck.

I don't understand people that have such a narrow focus of events that they can't mix different avenues of this thing we call our lives. Does anyone really think that politics and economics are not joined at the hip? To express admiration or disdain over a political agenda or a political figure is to be at the root of the economics that will come from those policies.

ReplyDeleteThis is a great blog not only because of Scott's knowledge of economics and the market place but also because of the diverse opinions the responders bring, even if political in nature.

Bob

Bob: Thanks, I agree. Politics and economics are absolutely inseparable. I've made a few giant mistakes in my career, and one was last year when I underestimated the ability of Obama to pursue a far-left economic agenda. That agenda is already having sweeping ramifications that cannot be ignored.

ReplyDelete