Japan's central bank was the first of the major central banks to practice "quantitative easing" in order to rid its economy of deflationary pressures. Following years of very low and negative inflation, and a severely depressed housing market and equity market, the BoJ began force-feeding reserves to the banking system in late 2001. It took them a long time to admit that they had been way too tight since the early 1990s. Within a few years of easing, the results came in: Japan's CPI went from being -1.6% in early 2002 to over 2% in 2008. They subsequently reversed themselves beginning in 2007, and, not surprisingly, inflation returned to negative levels by early 2009. Like all central banks, they have recently shifted to a more expansive policy in order to ward off deflationary pressures.

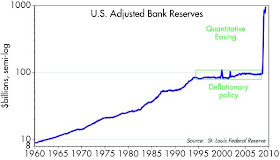

The U.S. Fed followed a fairly restrictive monetary policy throughout most of the 1990s, with the result that deflationary pressures began to build in the late 1990s and the economy fell into a recession in 2001. Inflation by several measures reach a low ebb in mid 2002, when the Personal Consumption Deflator fell to 1.0%. The Fed then relaxed policy beginning in 2003, and inflation drifted higher, to more than 5% in 2008. Then came the great financial crisis and the global economic slump, which subsequently prompted the Fed to pull out all the stops and more than double the amount of bank reserves in the system beginning in September 2008. Despite a severe recession and, according to most traditional estimates, a huge amount of economic slack, core inflation (as measured by the CPI) rose at a 2.3% annual rate in the three months ended May, 2009—up from a low of 1.7% for the fourth quarter of 2008.

The point here is that bank reserves—the most high-powered form of money that only a central bank can create—can and do have a significant impact on the inflationary climate of an economy. Which is to say that monetary policy can be very powerful if it wants to be. Moral of the story: never underestimate the power of a central bank to get what it wants. Monetary policy is one of the most powerful, if not the most powerful, of the tools that are available to government bureaucrats. Today, the Bernanke Fed wants very much to avoid deflation, and they would not be displeased if inflation were to rise a bit.

Caveats: Monetary policy works with long and variable lags, as Milton Friedman noted many years ago. Plus, monetary policy actions must be judged according to the context in which they are applied. To date, the Fed's aggressive expansion of bank reserves has probably only just barely offset the market's incredible desire to hold more dollar liquidity. In other words, Fed policy hasn't been as inflationary (yet) as one would expect given the degree to which they have expanded bank reserves. Similarly, the fairly rapid increase in bank reserves in the early 1980s coincided with falling inflation, since at the time the market's desire for dollar liquidity was very strong—stronger than the Fed's desire to relax monetary policy.

TIME TO OUTSOURCE AMERICA!!!!!!!!

ReplyDeleteWe can no longer serve the banking system as few of us can afford to borrow or those of us that can have no economic use to borrow!!!

In the name of efficiency, it could be better to shut America down and sell our natural resources to the BRICs.

If you think about it, it would be a lot more profitable for our banks to loan every Chinese family a few thousand dollars in a growing economy then take the risk on Americans where the default rate is skyrocketing making loans unprofitable.

In the name of economic efficiency, why not shut America down just as we did to thousands of factories across the nation and move all of our business to the BRICs whose citizens don't have much debt and demand much lower wages.

After all, few Americans can afford to borrow and consume anymore!!!!!!! Who are the banks going to lend to in America anymore???? If you really think about it, what good are we to the banks that we just bailed out???????

Has America become the rust belt today to bankers???? Most of us never seemed to care when it wasn't us....what happens now if it is all of us?????

Isn't that what efficient distribution of capital is all about???

Scott,

ReplyDeleteI was all prepared to give you the smack down but actually this was very nicely done and rather objective. The only thing I would caution though is that while the Japanese CPI did turn positive the Japanese GDP deflator never did (at least looking at the annual data). I suspect that the Japanese CPI is much more volatile than the Japanese GDP deflator and should be interpreted cautiously.

Alstry,

ReplyDeleteChinese growth may be a phantom of the government’s imagination. I would not bet the farm they are default better investments.

I think the companies who hold Russian auto loans are finding out the difficulties in loaning to foreigners...

on Japanese money supply, since the collapse of the Nikkei back in the late 1980's what has gone unnoticed is how little Japan's M-2 has grown, maybe by no more than 1% a year until recently (2009)

ReplyDeleteHerbert: interesting, yes. I think it reflects the inherent non-dynamic, conservative nature of the Japanese economy. Plus, the BoJ on balance has done a pretty good job of keeping the yen strong. Economic growth is pretty modest also (2% per year) until falling off a cliff recently. The workforce is now shrinking. Not much excitement there.

ReplyDelete