Last November I was saying that TIPS were an extremely attractive investment. Real yields had climbed to very high levels because the bond market was convinced that deflationary forces were so powerful that nobody wanted or cared about TIPS's inflation protection. I argued that the government-guaranteed real yield on TIPS was compelling regardless of one's view on inflation. Since I thought deflation was unlikely to persist, and was very unlikely to be as lasting as the market feared, then TIPS were doubly attractive because they offered a juicy real yield and very cheap inflation protection.

Last November I was saying that TIPS were an extremely attractive investment. Real yields had climbed to very high levels because the bond market was convinced that deflationary forces were so powerful that nobody wanted or cared about TIPS's inflation protection. I argued that the government-guaranteed real yield on TIPS was compelling regardless of one's view on inflation. Since I thought deflation was unlikely to persist, and was very unlikely to be as lasting as the market feared, then TIPS were doubly attractive because they offered a juicy real yield and very cheap inflation protection.A little over two months have passed, so it's time to review the situation. As the second chart shows, real yields have dropped significantly, which means that the prices of TIPS have risen significantly. That has been offset to a degree by two months' worth of negative CPI announcements. The market's view of future inflation has risen somewhat, because some of the expected deflation has occurred. But with oil and energy prices stabilizing and even rising over the past month or so, negative CPI months are much less likely to occur going forward.

TIPS are like the Swiss Army Knife of the bond market, since they can work for you in a variety of ways. They are the only instrument in the world that guarantees you a real yield (a guaranteed inflation-adjusted yield), because of the way they are structured and because they carry a U.S. government guarantee just like Treasury bonds. They are also the only instrument in the world that guarantees to pay you whatever the rate that consumer price inflation happens to be. They are good hedges against recession, since real yields tend to decline in a recession.

Today the real yield on 10-year TIPS is at a level that I consider to be "fair value:" neither very attractive nor very unattractive. But if you don't require the "on-the-run" issues (which have been bid up in price because they offer greater protection against a period of sustained deflation), then you find that real yields on TIPS are in the range of 2.3-2.6%, and I consider that to be a level which is cheap to extremely cheap. So the average TIPS bond, or a fund like TIP that invests in all TIPS issues, offers a real yield that is historically quite attractive. (Buying an indexed TIPS fund is probably a good idea for small investors, since the bid/ask spread for small amounts can be prohibitively expensive.)

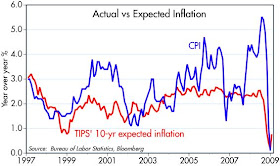

The first chart shows that the market is expecting the CPI to average about 0.8% over the next 10 years. Off-the-run issues have inflation expectations that are even lower. In other words, TIPS are priced to the expectation that inflation is going to be extremely low for many years. Much lower, in fact, than anything we've seen in our lifetimes. If you are worried that the Fed's extremely expansive monetary policy is going to generate inflation that is at least as high as what we've seen on average over the past 10 years (2.6%), then TIPS offer you a very cheap way to benefit should the market's expectation of very low inflation prove to be wrong. For example, let's say you buy the TIPS index, which today offers a real yield of about 2.4%, and that over the next 10 years CPI inflation averages only 2.5%: you would receive a total return of about 5% per year (minus transactions costs fees of course). Bear in mind that's 5% a year guaranteed by the U.S. government; a risk-free return. Stocks might do a lot better, but their return is not guaranteed at all.

So TIPS offer a very attractive real rate of return, and they provide inflation insurance that is very cheap. On a risk-reward basis I think they look much more attractive than almost any low-risk investment alternative. If you must keep your money safe for the next few years, and/or you are worried about rising inflation, than TIPS are still a steal.

Full disclosure: I am long TIPS bonds and TIP.

Scott, I really like your info and charts. It really helps to keep things in proper perspective. I must say, most 'TV' commentators have a much more negative slant than you do. It is hard not to fall into the negative camp. Do you ever have any doubts about your outlook or 'take' on the current situation?

ReplyDeleteThanks for your work.

Bobby

Thank you! I try to be as objective as possible. I read a wide variety of things and draw my own conclusions. I never watch business TV, and almost never watch TV at all for that matter. I often have doubts, and I have gone through several periods of deep, wrenching soul-searching coupled with significant losses in my personal portfolio. Nothing is ever black and white.

ReplyDeleteThank you! for the TIP's update!

ReplyDelete