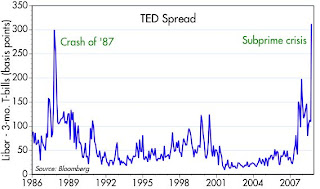

I don't like the idea of a bailout, and I wonder if it is necessary, but I do know that the financial markets are under extreme stress. This chart of the TED spread (a measure of stress in interbank lending) makes the point—this is worse than the Crash of '87. Bad policies and short-sighted politicians got us into this mess, and there is no easy way out at this point, unfortunately. The wheels of commerce are still turning, as I've been pointing out, and loans are still being made, but a potentially large number of banks are at risk of failure. The problem is that they have more exposure to subprime real estate than they ever imagined. That's because the market is currently assuming that the extent of the housing market collapse will be far greater than even the most extreme, pessimistic assumptions that people used a few years ago.

I don't like the idea of a bailout, and I wonder if it is necessary, but I do know that the financial markets are under extreme stress. This chart of the TED spread (a measure of stress in interbank lending) makes the point—this is worse than the Crash of '87. Bad policies and short-sighted politicians got us into this mess, and there is no easy way out at this point, unfortunately. The wheels of commerce are still turning, as I've been pointing out, and loans are still being made, but a potentially large number of banks are at risk of failure. The problem is that they have more exposure to subprime real estate than they ever imagined. That's because the market is currently assuming that the extent of the housing market collapse will be far greater than even the most extreme, pessimistic assumptions that people used a few years ago.I can't prove this, but people I trust tell me that subprime paper is currently priced to the assumption that nationwide housing prices will fall 40-50%, triggering massive defaults and losses to those holding subprime loan tranches that were once considered virtually bullet-proof. (Here's an analogy: you're a conservative investor that buys only AAA-rated corporate bonds from the country's premier corporations. One day you wake up to discover that virtually ever major corporation is expected to default on its obligations. You simply can't believe it, but you're wiped out.) So far prices have fallen by about 20% in major markets, according to the Case-Shiller indices, but the market is assuming we're less than halfway to the eventual bottom in housing prices. To be a willing seller of subprime-related paper today, you have to believe that prices will fall by more than 50% from their mid-2006 peak. I know some houses in the Inland Empire have already fallen by that much, but to think that this will be repeated everywhere around the country is pretty pessimistic to say the least, and would certainly prove catastrophic to just about everyone.

If the bailout can result in unburdening the banking system of some portion of these distressed securities, we will avert massive bank failures and restore badly-needed confidence. It is not unreasonable to think that the loans that Treasury ends up purchasing could prove to be quite profitable. They might not even have to spend $700 billion; just demonstrating that it is possible might be enough to attract bottom-feeders who would willing relieve the banks of these loans at higher prices.

i dont like the idea of a bailout either. look how high stocks jumped today because investors assumed a bailout would happen. i think there will be a lot of selling tomorrow since this bailout seems dismal. talk about walking on eggshells. . .

ReplyDeleteIt's not clear yet that the bailout will happen, and even if it does, it might contain so much ugly stuff (e.g., equity warrants) that participation in the program might be very low.

ReplyDeleteScott, when you say that "subprime paper is currently priced to the assumption that nationwide housing prices will fall 40-50%" you are implicitly assuming that the only thing determining value is a discount of cash flows.

ReplyDeleteThis is clearly not correct. Valuation judgments are subjective and dependent on many things. Much of this paper was originally bought on leverage during a time when there was an maniacal demand for high yielding securities.

If funds and others are now deleveraging, there could be a significant reduction in the total dollar demand for these securities at what used to be normal prices. It doesn't necessarily follow that "the market" is forecasting those events.

JMHO.

The value of a security is always the discounted present value of its cash flows, but in order to get those flows for subprime mortgages, you need to make a series of assumptions. Taking the price of a security as the given, you can back into the assumptions that are being made about the cash flows. The major assumption which leads to the current price of these securities is the decline of housing prices. There is also an assumption about recovery values after foreclosure, which I think is 50%.

ReplyDelete