History will record that public policy in the Covid era was extraordinarily bad. Lockdowns, school closures and mask mandates were not only ineffective, they exacted a huge toll in overall health, human suffering, learning loss, and economic damage. As we now know, Sweden, virtually the only country to eschew these policies, experienced the lowest excess mortality rate in the world and the healthiest economy.

Back in April/May of 2020 I predicted that "the shutdown of the US economy would prove to be the most expensive self-inflicted injury in the history of mankind." I believe I have been fully vindicated on that score.

In an attempt to mitigate the economic damage of these policies, many countries resorted to massive transfer payments designed to make up for job and earnings losses, and to shore up their economies. The U.S. was arguably the leader among nations in this regard. Sadly, as the dust settles we now see that massive transfer payments were the direct cause of the biggest surge in inflation since the inflationary 1970s.

As if that weren't bad enough, transfer payments (money people receive from the government for which no goods or services are exchanged; e.g., social security, unemployment insurance, stimulus payments) have seriously reduced the incentives to work, leaving the U.S. economy with a shortage of labor and an anemic economy. The Fed can't fix that—only Congress can.

Chart #1

Federal transfer payments are now running at about a $4 trillion annual rate. Chart #1 shows transfer payments as a percent of disposable income. Over 20% of the disposable income in the U.S. now comes in the form of payments to individuals who don't have to work for it. By this measure, transfer payments have more than quadrupled since the early 1950s, and they show no signs of shrinking.

Charts #2 and #3

Chart #2 zooms in on the percent of disposable income derived from transfer payments since 1970. Chart #3 is plotted with the same x-axis, and it shows the labor force participation rate (i.e., the percent of the population of working age that is either working or looking for work). The dashed lines strongly suggest that the big decline in the labor force participation rate since 2008 had a lot to do with a huge increase in transfer payments. Not surprisingly, paying people to not work does not encourage them to work.

If we want to restore the economy's former vigor, we need to reduce transfer payments and increase the incentives to work and invest. We need to incentivize people to work by reducing tax and regulatory burdens.

Chart #4

I've featured Chart #4 several times in the past 6 months or so. It is designed to show that the huge and unprecedented increase in the M2 money supply was the direct result of massive increases in the federal deficit. The government "borrowed" some $5-6 trillion in order to send out a blizzard of checks to individuals. Most of that money ended up sitting in bank savings and deposit accounts (the main source of M2 growth) because a) people didn't have an opportunity to spend it, given the lockdowns, and b) the huge degree of uncertainty and fear which dominated the Covid era made nearly everyone acutely risk-averse. Trillions of dollars were stockpiled in the nation's banks as a result, and now that people don't want or need all that money it is getting spent, and that is fueling the rise in prices.

Fortunately, the source of this national inflation nightmare is fading. The federal deficit is reverting to trend, and there doesn't appear to be a Congressional appetite for yet another round of "stimulus" checks.

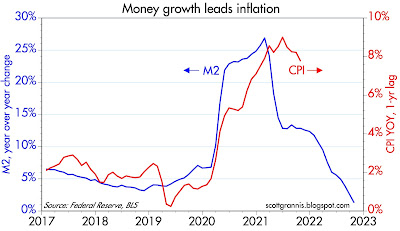

Chart #5

Chart #5 compares the year over year growth of M2 to the growth of the CPI. The CPI line is shifted one year to the left, in recognition of the fact that a) there are lags between monetary policy and its effects on inflation, and b) it took about a year from the time the first round of stimulus checks boosted the money supply until the time the Covid scare had passed and people started spending money in earnest. The chart suggests that it will take at least a year before inflation subsides to a level we're all more comfortable with. From what I can see, we are on track to a lower inflation future.

What we've learned from all of this:

The proximate cause of our inflation problem was a huge increase in federal transfer payments that ended up being monetized, most of it at a time when people no longer wanted to hold so much cash. The economy couldn't absorb all that extra spending (think supply-chain bottlenecks and labor shortages), so unwanted cash ended up fueling inflation. That source of inflation is no longer operative, since transfer payments have reverted to trend. The excess amount of M2 is being worked off as people spend money and the economy grows (in both real and nominal terms). Chart #3 in this post illustrates the process.

The most important thing the Fed can do today is what they have been doing: raise interest rates. Higher interest rates serve to increase the demand for all the excess money still sitting in bank deposits. Inflation happened because the demand for those deposits fell (because people preferred to spend their money rather than hold on to it) as the Covid scare faded. Without higher interest rates, people would be spending a lot more from their savings, and that would push inflation higher. With higher interest rates, savings and money market accounts have become much more attractive, and people are willing to hold on to the extra money, and that is allowing inflation to cool.

Memo to Fed: don't overdo the tightening. Inflation is receding, but it will take time to get back to 2%.

Memo to Congress: please stop spending money you don't have. It doesn't help the economy and it only threatens to keep inflation from falling.

UPDATE (12/20/22): Don't miss this article by my good friend Steve Moore: "It pays not to work in Biden's America—and here's the proof" Steve, Casey Mulligan and E. J. Antoni have documented astounding evidence that our welfare system pays too many people too much not to work. It fits perfectly with this post.

Scott, Thank you for the valuable addition to the previous post. Your professional analysis is very supportive in this volatile market.

ReplyDeleteI don't think social security should be listed as a transfer payment. Or you can, but it's my younger self transferring money to my older self. SS is not a handout. Money was taken out of my paycheck and held by the government and then given back to me. It is my money, the gov't just forced me to save it until my younger self became old.

ReplyDeleteShane: I’m sorry to disappoint you, but SS is definitely a transfer payment. The money that was taken from your salary for social security (FICA) was immediately spent by the federal government. It was never invested, and never held in trust for you. In fact, you have no legal right to receive anything from SS. You receive SS payments only as long as politicians are willing to honor their “promise” to you.

ReplyDeleteEveryone should know these facts. Everyone should know that Social Security is effectively a Ponzi scheme masquerading as an annuity, and the supposed actuaries are simply politicians who will always over-promise and under-deliver. It is a disgrace and it is arguably the worst possible retirement scheme for the American worker. Anyone who understands how SS works would agree that it should be privatized.

Scott, what policy changes would you recommend to Congress to incentivize people to work? Might be an exercise in futility given the political situation but if you have any thoughts on this would like to hear them.

ReplyDeleteScott - I wish I could "+1" your previous comment on SS. Indeed a Ponzi scheme that I hope is still around when I try to claim it. Thanks again for you ongoing analysis and insight.

ReplyDeleteToo many "huge problems". The 8.7% COLA must have been a huge overall increase in transfer payments?

ReplyDeletere: "Inflation is receding, but it will take time to get back to 2%."

ReplyDeleteOil is down coincident with long-term money flows. Alan Blinder said that “food shocks and OPEC ii (supply shocks) deserve much more blame for the alarming rise in inflation in 1979-1980.”

Blinder is wrong. For example, oil prices troughed in Jan 2016 as long-term money flows fell by 80 percent from 1/2013 to 1/2016. Oil fell by 70 percent during the same period.

This time oil is also impacted by China's covid shutdown (lower demand shock).

Salmo: "the 8.7% COLA" to social security payments hasn't happened yet, and that will surely boost transfer payments next year.

ReplyDeleteI will remind you that hubris precedes nemesis.

ReplyDeleteI seriously doubt that we'll see 2% inflation for a long time. Once, that markets realize that, there will be another leg lower. Maybe...

Scott, I understand the gov't spent the money they took. But it is MY money. I, like you, worked very hard for it. Over many long years. The gov't took it - with a promise to give it back to me. Now I understand they may not do so (fail to deliver on their promise). If/when that happens it'll be a disgrace. I'd also prefer they didn't take the money from me back when - and allowed me to invest it as I see fit. Of course, that wasn't and still isn't possible.

ReplyDeleteBut it isn't a transfer payment in the sense of the others you quote. No one worked for unemployment insurance. No one worked hard to get a stimulus payment. But we did work for our pay, quite hard in fact, which was taken from us with a promise to be given back. If they don't give it back, then it'll be a tax (not a transfer payment). When people hear the word transfer payment they think of deadbeats who are getting something for nothing. My SS (whether I get back 100%, or 70%) was something I worked darn hard for.

Don't misunderstand, I am not arguing with you about what SS has become (they spent the money on other things - and now it is possible it'll become underfunded, although they can mitigate that by moving the age goalposts for example). But, and perhaps this is semantics, it isn't a transfer payment like the other examples you gave. You may hate SS for what it is (or has become), but to say we didn't work our butts off for it - is disingenuous.

Shane, consider this: When an insurance company from which you bought an annuity or a life insurance policy makes contractual payments, that most certainly is not a transfer payment, because the company took your money and invested it with the goal of earning enough on its investment to meet its future obligations. It’s a return on investment. But when the government collects FICA payments from workers and uses that money to fund other government obligations it’s very different. The government must tax someone, or borrow the money, in order to make the payments to you. The government effectively takes money from someone’s pocket and puts it in your pocket. It’s a transfer, no investment involved. Without investment, the economy cannot grow and prosper. Taking money from one pocket and putting it another doesn’t create prosperity, just as digging a hole and filling it up again doesn’t amount to productive activity.

ReplyDeleteSadly, you worked very hard for your money, but unfortunately, the government is a very poor steward of your money. If you had invested your FICA contributions in a simple equity index fund, your retirement benefits would be multiples of what it will (with luck) be when you retire with SS.

Lockdowns, school closures, forced vaccinations and other Draconian methods were not about controlling the virus. They were about controlling us. Stand ready for the next crisis.

ReplyDelete