Since just before the onset of the Covid-19 crisis, federal revenues on a rolling 12-month basis have increased 36%, with the lion's share of this coming from surging individual income tax payments.

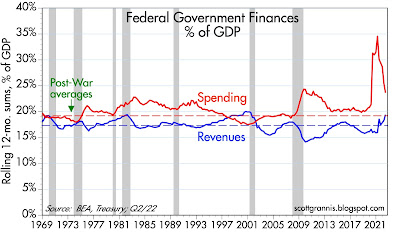

Federal revenues now stand at 19.4% of GDP, which is way above the average (17.4%) since 1968. This is the highest reading since June 2001, when it was 19.8%. In the past 5 decades or so, the highest reading for federal revenues as a percent of GDP was 20.2%, in September 2000. (Recall that the federal government enjoyed a brief period of budget surpluses from 1998 through 2001, thanks to booming tax receipts and slow growth in spending.)

The federal budget would be in surplus today, if not for the continued and profligate spending on the part of Congress. Instead, the deficit in the 12 months ended last month was $962 billion.

The federal budget would be in surplus today, if not for the continued and profligate spending on the part of Congress. Instead, the deficit in the 12 months ended last month was $962 billion.

Yet despite these facts, the Democrats want to increase taxes on corporations, double the number of employees at the IRS, and increase spending by $760 billion, lavishing money on, among other things, green energy boondoggles which have virtually no chance of making any measurable change in global temperatures.

Reason is in short supply in Washington these days.

Reason is in short supply in Washington these days.

What this means is that fiscal policy will become yet more of a headwind to growth, and living standards will struggle to increase, all the while Washington acquires more and more power over our lives.

Chart #1

Chart #1 shows monthly federal revenues (white) and the 12-month rolling average of those revenues (red). Revenues have increased from a monthly average of $296.5 billion to $402.7 billion.

Over the same period and on a rolling 12-month total basis, individual income taxes have increased by a staggering 48%, rising from $1.76 trillion to now $2.6 trillion.

Combine that enormously increased tax burden with the income lost to inflation in the past two years, and the average worker has paid an enormous price for the Covid shutdowns. It's really sickening to contemplate. And yet Washington wants still more.

UPDATE: Here is a better chart of the explosion in tax revenues:

Chart #2

And here is a better chart of how the federal government's tax take is very near record levels relative to GDP:

Chart #3

Amen.

ReplyDeleteYou don't have to be an arch-conservative to wonder why there is not percent-limit on federal outlays as fraction of GDP, unless a war is declared.

I am guessing that most people will start getting very sick and tired of declining standards of living by mid-2023. All the regulations (usually not mentioned much in the media- but their number have grown since 2021), along with the wonderful (/s) bills passed into law requiring subsidies, taxes, and other increased costs of government, will start to bite. I am guessing energy prices may start up again late in the year. Food and shelter are going to have very stubborn inflation behavior. Will people think 4-6% inflation is "good"?

ReplyDeleteThe skill with which the current administration has timed all this will have everything to do with the 2024 elections. If things improve- even after only self-inflicted wounds- we'll get another dose of this from 2025- 2028.

Why double the IRS? You answer your own question:

ReplyDeleteQE + free money = 36% revenue increase

QT + slowing economy = time for more IRS agents (with guns)

I don't think reason is in short supply in Washington. The ends they are aiming for are different than the ends you would prefer.

Benjamin, you sound like an arch-conservative. First zoning reform and now limiting federal outlays?

Minnesota:

ReplyDeleteYeah, well, politics has become scrambled for a lot of us.

Yes, a limit on federal outlays and an end to property zoning.

A downsized military and lot less foreign interventionism.

Border enforcement and balanced trade.

I am not woke.

Just your average neighborhood nut at your service.

A Central bank digital currency is aimed at the underground economy (missing taxes).

ReplyDelete