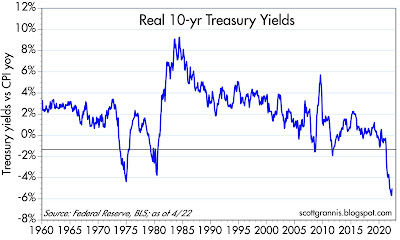

Chart #1

Chart #1 shows the long-term history of bond yields and inflation. Although the recent rise in yields has been rather sharp, yields are still an order of magnitude below where they should be if inflation is indeed persistent.

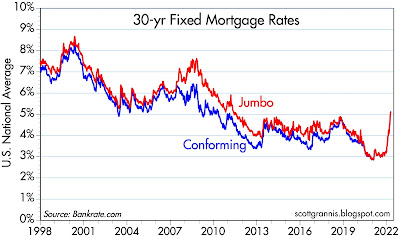

Chart #2

Chart #2 adjusts the yield on 10-yr Treasuries for the rate of inflation. Never have real yields been so low. What that means is that bond investors are beginning to learn that owning bonds is a great way to lose substantial purchasing power. How much longer will it take for bonds to at least compensate investors for inflation? By similar logic, anyone borrowing money at recent interest rates has made a killing if he or she used the borrowed money to buy real assets (e.g., property, businesses, commodities).

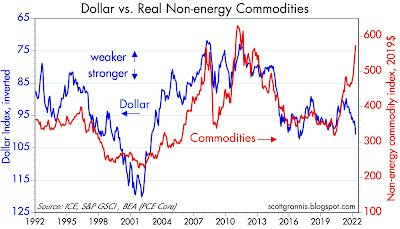

Chart #3

Chart #3 shows the nationwide average rate on 30-yr fixed rate mortgages. It has surged from 3% to now 5.25% in a very short period, but it is still way below the rate of housing price inflation, which has been in double-digit territory for the past year or two. Lesson that is being learned: buying homes with leverage at current mortgage rates can be extremely profitable. That lesson will translate into more demand for houses and more borrowing, which will only exacerbate the inflation fundamentals at work in the economy today. It will also erode the demand for money, which will effectively require the Fed to raise rates even more.

Chart #4

Chart #4 compares the strength of the dollar vs. other major currencies (blue line, inverted) with the prices of non-energy commodities. This chart is actually quite interesting, because the typical correlation of the dollar and commodity prices has completely broken down: it used to be that a weaker dollar correlated with higher commodity prices; now it seems that the stronger the dollar, the higher commodity prices go. This can only mean that artificially low interest rates are stimulating demand for hard assets, but they are not weakening the dollar—perhaps because most major currencies have exceptionally easy monetary conditions. The dollar is benefiting mainly from its safe-haven appeal.

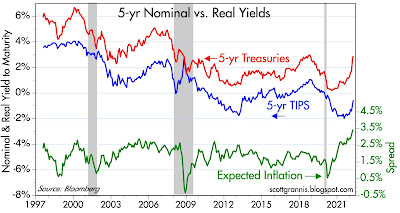

Chart #5

Chart #5 compares the nominal and real yields on 5-yr Treasuries (red and blue lines) with the difference between the two (green line), which in turn is the market's expectation for what the CPI will average over the next 5 years. Inflation expectations have indeed risen, and now stand at an historical high (recall that TIPS only came into existence in 1997). But the market is only expecting inflation to average a bit less than 3.5%, which is way less than the 11% annualized rate that we saw in the first three months of this year. In other words, the bond market is expecting inflation to fall significantly in coming years.

But since the Fed has not even begun to tighten, this is a rather brave assumption.

I find this analysis extremely helpful and clear. Thanks for doing and posting it.

ReplyDeleteThank you. I’ve read every post you’ve written since 2011, and have learned a huge amount. Very grateful.

ReplyDeleteWell, this blurb below is for Q4, and a little dated, but maybe things are not so bad.

ReplyDelete"Unit labor costs in the nonfarm business sector increased 0.9 percent in the fourth quarter of 2021, reflecting a 7.5-percent increase in hourly compensation and a 6.6-percent increase in productivity. Unit labor costs increased 3.5 percent over the last four quarters."

---30---

Well, a 3.5% rise in unit labor costs is not the end of the world.

There's a lot bad luck out there, in Ukraine, oil, and C19. The Biden Administration is not pro-business.

Residential rents have exploded in the US due to extensive property zoning and controls. That is local government in action.

The Fed may be been too easy, but over-tightening could be a worse choice.

There's a supply of savings, and there's a supply of loan-funds. LSAPs on sovereigns, in conjunction with the remuneration of IBDDs, suppresses nominal interest rates. QE decreases the real rate of interest for saver-holders. QE stokes asset bubbles and exacerbates income inequality. The so-called "wealth-effect" is B.S.

ReplyDeleteEconomists have the economic engine running in reverse. "In January 2019, the FOMC announced its intention to implement monetary policy in an ample reserves regime. Reserve requirements do not play a significant role in this operating framework.”

Banks don't loan out savings. From the standpoint of the forest and not the trees, banks pay for their earning assets with new money, not existing deposits. Transactions with its non-bank customers virtually always alters the volume of the money stock.

Lending by the banks is inflationary, whereas lending by the nonbanks is noninflationary ceteris paribus. Hiking policy rates destroys velocity, not money. It reduces R-gDp. This causes a recession. The correct response is to drain reserves while driving the banks out of the savings business.

So 10 yr treasury is still a good approximation of 10 yr real GDP growth correct? With it approaching 3% this is a small silver lining no?

ReplyDeleteAtaraxia: I don't think the 10-yr Treasury yield (nominal) has ever been a good approximation of 10-yr real GDP growth. If we get 10 years of 3% real growth (which is what the 10-yr Treasury nominal yield is) that would be fabulous, but we haven't seen a sustained period of 3% real GDP growth since the 2000s. Some would argue that the real yield on 10-yr TIPS fits that bill, or at least it should, but I sure hope it doesn't work since 10 years of zero growth would be awful.

ReplyDeleteIs it possible to counter the high inflation without normalizing the bond market (bring the real yield closer to zero)? What would you do Scott if you were in Powell's shoes?

ReplyDeletethe real yield on the 10 year should be calculated with the 10 year expected inflation.

ReplyDeleteI've gotta look back in your posts I could have sworn I learned from you that 10 year treasury nominal was market expectations for real gdp growth. I must be mistaken then. Or I misenterpreted it. Marcusbalbus that makes sense.

ReplyDeleteSorry for the question here, but how do I subscribe to the blog on my e-mail, Scott?

ReplyDeleteThanks for your work,

Rafa

Great post as always Scott! It seems the markets are finally waking up to inflation. Too much complacency on inflation. It went from its transitory to now were peaking. I highly doubt we are peaking here. Most investors today have never gone through inflation before. Today's inflation is different from the 70s/80s inflation. We have a war, covid, supply chain issues and massive money printing. PPI's are soaring now and inflations expectations are moving higher and higher. Interesting times but I don't think inflation is peaking. TY

ReplyDeleteWhat would I do if I were Powell? First, I would have started to raise rates at least one year ago, when it became obvious that the M2 money supply was surging and the economy was essentially out of the Covid woods. Doing so would have required great intestinal fortitude, however, given the official angst over Covid infections.

ReplyDeleteSo what to do now? Pre-announcing rate hikes of 50 bps per month is a step in the right direction, as it gives the market a chance to adjust to new realities before they hit. Already the market is pricing in a 3.25% Fed funds rate by June '23. But after that the market sees the funds rate slowly declining. I just can't believe that market-implied forecast. The funds rate should peak at a much higher level.

It all boils down to what level of interest rates will convince the public to hold the current massive supply of bank deposits (M2 is currently almost $22 trillion, which in turn is almost $5 trillion above where it probably should be). Nobody knows what the right rate is; the Fed and the market have to experiment to find the right rate by trial and error. As a first pass, common sense suggests the rate needs to be higher than the current level of inflation expectations, which is now about 3.5% and rising. But if it takes the Fed a year to get to 3.5%, inflation expectations could easily be higher than 4-5%. So going slow only prolongs the pain, and on that score I fully agree with Bill Dudley (former Fed official and a guy I've known since the early 90s).

So I would be much more aggressive than Powell. I would try to convince the market that if higher rates can fix the inflation problem, then higher rates don't need to be seen as a problem. It's always good if the Fed acts appropriately to keep inflation low. The problem is when they don't, which is what they are doing now.

Re "how do I subscribe to the blog on my e-mail?" Unfortunately I don't think it's possible. I'm still a novice at these things. What does seem to work is to follow me on twitter (@sfgrannis), since a tweet is generated every time I make a new post.

ReplyDeleteI believe Biden is an agent of the Devil. The only tool at the disposal of the monetary authorities, in a free capitalistic society, through which the volume of money can be properly controlled is legal reserves (not interest rate manipulation).

ReplyDeletePaul Volcker didn’t stop inflation by raising interest rates, he stopped inflation, the “time bomb”, the release of savings in the 1st qtr. of 1981, by imposing reserve requirements on NOW accounts in the 2nd qtr. But Powell eliminated reserve requirements.

Powell: “The connection between monetary aggregates and either growth or inflation was very strong for a long, long time, which ended about 40 years ago …. It was probably correct when it was written, but it’s been a different economy and a different financial system for some time.”

Powell's vacuous. The distributed lag effects of money flows, the volume and velocity of money, have been mathematical constants for > 100 years (not "long and variable").

Using a price mechanism, pegging policy rates, to ration Fed credit is non-sense (“a price mechanism is a system by which the allocation of resources and distribution of goods and services are made on the basis of relative market price”).

ReplyDeleteThe effect of current open market operations on interest rates is indirect, varies widely over time, and in magnitude. What the net expansion of money will be, as a consequence of a given change in policy rates, nobody knows until long after the fact. The consequence is a delayed, remote, and approximate control over the lending and money-creating capacity of the banking system.

“If the Fed wants a soft landing, its focus must be on the rate of growth in the money supply, broadly measured.” — John Greenwood and Steve H. Hanke WSJ – April 10, 2022

ReplyDelete“What is the adequate rate of growth for the money supply that would eventually hit the Fed’s inflation target of 2%? It’s the “golden growth” rate of around 6%. By taking the growth rate in M2 down from its current level of 11%, Mr. Powell can bring inflation down and land softly.”

Powell: "Inflation is not a problem for this time as near as I can figure. Right now, M2 [money supply] does not really have important implications. It is something we have to unlearn.”

Actually, M2 is mud pie. Money has no impact on prices unless it is turning over. The turnover ratio of total checkable deposits to savings deposits is > 95:1. The fiscal helicopter drops repeatedly injected unpredictable economic disturbances into the conventional rate-of-change in money flows. But that doesn’t mean you abandon a 100 + year historical trend.

Unless you close the gap between short-term and long-term money flows, the volume and velocity of money, you get higher prices regardless of a deceleration in long-term money flows.

ReplyDeleteAs Nobel Laureate Dr. Milton Friedman said: “Inflation is always and everywhere a monetary phenomenon, in the sense that it cannot occur without a more rapid increase in the quantity of money than in OUTPUT.”

Link: Industrial Production: Mining, Quarrying, and Oil and Gas Extraction: Oil and Gas Extraction (NAICS = 211) (IPG211S)

https://fred.stlouisfed.org/series/IPG211S

Scott, just the perception so far that the Fed will be more aggressive has caused the US dollar to rise about 10%. This is helping reduce inflation in this country a bit, but is putting inflation pressure and debt pressure on countries like Sri Lanka. How do you perceive that foreign risk of turmoil affecting the Fed’s decision.

ReplyDeleteGot my "last" stock market sell signal (I use three signals/systems) at the close Friday. I did a quick count, and this setup/situation has happened ~15 times since 1989 (easiest data for me to check), and about 5 of them coincided with big bear market drops, e.g. >15%, some bigger, such as the the 2000-2003 and 2008-2009 bears.

ReplyDeleteThe stock market is very risky now.

Salmo Trutta

ReplyDeletePlse explain your idea in a plain terms, I would love to get it right. Thanks.

Well the stock market could be a leading indicator for material interest rate increases. Let's hope higher rates bust out the incentive for investor buying of residential real estate.

ReplyDeletehttps://www.calculatedriskblog.com/2022/04/black-knight-mortgage-delinquencies-hit.html

ReplyDeleteMortgage delinquencies at all time low.

Well, things can always get worse, but at least 2022 is not looking like 2008-10.

Lots of bad news out there, pandemic, oil, Ukraine. The Biden Administration is not pro-business (well, except for Silicon Valley, housing finance, Wall Street and media).

But, one could argue all these negatives could get better in the next year.

Will the FED and Bonds still be behind the curve when the market drops 40% and the economy goes into a deep recession and deflationary spiral?

ReplyDeleteFred: the scenario you describe is what we all are hoping to avoid. It's a scenario in which the Fed falls behind the curve for an extended period and is then forced to tighten aggressively. Typically that is what precedes deep recessions and declining inflation.

ReplyDeleteI don't see a big disaster for now, since the Fed hasn't tightened at all. Real interest rates are still very low and liquidity (especially M2) is abundant. In the presence of very low real rates and abundant liquidity it is difficult to see what would cause a deep recession and deflation.

Further to my comment above: One thing that could spark a market collapse and deflation, in the absence of a massive Fed tightening, is a significant escalation of the war in Ukraine. If Russia decides to resort to the nuclear option, for example, we could well be faced with an "end of the world as we know it" scenario. While that cannot be ruled out, I don't think it makes sense to try to plan for such an event.

ReplyDeleteSelling because you fear nuclear war and the end of the world seems silly to me. Who will you trade with in such an event? A cockroach?

ReplyDeleteWe all need to prepare for a savage market crash exceeding 75% across all asset classes -- stocks, bonds, real estate, crypto, everything. Then we can get excited about a rebound. Best to switch to Euclidean counts other than dollars -- shares, coins, acres, lbs, gallons, etc.

ReplyDeletePS: Be sure you have a year's supply of food and water on hand in your safe place -- at least we can eat well if everything goes berserk!

ReplyDeletePPS: Per aspera ad astra!

ReplyDeleteSo, given "In the presence of very low real rates and abundant liquidity it is difficult to see what would cause a deep recession and deflation", should we expect to see a bear steepening of the yield curve over the next 12 - 18 months?

ReplyDeleteGross Domestic Product: Implicit Price Deflator (A191RI1Q225SBEA) =8%

ReplyDeletehttps://fred.stlouisfed.org/series/A191RI1Q225SBEA

The monetary “punch” has grown since the pandemic. The percentage of transaction deposits to savings deposits has risen from 1.27% to 1.49%.

The economy is being run in reverse. Lending by the Reserve and commercial banks is inflationary (S≠I). Whereas lending by the nonbanks is noninflationary (other things equal) where S=I. In fact, if savings are not expeditiously activated, then a dampening economic impact is generated.

The solution is to drive the banks out of the savings business, increasing velocity, while at the same time the FED drains the money stock. The 1966 Interest Rate Adjustment Act is prima facie evidence.

Link: https://www.richmondfed.org/~/media/richmondfedorg/publications/research/economic_review/1978/pdf/er640602.pdf#:~:text=Congress%20reacted%20to%20these%20concerns%20in%20September%20of,interest%20rate%20ceilings%20to%20the%20thrift%20insti-%20tutions.

REGULATION Q AND THE BEHAVIOR OF SAVINGS AND SMALL TIME DEPOSITS AT COMMERCIAL BANKS AND THE THRIFT INSTITUTIONS by Timothy Q. Cook

Reg Q. Boy, that goes back, waaaaaayyyy back.

ReplyDeleteMarch PCE core out yesterday at 5.3% yoy. The PCE core has been running at this level for several months. Not pretty, but not the horrific runaway catastrophic world-ending inflation that you are reading about.

ReplyDeleteLots of bad luck out there, such as Ukraine, oil, pandemic, supply chain snags, government bungling.

I think the worst is behind us and that publicly held companies will maneuver to benefit from inflation on the sales side, while holding down costs.

Some dividend stocks are interesting. I just don't know which ones.

Hi Benjamin,

ReplyDeleteAlways a pleasure getting your perspective.

Any thoughts on Q1 real productivity numbers in this hyper-financialized world?

Another topic that may interest you is that (despite nobody talking about this now AFAIK) the Fed's net worth is likely underwater (negative net worth) and, if present trends continue, the Fed may no longer remit to the Treasury the interest it receives on Treasury securities it holds as assets in order to rebuild equity, at least that's what Mr. Bernanke theoretically suggested when asked a few years ago.

i agree inflation is about to break but wonder about the extent of the break?

In the real world, the Fed is about to tighten in an economy already growing negative with declining real incomes ex-transfers. Interesting times..

Hello,

ReplyDeleteCan FED start buying equities as an emergency tool at some point?

@Benjamin Cole

ReplyDeleteInterest is the price of credit. The price of money is the reciprocal of the price level.

Powell: “That classic relationship between monetary aggregates and economic growth and the size of the economy, it just no longer holds. We have had big growth of monetary aggregates at various times without inflation, so something we have to unlearn.”

https://www.federalreserve.gov/monetarypolicy/2021-07-mpr-part2.htm#:~:text=Monetary%20Policy%20Report%20submitted%20to%20the%20Congress%20on,rate%20of%202%20percent%20over%20the%20longer%20run

The Keynesian economists have achieved their objective, that there is no difference between money and liquid assets.

Carl- my guess is we see unit labor costs in the first quarter at sub 5% yoy.

ReplyDeleteI hope the Fed goes easy on fighting inflation.

Did you know that when Volcker was Volcker and Reagan was Reagan, The Wall Street Journal opined that any inflation rate under 5% was good enough?

https://www.mercatus.org/system/files/hetzel-pandemic-monetary-policy.pdf

ReplyDeleteHetzel: “To control inflation, the FOMC must control the growth rate of nominal GDP relative to the growth rate of potential real GDP. Figures for GDP are available only with a long lag and are subject to revision”

So, we need hypermind predictions.

Hetzel: “Another characteristic of the FOMC’s Keynesian framework is the assumed transmission of monetary policy through the influence exerted on financial intermediation. That is, monetary policy works through its influence on the cost and availability of credit…

Effectively, the FOMC managed a search procedure by the bond markets for the natural rate of interest.”

Never are the banks financial intermediaries in the savings-investment process. The utilization of bank credit to finance real investment or government deficits does not constitute a utilization of savings since financing is accomplished by the creation of new money. Savings are not synonymous with the money supply.

Imports subtracted -3.2 percentage points from the GDP in the 1st qtr. The FED monetized 75% of all new Treasury issuance over the last 24 months. M2 grew at a blistering 36% rate over the last 24 months.

ReplyDeleteThe money stocks rate of growth must be drastically cut over the next 24 months.

Salmo Trutta: I happen to be a fan of Robert Hetzel. That said, he belongs to that large clan of macroeconomists who regard a moderately higher rate of inflation as catastrophic ruin.

ReplyDeleteI wonder how macroeconomists would view the world if they faced 10% to 20% unemployment in every recession?

And as an aside, completely unrelated, Warren Buffett, age 92, and Charlie Munger, age 98, just held a five-hour long annual meeting.

If you are old enough, that fact alone will make you happy.

Hetzel sized up the divergent viewpoints clearly. Unemployment represents a macro error. FOMC schizophrenia: Do I stop because inflation is increasing? Or do I go because R-gDp is falling?

ReplyDeleteBanks don't lend deposits. Deposits are the result of lending/investing. Ergo, all bank-held savings are frozen. Link: "The Riddle of Money Finally Solved" by Dr. Philip George

http://www.philipji.com/riddle-of-money/

https://danericselliottwaves.org/

ReplyDeleteI think Daneric has the right ideas.

Excellent comments Scott.

ReplyDeleteI sure remember 1980 - Jimmy Carter hiring Wm G Miller, from Bendix, with no financial experience- they together wanted paradise zoomed $ supply rates & inflation skyrocket to17-18% - Paul Volker forced in with meat ax!! Recession followed.

My question Scott - What is your best guestimate on the timing of the next recession and its magnitude?

Thanks much.