In response to a reader's comment regarding why gold prices these days are falling while inflation is rising, I offer two charts which may help.

The bottom line is that gold prices do not react to changes in inflation, they anticipate changes in inflation. Markets are constantly trying to predict what will happen, oftentimes well in advance of the actual event. This is as it should be, of course. Otherwise it would be too easy.

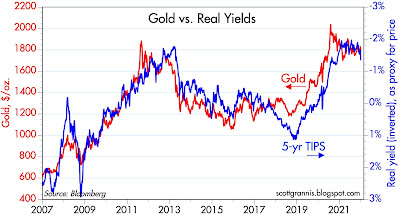

Chart #1

Chart #1 compares gold prices to the real yield on 5-yr TIPS (inverted). The inverse fit between gold and TIPS yields is pretty impressive, but I caution that this fit does not apply so well to the years prior to what is shown in this chart. My interpretation of the chart begins with the observation that real yields as reflected in 5-yr TIPS are a proxy for how accommodative or tight the market expects the Fed to be in coming years. An accommodative Fed is one that will tend to push real yields lower (as happened during the period 2007 through 2011). A tight Fed does the opposite: it pushes real yields higher (as happened from 2012 through 2015). When the Fed is expected to be easy, gold prices rise in the expectation that an easy Fed today will deliver higher inflation tomorrow, and vice versa. Currently, real yields are beginning to rise from very low levels, and the gold market is weak in the expectation that a tighter Fed will deliver lower inflation in the future.

Chart #2

Interestingly, a strict interpretation of Chart #2 would lead one to surmise that gold prices are overdue for a decline. It will be interesting to see if this actually happens.

Fascinating commentary.

ReplyDeleteIMHO, gold is dubious, in the same way diamonds, or rare oil paintings, silver, Bitcoin or a 1959 Impala are dubious.

The value is not based on a stream of income that can be produced, but on elusive investor sentiment. If enough people concur gold is worth something and an inflation hedge...then it is true.

Same for Bitcoin, btw. But if people lose faith....

BTW, I would love a 1959 Impala. That vehicle represents real, enduring value!

As I have gained more investment experience, I have settled on several asset classes, and don't do much investing in smaller groups than these classes. I have done some, however, including "gold" investing, but through a fairly diversified mutual fund. It was/is a combination of the metal and mining assets, and also includes other precious metals.

ReplyDeleteIf I get an inflation "buy signal" I invest in a broad commodity fund. I have never been able to figure out whether gold, energy, crypto, or whatever, will lead the way.

Broad based commodity funds did very well in 2021.

I would love a 1959 Impala too.

Thanks for sharing. One of the more interesting articles I read on inflation looked at the 1800's when gold was money. During the 1800's, despite swings in inflation the cumulative average inflation rate was -0.5% (i.e. long term deflation due to factors like the industrial revolution). The other way of stating this is that gold essentially gained 0.5% in value per year during the 1800's. If you make the assumption the real price of gold increases by 0.5% per year and correct for inflation, gold is overpriced. Assuming prices have rises from $1 to $33.09 due to inflation since 1900 and 121 years at 0.5% value growth would put the price of gold at $1250/oz.

ReplyDeleteWhile overpriced, gold still has a lot of swings as people try to hedge against future inflation. Future inflation expectations tend to swing. If gold were at the $1250 price suggested by history, the 0.5% annual real return would be a far better investment than the negative real interest rates today. Is that worth a 44% premium? I honestly don't know.

Gold and the Fed—an ever-interesting relationship! 📉📈 It's intriguing to see gold prices dropping even as inflation rises, as gold traditionally serves as an inflation hedge. Factors like interest rate expectations, the Fed's monetary policy, and global market sentiment often play a role in this divergence. Those charts will surely shed some light! For anyone tracking gold trends, be sure to check out the gold prices in Kuwait for the latest updates.

ReplyDelete