I've been predicting higher than expected inflation for some time now, so today's numbers were not a surprise to me. The market barely budged, since there appears to be an overwhelming consensus—reinforced by the Fed numerous times—that higher inflation is merely transitory and in fact, welcome, given the Fed's desire to see inflation average well over 2% a year for a few years. I don't see the rationale for these views, however, and I expect to see big changes in market expectations in the next year.

My thesis has been, and continues to be, that the huge increase in M2 that we saw over the past 16 months was initially not worrisome, since the world's demand for M2 money (mostly cash and bank savings deposits) was driven through the roof by the panic and uncertainties generated by the Covid-19 crisis. The peak of the Covid crisis was arguably last November, when successful vaccine trials were announced. Since then new Covid cases have plunged, confidence has soared, and the economy has rebounded sharply, which in turn means that the demand for all that extra money has all but vanished. Unfortunately, the Fed has taken no steps to offset this. This has left the economy with upwards of $3 trillion in unwanted cash (as I have explained in previous posts). Now that prices are surging, the interest rate that the holders of all that cash receive is hugely negative. Who wants to hold $3 trillion in extra cash that is losing purchasing power at the rate of 10% a year? No wonder prices are rising, and they will continue to rise as the public attempts to reduce their money balances in favor of things (e.g., commodities, property, equities) that promise much better returns.

It's simple: The economy is loaded with unwanted cash, and the real (inflation-adjusted) return on that cash (and the real return on almost all fixed-income instruments) is hugely negative. This is an untenable and unsustainable situation which will cause inflation to rise even more. It will only end when the Fed realizes it has made a mistake and starts jacking short-term rates higher, and/or starts draining cash by selling trillions worth of bonds.

On the bright side, the June Treasury report saw a huge surge in revenues that was largely unexpected. The catastrophic budget deterioration that we saw for the past 16 months now looks to have turned the corner. There is hope for the future! Unless, of course, the Biden administration succeeds in passing another multi-trillion spending lalapaloosa. Fortunately, the likelihood of that is diminishing by the day—in my opinion.

Here's a huge and very under-appreciated fact: an unexpected and significant rise in inflation is a boon to federal finances. Why? Because it creates an "inflation tax." Anyone who owns a Treasury security these days is effectively receiving a negative rate of interest that could be as high as 10% per year. The average yield on Treasuries today is somewhere in the neighborhood of 1 - 1½%. So at the current rate of CPI inflation (almost 10% annualized), Treasury debt is "costing" the government -8 ½ to -9% per year. That is, the real value of the debt is declining by that amount. With debt owed to the public now just over $22 trillion, that's like a gift of roughly $2 trillion per year to the federal government! In the 12 months ending June '21, the federal deficit was $2.6 trillion. This year's inflation tax will pay for about 75% of that. In other words, inflation this year will take about $2 trillion out of the pockets of those owning Treasuries and give it to the federal government. Why bother with raising taxes? (Did I mention that this is the way the Argentine government finances itself?)

So it is with mixed emotions that I detail some of this story with charts:

Chart #1

Chart #1 shows how consumer confidence has surged since late last year. The wild gyrations of confidence in the past year explains why the demand for money rose in the first half of last year and is now falling. The future looks much less scary now, so who needs a ton of money sitting in their bank account earning nothing?

Chart #2

Chart #2 looks at the ratio of gold to oil prices. This ratio has been remarkably stable—on average—over time, with an ounce of gold buying about 20 barrels of oil. Another thing this chart shows is that the prices of these two very different commodities have tended to rise by about the same amount over time.

Chart #3

As Chart #3 shows, crude oil today costs about $75 a barrel, which is not a lot more than its long-term inflation-adjusted value of $59. Oil arguably is thus a contributing factor to today's rising prices, but not significantly so.

Chart #4

Chart #4 shows the level of the ex-energy version of the Consumer Price Index, plotted on a semi-log scale in order to show that the rate of increase in the prices of goods and services in this basket has been remarkably stable at about 2% per year—until this year, that is. The index so far this year has surged at a 7.4% annualized rate. This cannot be explained away by referring to the fact that prices were soft in the second quarter of last year. We are looking here at an inflation breakout.

Chart #5

Chart #5 shows the 6-mo. annualized change of both the total CPI and the ex-energy version. We haven't seen inflation like this since the period just before the Great Recession. Recall that the Fed tightening needed to rein in that inflation episode was, I would argue, the proximate cause of that recession.

Chart #6

Chart #6 shows the 3-mo. annualized rate of inflation according to the Core CPI (ex-food and energy). This measure of inflation now stands at 10.6%, a level not seen since the early 1980s.

Chart #7

No matter which sub-index of inflation you look at, prices are surging. Chart #7 shows that 47% of small business owners report seeing a meaningful rise in prices. That's a level we haven't seen since March of 1981, when the U.S. economy was still suffering from double-digit inflation.

Chart #8

Chart #8 shows the level of real and nominal yields on 5-yr Treasury securities, and the difference between the two (green line) which is the market's expected average rate of inflation over the next 5 years. It's amazing to me that inflation expectations still appear to be relatively tame, despite today's blowout inflation report.

Chart #9

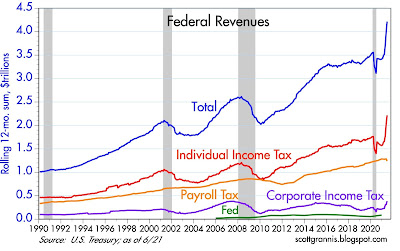

Chart #10

Chart #10 should warm the cockles of many politicians' hearts. All of these lines represent the rolling 12-month total of Treasury revenues from different sources. Note the spectacular increase in individual income tax receipts and corporate income tax receipts in recent months!

Chart #11

Chart #11 shows the trend of federal spending and revenues. The gap between the two (the deficit) has narrowed in the past few months.

Chart #12

Chart #12 puts federal finances into a proper perspective by measuring each as a % of GDP. Revenues are now coming in at a higher level than the post-war average! Spending is still absurdly high, but declining.

Chart #13

Finally, Chart #13 shows the federal budget deficit as a % of GDP. The deficit soared to an unheard-of level of more than 18% of GDP thanks to trillions of dollars of checks sent out all over the place. The deficit currently is back down to 12% of GDP, which is still absurdly high, but at the rate things are going we should see a further dramatic improvement in the budget outlook in the months to come.

And don't forget the inflation tax, which doesn't show on any of these charts. It could contribute about $2 trillion—effectively—towards paying down the debt this year alone.

It's going to be a wild ride for the foreseeable future, but it's difficult to quantify and it's difficult to recommend a course of action. Despite the potentially huge amount of uncertainty we are likely to be facing in the coming months or years, one thing does not recommend itself, and that is holding cash. Cash has traditionally been the best port in a storm, but that is most definitely not the case today, and neither is holding any short- or medium-term Treasury security.

Thanks for pulling this all together for us! Chart #4 is the one that hits me. It makes me think that we'll start getting inflation because we're getting inflation, which is the sentiment idea you write about in the post.

ReplyDeletePersonally, I shop for food at Costco and am seeing noticeable inflation week to week.

Correction: In the text, chart #5 is labeled as Chart #6.

@K T Cat: thanks for spotting that error! And yes, some inflation leads to more inflation, since inflation undermines people's desire to hold money. Unless, of course, the Fed takes offsetting measures. Which, unfortunately, they do not appear ready to.

ReplyDeleteCoincidentally, James Freeman at WSJ has a really interesting history from Stephen Roach of the path to "core inflation" calculation. Pointing out how the Fed kept excluding components that were *inconvenient* to their instinctive view of current inflation.

ReplyDelete"Burns didn't stop there. Over the next few years, he periodically uncovered similar idiosyncratic developments affecting the prices of mobile homes, used cars, children's toys, even women's jewelry (gold mania, he dubbed it); he also raised questions about home ownership costs, which accounted for another 16% of the CPI. Take them all out, he insisted!

By the time Burns was done, only about 35% of the CPI was left – and it was rising at a double-digit rate! Only at that point, in 1975, did Burns concede – far too late – that the United States had an inflation problem. The painful lesson: ignore so-called transitory factors at great peril."

https://www.wsj.com/articles/the-dwindling-value-of-a-dollar-11626200727?st=jbb2quo2i7m03ds&reflink=desktopwebshare_permalink

This comment has been removed by the author.

ReplyDeleteChart #8 is the most compelling chart for those wanting to make the case for inflation. The market's expectation of inflation over the next five years has indeed ticked up. But a few points:

ReplyDelete1) the 5-yr breakeven is off the recent peak.

2) The 5-yr breakeven is at a level that Powell has addressed in saying he'll let inflation run hot, i.e. above 2%, for some time. It's only 50 bps above that.

3) 10-year breakeven is also declining and, interestingly, is LOWER than 5-yr BE's.

4) Gold suggests there's not much to worry about in terms of inflation.

5) You're right to point out the high level of M2. But velocity remains stubbornly low. Thus, the the expectation of not-high inflation remains reasonable.

6) I'm taken aback at some of the talking heads, not SG, that are hysterically making the case for inflation citing CPI and the (anomalous) yoy figures. This is barely even honest. Even using the CPI figures - the least reliable of inflation readings - the June CPI was just 3% above June of 2019. Clearly, much of the reported 5.4% headline (4.5% core) is transitory. I suspect we'll really see a reversion toward 2% once all the states stop paying people to not work.

7) The Fed, unlike in prior periods, has the ability to immediately choke off inflation by raising the rate of IOER. This is very powerful. Heck, just look at the liquidity drain that stemmed from the mere 5 bp hike in reverse repos.

My much larger fear is that we're soon going to be forced to revert back to worrying about economic growth. Of course we can see the huge GDP growth numbers this year. But I think we all know those aren't sustainable either, esp in light of our fearless leaders' economic policies.

It seems that shorting short / medium term treasuries is a good bet based on your view. Would you disagree?

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteGreat wrap-up, as always.

ReplyDeleteI am steadfastly, even forcefully, ambivalent on all aspects of the economy, as usual.

I will note that inflation is a no-show or small potatoes in many parts of the world such as Japan, SE Asia, even China (despite some PPI surges) and Europe (same story). Australia and NZ too.

Canada expects 3% inflation this year, declining thereafter.

There was a time, in the 1980s, when The Wall Street Journal editorialized hat inflation was low enough and the Fed should ease, when Reagan was seeking re-election. It was about 4% then.

A little bit of history, and I quote Milton Friedman in 1992.

“The Federal Reserve has reduced the federal funds rate repeatedly from nearly 10% in 1989 to about 3% recently. According to conventional wisdom on Wall Street, that is evidence that monetary policy has been extremely easy, that the Fed has done all it can to stimulate the economy, and that it is pushing on a string, as another ancient cliché has it. This wisdom may be conventional, but it is incorrect.”—Milton Friedman, The Wall Street Journal, October 23, 1992.

It was October 1992, inflation as measured by the CPI was running at about 3.2 percent, and real GDP was expanding at about 4.0%. Friedman said the Fed was being "too tight."

Today some macroeconomists need adult diapers when inflation gets to 3%.

We (again) live in interesting times.

As usual, I will say there is a lot of barking up the wrong tree. If we really want to dent inflation, let's eliminate property zoning. A flood of new housing would pop up as if by magic (free markets are good!) and housing costs would go into a secular decline for a few decades.

This comment has been removed by the author.

ReplyDeleteI wish I had your confidence.

ReplyDeleteAs it stands today, I am hedging for both deflation and inflation. That is, 15% of my portfolio (deflation) is in cash and high quality bonds, while the other side is 15% (inflation) in a broad based Vanguard commodities index fund and non taxable forest preserves. Everything in the middle (70%) remains in equally distributed proportions of Wilshire 5000 equities and rent producing farmland.

My primary objective at this point in my life is not so much to get any wealthier as it is to not accidentally blowup my entire portfolio and then find myself unexpectedly poor...if that makes sense?

Sign me, A Very Frightened Bull

@HDX, Thank you for the id compliments as well as a great response. So given your views, you think that the Fed will keep bidding yields down in perpetuity? How are you reflecting your views via investment? I'm not smart enough to understand all the puts and takes here, but does the $3t in excess cash that SG mentions trump Fed buying at some point soon (finally)?

ReplyDeleteHello,

ReplyDeleteToday BIS published a report in which they see inflation as transitory one. BTW, Scott could you publish from time to time a graph of USDJPY/USDEUR hedging costs. Thanks as always.

How can all you inflationistas be so confident in your view when the bond market is telling you the opposite?

ReplyDeleteBefore you answer please know that every prior episode of QE has resulted in HIGHER yields, not LOWER yields, over the course of the QE. So the (admittedly) heavy hand of the Fed doesn't fully explain the low and declining yields.

Adam - "Today BIS published a report in which they see inflation as transitory one."

ReplyDeleteGrechster - "How can all you inflationistas be so confident in your view when the bond market is telling you the opposite?"

Years ago, I played the role of a research scientist and mathematician. Watching what is coming out of our universities, industry and government, I no longer trust anything. I won't go on a rant here, but suffice it to say that plenty of the things being published in previously reputable journals is bonkers. Dittos for my current industry, one that you'd expect to have been immune from the current madness.

When an authoritative someone tells me inflation is transitory while I see the Fed printing money, real estate going through the roof and Costco food prices and gasoline going up, I just think of scientific journals and how I know that, at least in some articles, they are lying to me.

KT:

ReplyDeleteI couldn't agree more on the general comment re education. I also pay little attention to so-called experts, whether it be medical issues or financial issues.

But that is precisely why I rely even more on market-driven metrics. You will never see me cite experts or even polls since they aren't reliable.

"No wonder prices are rising, and they will continue to rise as the public attempts to reduce their money balances in favor of things (e.g., commodities, property, equities) that promise much better returns."

ReplyDeleteAnd

"The future looks much less scary now, so who needs a ton of money sitting in their bank account earning nothing?"

There is a huge conceptual problem with these statements. The excess cash (unless the private part of the real economy gets going) cannot not magically disappear or transform into wealth. The excess cash will only disappear when the underlying debt is retired (classic definition from fractional reserve banking).

From anecdotal to aggregate, people are not spending the excess cash (excess cash in private accounts essentially essentially as a result of higher public debt) because prices will rise soon or even tomorrow, people spend excess cash because the borrowed money was given to them. This conceptual aspect explains well why the velocity of money has been going down despite heroic attempts at reflation for now more than a decade. If the private market doesn't get going, the people will expect more free money...Just look at Japan.

Of course, it's possible that the recovery is just around the corner.

Lately, from various surveys and other sources, it's been shown that many Americans changed size (most up) during the covid episode and this may catapult the demand for apparel going forward. What i can't figure out though is why (compared to 2019 and before to now) people with more weight (or free money) are expected to run faster (or see inflation) going forward.

https://www.npd.com/news/blog/2021/time-to-buy-current-wardrobes-no-longer-getting-us-by/?utm_source=newsletter&utm_medium=email&utm_campaign=newsletter_axiosmarkets&stream=business

i guess people should be expected to run slower. No? At least that's what risk-free and real yields are suggesting.

This comment has been removed by the author.

ReplyDeleteJust to be clear, I don't know what to believe any more. Some of it's true and if it seems to make sense to me, then that's a big plus and we can move on from there. If I find things that seem wacky, well, it's time to move along to something new. I do plenty of waving my arms around and yelling on my own blog, but it's just trying to make sense of what I observe.

ReplyDeleteThat's one of the reasons I love this blog. I do believe Scott. I am deeply grateful for this site.

I appreciate his take on inflation. It matches the data I'm observing. It's entirely possible that inflation is indeed transitory, but it doesn't feel that way right now.

This comment has been removed by the author.

ReplyDeleteHDX - those are good points you make above. Similarly, from recent Glen Greenwald:

ReplyDelete~~~~~

House Speaker Nancy Pelosi is the sixth-richest member of Congress, according to the most recent financial disclosure statements filed in 2019. As the California Democrat has risen through party ranks and obtained more and more political power, her personal wealth has risen right along with it. Pelosi “has seen her wealth increase to nearly $115 million from $41 million in 2004,” reports the transparency non-profit group Open Secrets. […]

And ever since ascending to the top spot in the House, Pelosi and her husband, Paul, keep getting richer and richer. Much of their added wealth is due to extremely lucrative and "lucky” decisions about when to buy and sell stocks and options in the very industries and companies over which Pelosi, as House Speaker, exercises enormous and direct influence. (Husband making these trades personally.)

The sector in which the Pelosis most frequently buy and sell stocks is, by far, the Silicon Valley tech industry.

~~~~~

The corruption in Washington knows no limits. It infects every issue - even places like the Fed and how their decisions affect the prospects for themselves and their overlords to remain in power. That's a clue that perhaps out of control inflation is more likely because of Fed failure to act.

Side note - Nice that you dialed down the vitriol. That's a lesson I very much had to learn, and the example of this blog and Scott over many years has helped me immensely. Gotta say though that JBD rants have style is thoroughly enjoyable. :-)

On money velocity by Ken Fisher

ReplyDeletehttps://youtu.be/GdiuANp2HAU

I have enjoyed reading Scott's blog since 2008 and find him to be spot on most of the time, but I do recall he predicted a big jump in inflation due to Obama's spending during the financial crisis and the Fed's easy money policy, which never materialized. While we may indeed get hit hard by inflation, I do not think it's wise to be 100% invested in stocks, especially if you're near or in retirement like me. Jaime Dimon seems to think it's prudent to hold cash now- especially if the Fed does tighten and the market crashes as a result. I've got plenty invested in stocks and think holding a good amount in cash too so I can sleep at night in case of a major stock market meltdown makes sense for me. By the way, how did we survive inflation in the 5% range in the booming late 80's but we can't stand 2-3% now?

ReplyDeleteDave said

ReplyDeleteScott....It seems those willing to hold money today, are doing so because they still believe that current inflation levels are temporar, due to the rebound effects that produce today's prices with earlier "base" prices, and the pent up demand versus the temporary lag in proction rebound. What will it take to change the minds of the "holders" of money.....since your theory counts on their changing their minds about long term inflation......before they begin riding themselves of their money holdings and spending whatever they have.

DJD: Re "What will it take to change the minds of the "holders" of money"

ReplyDeleteI would submit that the holders of money are already trying to reduce their money holdings of money in favor of other things that will deliver better value over time. But most likely they are not making an explicit calculation of future inflation. That may come later. What we've seen over the past six months is perhaps the first wave of the inflation resulting from too much money in the system. I say this in part because breakeven inflation spreads (the bond market's inflation expectation) remain relatively subdued and nominal bond yields remain quite low and very negative in real terms. This would imply a second wave that would be much more powerful than the current one, driven by rising nominal yields and perhaps also by a slow-to-react Fed that raises short-term interest rates slowly and thus remains "behind the curve" for an extended period.

Adam, re Ken Fisher's remarks on money velocity.

ReplyDeleteIt should be clear, I hope, that what I'm forecasting is both a decline in money demand and an increase in money velocity. The two are flip sides of the same coin, after all. Mathematically, they are the inverse of each other: money demand = M2/GDP, money velocity = GDP/M2.

This comment has been removed by the author.

ReplyDeleteFred: thank you for reminding both me and other readers that I made a similar rising inflation forecast in 2009 which turned out to be dead wrong. My forecast back then was driven by the significant increase in bank reserves and M2 that occurred in the wake of the Fed's QE1 episode. Yes I was wrong, no question, but to my credit I did realize my mistake within a year or so, and that change of heart was driven by my realizing that the Great Recession had created a huge increase in money demand which effectively neutralized the Fed's easing. From 2010 on I stuck with my low inflation/low growth forecast which then proved correct.

ReplyDeleteIn this post I argue that this time things are different, and perhaps the biggest difference is the increase in M2, which far eclipses the increase in 2009. (I'm working on another post which deals with this.) Also, the current episode has obviously ALREADY witnessed a big increase in inflation, and that never happened after QE1, QE2, or QE3. Last year saw a huge increase in money demand, but the evidence so far this year points strongly to the beginnings of a big decline in money demand.

I am sympathetic to your argument that it makes sense to hold on to cash in light of the fact (which I have alluded to several times in recent months) that the Fed will inevitably respond to higher-than-expected inflation by tightening policy, and every money policy tightening period in the past has resulted in a recession, so a recession looms on the horizon today. Again, however, I would argue that this time is very different considering the extremely low level of real interest rates today which basically guarantees that holding cash is a money-losing proposition. That was not the case prior to previous recessions, because real interest rates were always relatively high (as a result of Fed tightening) prior to tightening-induced recessions. Holding cash back then was not necessarily a money-losing proposition.

Today, holding cash is a very bad investment because it has already resulted in a significant loss of purchasing power. Holding any Treasury security, for that matter, is almost guaranteed to result in a significant loss of purchasing power given the very low level of real interest rates and the ongoing present of inflation in excess of 2%, which the Fed has promised repeatedly will continue for at least the next year or two.

I really enjoyed reading the last comment by Scott Grannis (also refreshing in its honesty. Most macroeconomic observers have never made a misstep even in long careers).

ReplyDeleteToday's investment environment strikes me as challenging.

As Grannis has laid out, high pe's, low yields, yet possibly inflation and central-bank tightening on the horizon.

You don't want to be in cash, but maybe you are scared to buy anything!

Governments should be business-friendly, and generally are in the Asian Pacific, but generally are not in US and Western Europe. This is worrisome, too.

For a long time, it has struck me the globe is generating huge slugs of capital, due to rising incomes (which allows savings), and forced savings in some economies, such as Germany and China. In Japan, people save just because they do.

Such a large supply of capital should be a good thing, but also leads to higher asset prices. But if the supply of capital continuously outstrips demand, then...well, we should see losses on invested capital. The market will become overinvested, as "too much" capital seeks a home.

Pertaining to the CPI, there is perhaps no divine method for measuring inflation. I suspect the CPI has under-counted inflation in recent decades, not on Boskin reforms (which can be debated), but because housing costs have exploded in many regions of the country. College is another hurdle.

How does any young couple in West Coast or Northeast buy a house and raise a family? First, college degrees are considered a necessity, but are very expensive. Then a budget house costs $800,000.

For me, this is what our nation needs to talk about.

Will recent inflation be transitory or not?

ReplyDeleteImagine yourself 30 years ago and the Treasury decides to spend 20% of GDP. One would have expected huge inflation. Why? From a macro perspective because of relatively high money velocity. Now, all we get, at least so far, are fairly mild inflationary readings (historically speaking and keeping in mind that inflationary pressures take a long time to build). Why? From a macro perspective because money velocity has been decreasing, so much so recently as to mitigate most of the increase in money supply.

Why?

i think it's because the Treasury-Fed financial complex is trying to do the same and more and expect a different result.

In 2019, it was discovered that monetary tightening was no longer possible and we're about to find out how fiscal tightening will be difficult. Last year 20% of GDP public funds (matched with debt) were spent. There is some kind of expectation for more. Whatever part of the 20% that is not coming, from a macro perspective, will have to come from private initiatives. Whatever is not made up (in the next few weeks) by the private sector will mean decreased private savings, decreased corporate profits and decreased trade deficits.

i think we may underestimate the oncoming challenge to the same extent the power to spend and the accompanying temporary boost were.

Mr. Milton Friedman assumed that money velocity was constant. That's what the data of his time said. He was living in a time though where the most of the liabilities of the Fed balance sheet were currency in circulation (which rose in correlation to the underlying economy). Mr. Irving Fisher, before he lost his prestige, produced a lot of work praising the stability of money (including in 1928) and, before 1929, assumed that money velocity was constant. However, in 1933, when he had lost his aura (unfortunately that's when he produced his most important work, too bad he had been discounted then) and showed that, using a debt-deflation concept, once a certain level of debt is reached, adding more debt will have a negative effect on money velocity.

Now in 2021, the Fed balance sheet (liabilities) is dominated by reserves deposited by large institutions and it's being discovered that the money injected into the system has produced a potentially huge destabilizing effect through asset inflation and little or no effect on the real economy where real money circulates. Unless fundamental rules are changed (ie MMT etc), i think Mr. Fisher will be proven right, again.

This comment has been removed by the author.

ReplyDeleteSupply and demand distortions abound affecting inflation. Cost push, demand pull, monetary AND fiscal policy...

ReplyDeleteAlso, since there are fewer producers supplying consumer staples and housing, those producers are getting very good at front running the direct payments to consumers made via fiscal policy. Tax payer and debt funded inflation.

Thanks for the reply Scott. You make excellent points. I still feel more comfortable holding some cash for emergencies and some big purchases coming up even if I know that I'm losing money in the short term. I just believe I need a bit more liquidity in the event of a downturn and really don't want to sell in a falling market.

ReplyDeleteHDX: Lighten up and get yourself a Happy Meal. You must be a pain in the neck to live with (unless of course you only act tough behind the anonymity of the net).

Fred: I think its important to take one's frustrations out on the people who cause problems. Having vented on the @ssholes of the world, I don't snap at nice people who bluntly are not the source of problems.

ReplyDeleteI know, the California way is to take two prozak and smoke a joint -- then act happy toward everyone while stabbing people (friends and foe alike) in the back. That's just how California goes.

Much of the world gets by with less pharmaceuticals, and we don't send witches to Washington to impose our f#cked up drug lifestyle on others.

I don't care if I'm ruining California's buzz. F#ck you. Be nice to others, but kick a Californian in the gonads.

Hdx take your political views elsewhere. Focus on what Scott has created, a community that is passionate about the economy and its implications. Take your anger elsewhere.

DeleteHDX: I've lived in Georgia for 35 years and have voted Republican my entire life. You can go F#ck yourself and the horse you rode in on for all I care.

ReplyDeleteI am bit surprised if anyone thinks I am "woke."

ReplyDeleteWhen the woke crowd jibber-jabbers...call me, "Rip Van Winkle"!

Hey, we are all puzzling the future together. I am happy to read all insights.

Fred: according to Miles Taylor, former DHS employee under Obama (and trying to get back in under Biden)... Republicans are now the number one threat to the USA. More of a threat than ISIS or al-qaeda or anything else.

ReplyDeleteThe bureaucrat actually said that, on TV. And according to this bureaucrat, the USA bombed ISIS, al-qaeda and other terrorist groups out of existence, and that should be done to republicans next.

Meanwhile, Biden's press secretary confirmed that the Biden administration is officially working with facebook and twitter to censor opinions the regime doesn't agree with. That's not a tin-foil hat crazy saying this -- its Biden's official press secretary.

So you might want to be careful claiming you aren't 100% in step with the party line. Big brother is listening. Google owns blogger. You just admitted to being a terrorist in the eyes of a federal bureaucrat.

PS -- you don't sound like a southerner. Are you sure you live in Georgia?

@Bill Snarf -- I didn't get the memo that this was a Biden press conference. We only want to talk about happy stuff god dangit!

ReplyDeleteListen Bill. If talking about reality in a snarky way is ruining your buzz, you need to up your prozac intake. Add in some vicodin. Did you know that you can visit 2,3 and even 4 different doctors and get the same prescriptions from each? Just don't tell them you already got prescriptions from the other docs.

This is California baby. You gotta learn how to work the system.

Take as much prozac and vicodin. We only allow happy thoughts here!

Make sure you smoke a few doobies too. California legalized pot so the state can get a piece of the action. You will find it much easier to step over homeless people and ignore vets if you are high as a kite.

Some people will say the homeless are people too. Some will say veterans put their lives on the line for your safety. They are part of "the economy and its implications".

Those people are just trying to ruin your buzz Bill. Don't let 'em! Up your prozac dosage today, so you can think only happy thoughts!

As long as stocks keep going up, your so-called economy and its implications are no problem. As long as stocks keep going up, and suckers keep buying Treasuries (or the Fed, doesn't matter) -- you can keep your supply of prozak and vicodin full.

If the economy and its implications happen to actually impact you, switch to fentynol. Its cheaper.

Carl, I really appreciate your comments. You're a lot more knowledgeable than I am, so it's going to take me some time counting on my fingers and toes to understand how this works - debt-deflation concept, once a certain level of debt is reached, adding more debt will have a negative effect on money velocity.

ReplyDeleteIn any case, thanks.

Carl, I did a little pondering and I'm left with a conundrum.

ReplyDeleteAs I understand it, debt deflation is caused by the debtor's increasing difficulty to make their payments. I don't see that as the case here because the Fed will simply print money to handle it. To me, it looks like the Fed has shackled itself to the Federal government and can't get out. That means the government can spend all it wants because it's got a sugar daddy with a money printing machine.

Where's the flaw in that?

Monday morning observations…

ReplyDeleteTreasury prices are soaring. Dow down almost 800 at one point.

10 year yield saw a 1.17 handle this am for a minute. Was 1.30 on Friday.

Yield gapped below moving averages today. That is usually meaningful.

Next gaps remain at 0.96% and 0.57%.

“Re-Open” stocks gapping down & fell 3-5% this am, early.

Global Natural Resources down 3%

Staple/defensive sectors actually catching a bid.

TLT is up 5% this month. Half of that today.

S&P is negative this month.

It’s ALMOST as if the market may be losing confidence in our unprecedented spending & slow-growth economic policies.

And the rampant lawlessness revealed in the Election audits.

ALMOST as if the government-caused supply chain disruptions are truly disruptin’.

My local Ford dealer had ELEVEN new cars on the lot to sell last week.

Owner told me it’s the lowest number of new cars in dealer history since opening in 1953.

Cannot get cars & trucks. Inflation or Deflation? Hmmmm.

M2 decelerating. It’s ALMOST as if deflationary forces are getting heavier.

I predict they are going to have to wake up Joe before lunch to save us.

I dunno, it's hard to see how a 33% increase in the M2 money supply ($5 trillion) since February of last year is deflationary.

ReplyDeletei dunno either and the inflation/deflation debate has been entering the vicinity of a very unstable stability but who knows? My bet is that the US people will not go into full MMT mode.

ReplyDelete@KTCat

'We' are simply bumping ideas here into each others' heads.

The money printing aspect may not be well understood (i guess that's the idea for the Fed) as the unconventional open market operations are only an asset swap with a balance sheet expansion (more money and more debt, as matching assets and liabilities).

Technically, the debt issued (along the cash credited) does not need to be repaid but people function with the assumption that it could be or, at least, that debt levels remain connected to real underlying economic activity.

For perspective, take this quote from The Voyage of the Dawntreader:

"I also find it very clearly written in our laws," Caspian went on, "that if the tribute is not delivered the whole debt has to be paid by the governor of the Lone Islands out of his private purse."

At this Gumpas began to pay real attention. "Oh, that's quite out of the question," he said. "It is an economic impossibility—er—your Majesty must be joking."

So yes debt has a rental price and needs, in theory, to be repaid and the underlying use of funds, in the aggregate, has to productively produce wealth.

This all very complicated so let's try to use a simplified model.

In an economy, one could say that the link between cash/debt and the outcomes for the real economy is an inverted "U". When there is not enough cash/debt, the economy will not reach its potential.

Then, increasing credit will improve the economic potential (that's what Mr. Hyman Minsky described in economic booms and why this should lead to decreasing credit during downturns).

However, there is a point where increasing credit will result in decreased economic potential.

Where are we on the curve?

Using the concept of debt intensity (the amount of aggregate debt incurred versus the amount of GDP produced), we have witnessed an unprecedented increase in debt intensity in the last 25 years, a period where money velocity has been declining also to an unprecedented degree and it's hard to say that those two phenomena are disconnected.

Basically, the only tool the Fed has is the use of managed low interest rates with the elimination of constraints for debt.

How is digging a hole deeper helping in getting out of the hole?

The trick though, like in drug addiction, is that the debt trap will require gradually higher debt boosts and my guess is that the resulting inflation readings will become increasingly more fleeting or transient, if at all.

Perhaps Shakespeare was onto something when he made Polonius say the following in Hamlet:

"Neither borrower, nor a lender he"

i think the author went too far and England had not developed economic sophistication then but the pendulum has gone too far in the other direction: too many lenders and too many borrowers for the underlying economic activity.

Too much debt can kill you, gradually and then suddenly, no joking.

Thanks for the reply, Carl. Now I need to digest it. Hope you have a great day.

ReplyDeleteMark:

ReplyDeleteObviously last year M2 shot up during Covid. Are we thinking that type of money growth will continue?

Markets look ahead, right?

Hasn't the M2 growth decelerated substantially this year?

Obviously M2 has soared since Feb 2020. Isnt it a lesser rate since Feb 2021?

Are markets thinking M2 growth will accelerate from here?

Markets seem to be questioning the robust GDP forecasts. Just my opinion. Yesterday's declines had oomph.

Steady earners have been leading again, while rebound sectors hit a wall.

Yesterday seemed like air coming out of the Re-Open trade.

All of TV says jump in...that selloff was a marvelous gift.

They say its wonderful that the Wall of Worry just got steeper. Maybe they are right.

That was quite a plummet in yields yesterday, too. Those are starting to become more frequent.

Seems to me that inflation fears would be pushing rates higher, not lower.

High yield, Converts and Senior Loans were all relative losers yesterday.

Is the market seeing more upgrades, or downgrades coming in the next cycle?

Are the new government policies good for growth?

It seems to me that growth will have to come in spite of policy.

Abrupt curve flattening seems a bit ominous.