Chart #1

Chart #1 shows an index of the prices of non-energy commodities. Prices have now rebounded to where they were prior to the onset of the Covid Crisis, and that is a strong indicator that the global economy is rebounding. To be sure, soaring prices could also be due to the inflationary impulse of monetary policy, as I also noted in my last post: by promising to keep rates at extremely low levels, the Fed is actively encouraging people to spend the money they have stockpiled, and in addition to borrow more. "Borrow and Buy" is the new Fed mantra, in my view, though you won't hear it from many other sources—most people are worried that the Fed is pushing on a string and deflation hangs over our heads like a dark cloud. Curiously, those same people are probably arguing that the Fed is just inflating asset bubbles which will sooner or later pop.

Chart #2

Small businesses were crushed by the lockdowns, and sentiment was in the dumps not too long ago. But as Chart #2 shows, small business optimism has rebounded strongly, and is now higher than it was at any time during the slow-growth Obama years. However, optimism is still substantially lower than it was two years ago.

Chart #3

Chart #4

Chart #3 adds some meat to the small business story. Here we see that hiring plans recently have soared to relatively high levels (blue line). Despite the small army of the unemployed looking for work (~13 million, as Chart #4 shows), businesses continue to report difficulties in filling positions with qualified workers (red line, Chart #3). There is a lot of activity going on behind the scenes—and the LA freeways are getting more congested.

Chart #5

Chart #5 shows a very surprising surge in the prices of used autos in the past 3 months. Used car prices are now 16% higher than they were a year ago! Some lucky people must have found themselves with extra money, while others are finding cheap borrowing rates (borrow and buy!). Everyone is eager to get back out on the road again. You can also find hints of inflation in this chart. After almost two decades of declining inflation-adjusted prices (red line), prices are now exploding to the upside no matter how you look at it. We're haven't seen anything like this since the inflationary 1970s.

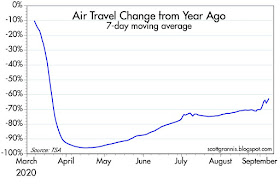

Chart #7

Chart #6 shows that the late summer doldrums in air travel are now giving way to what looks like a renewed surge in air travel. The blue line represents actual daily passengers going through TSA security lines, while the green line is simply the 7-day moving average, which is important to follow because there are very definite intra-weekly patterns in this data. What you don't see in this chart is that August is typically a slow month for air travel. Last year, TSA throughput in the month of August actually declined by 15%. So the fact that TSA throughput held steady in August this year means it was unusually strong. That fact shows up better in Chart #7, which shows how the the 7-day moving average this year stacks up relative to the same period last year. Here we see that air travel was picking up relative to 2019 throughout the month of August, and over Labor Day it really picked up. I've heard from not a few friends that they are feeling better about flying these days. Air travel today is still only 37% of last year's levels, but that is up significantly from what it was just a few months ago.

Chart #8

Finally, Chart #8 is an update to what is now a perennial favorite of mine. Here the latest stock market drop looks a lot like all the others in recent years, in the sense that all the important declines in equity prices have been strongly correlated with a surge in the fear index (Vix). Fear is still very much with us, given the still-elevated level of the Vix, and risk-aversion is still quite strong, as evidenced by the 10-yr Treasury yield, which is hugging extremely low levels (0.6 - 0.7%). These are not the symptoms of an over-extended market.

I know that a lot of people worry that stocks are in a Fed-blown bubble, but with a 1-yr forward PE ratio of 26-27, stocks today are simply discounting a sizable pickup in earnings over the next year. If the economy continues to improve as it has these past few months, that's not unreasonable at all. Especially considering that the alternativez to stocks—notes and bonds—sport PE ratios that are an order of magnitude higher than stocks. One quick example: the 0.7% yield on Treasuries is equivalent to a PE ratio of 143.

Excellent and concise analysis as always Scott. I do have one question though. Isn’t air traffic actually sill down 63%? This would mean that we are at 37% vs last year instead of 63% as you stated. Either way, the trend is certainly moving in the right direction. Thanks for the post!

ReplyDeleteScott;

ReplyDeleteAbout prices for used cars...

manufacturers have cut back on production of new cars and they are not slashing prices. People still need cars, are switching to the next best option, which would be a good used car.

This comment has been removed by the author.

DeleteA Clark, re percentages. Thank you for spotting that, I'm obviously missing an editor! Air travel today is about 37% of what it was a year ago.

ReplyDeleteAM

DeleteNo problem. Just making sure I wasn’t looking at the data incorrectly. Point taken that the incremental improvement of air traffic continues. Hopefully it will improve in time to avoid a bankruptcy of a major airline company or two.

Scott,

ReplyDeleteI have to disagree on air travel. While there may be some good signs on pleasure travel, I think the airlines are in trouble on business travel. We're doing so much more now on zoom that I think clients are going to be reluctant to pay for in person meetings. We're doing most depositions via zoom with very few problems, for example. Without robust business travel I think airline profits will lag for quite some time.

Fred, re business travel: My only point in this post is that, on the margin, things are improving. I think anyone would agree that it's going to be a long time until air travel fully recovers, if it ever does, and things like Zoom are the game-changers. In any event, it's not the level of air travel, it's the change on the margin that matters. As for air travel in general, I sense a huge and growing pent-up demand for pleasure travel.

ReplyDeleteI would add that an index of airline stocks is up 62% vs its May low, but still down 46% from its February high. The S&P 500 is up 52% from its March low, and up a bit from its February high. So, compared to the depths of this Recession, the outlook for air travel has improved more, on the margin, than the overall outlook, but the expected level of air travel is still extremely depressed. No one is even remotely suggesting that air travel will soon return to normal.

The semi log TSA chart is visually misleading but the next chart corrects that this time. September and October are usually big months for very profitable business travel. My friend the 70 year old stewardess took a leave for 5 months until she spent all her savings. Now she is back in planes serving first class passenger's sitting next to each othet, but couldn't eat inside a NYC restaurant during her last layover!

ReplyDeleteForward PE ha's s poor correlation with 10 year market returns. Sane with PE even without the usual over optimistic guesses of the forward PE. Price to Sales has a strong correlation with 10 year market returns.

My daily car ride to get out of house and survey business finally showed some improvement this week. I count the cars in the parking lot of huge office building every day since mid-March. Usually hundreds of cars there pre-Covid. Never exceeded 24 cars until Monday and now 32 cars today. That's progress. With hundreds of empty parking spaces most of the cars are parked next to each other near the entrace. Even a $100,000+ Porche.

The partial lock downs are long past any medical usefulness and may never have been useful for people under age 60. Will all this end after election day? When tlwill the anti-Trump riots begin after he wins? Hard to predict what irrational people will do.

Per usual, another very valuable wrap-up by Scott Grannis.

ReplyDeleteIs the Fed too loose?

As it turns out, real interest rates have been falling (generally) for several hundred years. My amateur assessment is that capital becomes more abundant as societies become richer and there is a greater ability to save.

It is not a pleasant prospect, but your capital is just not that valuable or scarce anymore. The upside is this should be very good for the economy in general, and people in general, as every good idea in commerce can find financing.

I think there is a role for the Fed in maintaining aggregate demand. Theoretically, this might be a bad idea, but practically it might be a good idea.

But what is really hurting our economy is not the Fed, it is the insane Covid-19 lockdowns.

Good luck everybody.

Total number of people collecting unemployment compensation (continuing claims) rose to 29.6 million this week, up two weeks in a row. Was 27 million two weeks ago and 32 million at the peak in May. There has not been a lot of decline since the peak. These counts better capture the tota paid work hours lost since early 2020, the good old days. The conventional unemployment rate only captures people with zero work hours who are actively looking for a job.

ReplyDeleteLatest data here:

http://el2017.blogspot.com/2020/09/unemployement-compensation-counts.htm

Very nice to see the disagreement above on Air Travel...it's a safe play then. If worry about airlines go Chapter 11, maybe airports would be a good asset in a longer run, considering their debt level.

ReplyDelete