I've featured this chart numerous times in recent years. What it shows is that every significant decline in stock prices in recent years has coincided with a spike in market nervousness (which I define by dividing the Vix index by the yield on 10-yr Treasuries—this measure increases as nervousness rises and yields decline, and vice versa). To date, all those "panic attacks" have proved unfounded—the economy kept on growing at a modest pace. I'm guessing that the current bout of nerves is being driven primarily by rising bond yields, which in turn are the natural result of improving economic fundamentals that are laying the groundwork for a stronger economy. There are other worries at work, to be sure, and the list would include 1) concerns that the Fed is going to be spooked by rising inflation expectations and stronger growth and thus tighten too much, 2) volatility hedgers caught in a squeeze, 3) concerns that valuations are too high, and/or 4) the combination of tax cuts and increased spending which could lead to more trillion-dollar budget deficits.

So, as has been the case during most of the bouts of nervousness in recent years, there is no shortage of things to worry about. But, I would argue, the main thing to worry about is the health of the economy. If the economy continues to strengthen, that will "trump" just about all the above worries. For example, if the deficit increases temporarily but we end up with a stronger economy, the burden of debt will likely decline. So let's review some key economic and financial market fundamentals, all of which are quite positive. (All charts reflect the most recent data available as of February 9th.)

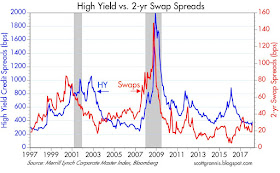

Chart #1

Chart #1 shows that 2-yr swap spreads (a highly liquid and reliable measure of generic, high-quality credit risk) have increased only slightly during the recent equity selloff, and remain well with a "normal" range. This further indicates that financial markets are liquid and that financial market fundamentals are healthy. Historically, swap spreads have been good predictors of recessions and recoveries, rising in advance of recessions and declining in advance of recoveries.

Chart #2

Chart #2 compares swap spreads here with those in the Eurozone. Notably, Eurozone financial fundamentals have been improving of late. No hint of trouble either here or abroad.

Chart #3

Chart #3 shows that swap spreads have also been good predictors of credit spreads in general. Currently there is little reason to be concerned.

Chart #4

Chart #4 shows that both high- and low-quality corporate credit spreads are relatively low, having risen only marginally in the past week. This indicates that the bond market is not very concerned at all about the quality of earnings or the health of the economy.

Chart #5

Chart #5 shows the nominal and real yields on 5-yr Treasuries, and the difference between the two, which is the market's expected annual rate of inflation over the next 5 years. Inflation expectations are well-anchored at just slight above 2%. It's tough to conclude from this that the market is concerned about either too much or too little inflation. Current inflation expectations are very much in line with what we have seen in recent decades.

Chart #6

Chart #6 shows the same comparison as Chart #5 for 10-yr Treasuries and expected inflation over the next 10 years. Again, current expectations are very much in line with past experience.

Chart #7

Chart #7 shows two measures of the dollar's value vis a vis other currencies, on a trade-weighted and inflation-adjusted basis. These are arguably the best available measures of the dollar's relative value against other currencies. What we see is that the dollar today is roughly equal to or slightly above its long-term historical average.

Chart #8

Chart #8 shows a simpler measure of the dollar vis a vis major currencies since the beginning of last year. The dollar has been declining meaningfully over this period. Taken alone, this would suggest that the market has either become bearish on the outlook for the US economy and/or concerned that the Fed has been too complacent about raising interest rates. I'm inclined toward the latter explanation, since it's hard to believe the world has ignored the many signs of improvement in the US economy over the past year.

As I've explained before, over the past year we have seen accumulating evidence that the demand for money in the US has been weakening. That's the natural result of a return of confidence and a growing desire on the part of the public to become less risk-averse. Yet the Fed has been slow to take offsetting measures (e.g., by raising short-term interest rates and/or draining excess reserves, which remain quite abundant). In short, this suggests that the Fed has fallen a bit "behind the curve." They haven't kept the supply of dollars and the demand for dollars in balance; the result has been a surplus of dollars and thus a weaker dollar. This has shown up as well in higher gold and commodity prices in the past year. If the dollar were to weaken more I would become concerned, but for now, with inflation expectations still reasonable, it is premature to conclude that the Fed has made a big mistake. I am somewhat reassured by the recent decline in gold, commodity prices, and oil prices that has occurred opposite the strengthening of the dollar.

Chart #9

Chart #9 compares the real yield on 5-yr TIPS with the 2-yr annualized growth of the US economy. It strongly suggests that real yields over time tend to follow the real rate of growth in the economy. The recent rise in real yields—which is still modest—tracks very well with the growing perception that the rate of growth in the US economy is picking up. In fact, over the last three quarters the economy has grown at a 2.9% annualized rate, which is comfortably above the 2.2% rate it has averaged since the recovery began in mid-2009. Growth expectations from the NY and Atlanta Fed offices put first quarter GDP growth at somewhere between 3.3% and 4%.

The rise in rates is thus fully explained by the improvement in the outlook for growth, and is nothing to be concerned about. There is no a priori reason equities can't continue to rise in value even if stronger growth results in higher interest rates. But it is nevertheless likely that higher interest rates will tend to depress PE ratios and thus keep future equity returns more modest than we have seen in the past.

Chart #10

Chart #10 compares the real yield on 5-yr TIPS with the inflation-adjusted Fed funds rate. The blue line is the overnight real short-term interest rate, while the red line is the market's expectation for what the blue line will average over the next 5 years. This tells us that the market expects only a modest amount of "tightening" from the Fed in coming years. The slope of the real yield curve today is positive; if it were negative, that would be a sign that the market thinks the Fed has tightened too much and will need to lower rates in the future.

Chart #11

Chart #11 looks at the nominal yield curve, from 2 years to 10 years. Rates have risen and the curve has flattened in recent years, which is very much in line with what one would expect when the economy is growing. But importantly, the yield curve is not flat nor is it negative. During most of the fast-growing 1990s, the curve was actually a bit flatter than it is now. So it's hard to get concerned about recent developments in the yield curve.

Chart #12

Chart #12 is the classic way to see whether the economy is at risk of recession. Recessions have always been preceded by a substantial increase in real short-term interest rates (blue line) and a flat or negatively-sloped yield curve (red line). Today we are not even close to the conditions that would suggest a near-term risk of recession. That's another way of saying that the Fed is not even remotely too tight, nor is it expected to be any time in the foreseeable future.

It's also important to note that excess bank reserves are still abundant (about $2 trillion). Past recessions were triggered by very tight Fed policy, when the Fed drained bank reserves and squeezed liquidity in order to boost short-term interest rates. Today, thanks to an important change in the Fed's operating policy in late 2008, the Fed can tighten by either draining reserves (but it might take a long time to create a scarcity), and/or directly raising short-term interest rates. To date they have done neither in a way that might be considered a threat to financial stability. They have merely nudged rates higher in response to a healthier economy.

Chart #13

Meanwhile, the signs of improving economic fundamentals are abundant and impressive. Chart #13 suggests that the current health of the manufacturing sector is consistent with a substantial pickup in overall growth.

Chart #14

Chart #14 shows that manufacturers are experiencing healthy demand from overseas. The US is improving and so is the rest of the world. That's a heady combination.

Chart #15

Chart #15 shows that the all-important service sector is expecting to increase hiring significantly in coming months. This is consistent with surveys of consumer and small business confidence, all of which are showing a big improvement over the past year.

Chart #16

Chart #17

Charts #16 and #17 compare—vary favorably—the health of the manufacturing and service sectors in the US and Eurozone. All are looking about as good as it gets.

Chart #18

As for equity valuations, Chart #18 reflects the recent decline in the PE ratio (using trailing 12-month earnings) of the S&P 500 to 21.1. The one-year forward PE ratio is now only 15.2, only slightly above its long-term average. Trailing 12-month earnings are up almost 13% as of January '18, and sharply lower corporate tax rates going forward can only boost them further. Stocks are no longer cheap, that's for sure, but neither are they are egregiously overvalued.

The current selloff may well continue for awhile, but sooner or later the reality of a stronger economy and a non-threatening Fed likely will allow the market to overcome this latest wall of worry.

Man I love those swap spread graphs.

ReplyDeleteExcellent post. Love it.

sly switch from trailing to forward.

ReplyDeleteAh, those tax cuts are working their magic! It goes in somewhat this order:

ReplyDelete-Larger deficits (And let's add a few hundred billions of spending while we are at it! Because as Dick Cheney so memorably pointed out, "Reagan proved that deficits don't matter").

-Higher interest rates

-Stronger dollar

-Larger Trade Deficits

-Less investment and nervous investors. It's a little surprising that the investors are already nervous, it usually takes a little longer. I suppose it goes to show that the situation is self-evidently poor.

The Trump Tax Cuts. The Wrong Policy, at the Wrong Time, for the Wrong Reasons.

But Fear Not brave citizens! Soon enough we'll be treated to all sorts of moaning and groaning about entitlements and the horrible debt problem, and how the old and the sick are being lulled into a lazy trance in the hammock of the welfare state. Which will be led by Paul Ryan who's family was sustained on public assistance after his alcoholic father died. -->Freudian analysis was invented for people like Paul Ryan.

And those tax cuts that will pay for themselves because of the super-amazing explosive growth? What did you say? Hey, wait, look, look, over there, I see some gay people trying to get married. -->THE NATION IS AT RISK. They won't even let me say Merry Chistmas any more.

Great work as usual. Though no word on China, is it not important compared to Europe but it sure seems to be from the aus and emerging markets view point.

ReplyDeleteWow. Great article.

ReplyDeleteIt reflects what I see in the indicators I observe myself.

I don't know, if you follow Infowars, Scott, but Alex Jones' thesis is, that the demise of the USA over the last decades was an orchestrated bleeding-out by the globalist-elite, while pumping up communist China by technology and knowledge transfer, while destroying the middle class in the western countries. Trump's real task would be to stop that.

If Jones is right - and Trump's bilateral, fair-trade and reciprocal trade concepts, killing TPP and the NWO climate scam, becomes clearer - then the US could be at the beginning of a true re-industrialization - the reversal of the destruction of the West since 1989, when the failed planned economy experiment was dropped.

If the USA really is on its way to liberate itself from the globalist world-government agenda (which to succeed needs to bring the USA as model of freedom, prosperity and invidivual responsibility instead of collectivism down), and give the country back to the American citizens (just like Putin did with Russia and maybe Brexit will do to the Brits), I don't see why this couldn't create one of the biggest REAL booms in the history of your country (at the cost of communist China, the EUSSR and the NWO in general).

Everyone looks at the stock market and compares it with the past. But what if the USA going back to its roots of liberty and is being liberated from the globalist conspiracy?

As a bond trader I can tell you there is a BIG difference between now and since '08. There is NO PLACE TO HIDE. Virtually all bonds are falling in price and THAT is a change. I'm holding cash for the first time since '08. I am not suggesting this will have a pernicious affect on the economy but I will say the last time it happened was '08.

ReplyDeleteI hate to prognosticate. That said, I'm pretty confident that inflation is on the rise and yields are following. I do not like the GOP budget plan and insouciant attitude of the public towards debt. It's mattress time if you're a bond trader.

Great post, love the numbered charts. I feel refreshed and galvanized.

ReplyDeleteStill, big federal deficits forever...I need my worry beads

Great to have you back from vacation, Scott. Thanks so much for sharing these insightful updates on the economy's underpinnings.

ReplyDeleteThere will only ever be constraint on deficit when there is a Democratic president and a Republican congress. One can't even blame the politicians really -- it's only under this specific divide that a significant chunk of the population makes a stink about it. To the extent you think it is an important issue, vote accordingly.

ReplyDeleteThanks, Scott.

ReplyDeleteI'm not one who's prone to obsession about the debt/deficit. But this is getting pretty ridiculous. (And I actually believe GDP growth will surprise to the upside, and perhaps significantly!)

To endzeit14: I like your panglossian view - couldn't resist, readers (HT to the ever-cheerful marcus) - but I wish I could share your view of liberty in America. It appears to me that every one of the Amendments in the Bill of Rights is under duress. Heck, the Fourth, Eighth, and Tenth Amendments don't exist anymore. Trump hasn't helped one iota (as I thought he might). The economy could perform spectacularly but the direction of civil liberties is downright depressing. (On a positive note, a knowledgeable friend of mine told me that roughly all the wealth ever created during the Roman Empire occurred after the fall of the Republic. So perhaps we can get/stay wealthy in our civil rights dystopia!)

Not entirely sure how you get a bigger GDP aside from getting people to return to the workforce. Although unemployment rates are low, labor participation rates is lackluster. The only way to increase GDP is either to employ more people or that they do more work. the implication of the first is that there's either (a) no more candy to stay at home, or (b) that participation is attractive and worthwhile (or a combination of the two).On the second issue, companies are returning capital to their investors in massive amounts. There is no need for additional capital in America -- rather extraordinary dividend or share buybacks are how most of the excess cash is being used.

ReplyDeletePart of the problem with your (excellent) analysis is that you are looking in the rearview mirror as a predictor of future performance. Lets assume that deficits don't matter when GOP is in power. the $150 billion "planned increase in deficit" is already near $380 billion for 2018. Bond prices are very low, stock prices are high (historical) maybe its a new benchmark, I have no idea, but it remains that the market is priced for perfection.

Last week's US correction has one specific worrying trend -- there was no reason for a correction last week. Economic news was ok, political pressures were unchanged. When the cause of a small correction is unknown -- or there are no new pressures in the system, you have to wonder why the market is correcting now!

Interesting to see so much concern about deficits. Some perspective: the deficit is currently running just under $700 billion/yr, which is a modest 3.5% of GDP. This is not necessarily a problem. Today, a $1 trillion deficit would be equal to about 5% of GDP. That's about half the size of the early Obama deficits, which ranged from 9-10% of GDP.

ReplyDeleteWhether the deficit grows significantly is a function of several variables: overall GDP growth, spending growth, and revenue growth. Most of the projections of trillion dollar deficits assume a fairly modest pickup in nominal GDP, either a decline or relatively flat revenues, and a meaningful pickup in spending (as Trump's budget suggests). I think we could see a more meaningful pickup in nominal GDP, surprisingly strong revenues, especially from corporations repatriating overseas cash, and only a modest pickup in spending. But that's just a guess, and it's as good as anyone else's guess.

To get a pickup in real growth we'll need an increase in the labor force participation rate. There are many millions of people on the sidelines these days who could be tempted back into the workforce by higher wages and lower tax rates. I don't see why both those can't happen. I believe we'll see a strong pickup in investment in general, and higher wages are almost sure to accompany that pickup. Why? Because sharply lower corporate tax rates make many projects feasible today that weren't feasible last year. Returns on investment will be strong enough to warrant higher wages.

As for there being a capital glut, I disagree. Capital is nearly always in infinite supply (show me a trillion dollar investment opportunity that has after tax returns of 15% and I'll wager you will have people pounding down the doors to get involved). What is scarce is opportunities to make sufficient after-tax, risk-adjusted returns.

Whatever amount of money corporations use to buy back shares or increase dividends must perforce be reinvested in something; only a modest fraction will be spent on increased consumption. If shareholders suddenly find themselves with lots of extra cash it's not impossible they might find better things to invest in than could the companies returning the cash.

The US economy has tons of unused capacity. There is the potential for surprisingly good results.

"There will only ever be constraint on deficit when there is a Democratic president and a Republican Congress"

ReplyDelete-->And this is because Republicans only care about deficits when there is a Democratic President.

If you really care about the budget and deficits, please remember that it was Bill Clinton with a Democratic Congress who last balanced the budget by raising taxes and cutting defense spending, over the howls of the Republicans, who claimed that it would destroy our economy and leave us defenseless. And then Bush / Cheney immediately unbalanced it with those tax cuts that would pay for themselves with super-growth while they boosted military spending.

So if you loved the economy under W, smile, the GOP is following the same script.

The plotline is very easy to follow if you care to. Ever since Reagan, the GOP has created budget deficits as a tool to "Drown the government in the bathtub". It's the sheer dishonesty they display on the issue that is astonishing, and the fact that anyone out there believes them is equally astonishing.

It's really a 3 part rule:

-GOP fully in charge: Tax cuts, big Deficits.

-GOP / Dem Split: Medium Deficits, as the GOP will succeed in limiting taxation as with Obama.

-Dem fully in charge: More taxes, lower deficits.

So look at Gerry Brown in California --> Balance / Surplus. Over the objections of the Republicans, of course.

Then Brownbak in Kansas --> Catastrophic Deficits. To add insult to injury, look at the Growth in Brownback's Kansas, no super-charged job-creation in sight. Followed by raising the taxes back up.

Scott: good points on the relative size of the federal deficit to GDP.

ReplyDeleteOn the other hand, the last time the US ran trillion-dollar deficits was at the bottom of the worst postwar recession.

Now a trillions in annual red ink after 10 years of growth.

As Senator Dirksen said, "A trillion here and trillion there and pretty soon you are talking about real money."

Handy link for deficit/GDP since 1929: https://www.thebalance.com/us-deficit-by-year-3306306.

ReplyDeleteIt's always astonishing to me how expensive WWII was, and how we rebounded from that with a tax regime that, if imposed today, Bernie Sanders himself would declare unfair to the upper class.

For the most part, I'm inclined to agree with Scott's Panglossian outlook on deficit. It may be 5% this year, or less if things keep getting better, or more if we have a recession. Whatever. My retirement is fine. My main worry is that almost no one talks anymore about the Great Recession and how (or whether we should even bother) to avert another such event.

Lmao. You guys are funny with incorporating of panglossian.

ReplyDeleteI laughed out loud.

Charlie: don't forget that the very high marginal tax rates prior to the Reagan years were substantially offset by a variety of tax deductions. I'm so old I remember when I could deduct the interest on my credit card debt! The share of total taxes paid by the rich was much less in the 40s, 50s, 60s and 70s than it is today because of those deductions. The effective maximum tax rate, in other words, was far less back then than it is today.

ReplyDeleteUnknown: you need to get your facts straight. Clinton balanced the budget back when the Republicans (remember Newt Gingrich?) were in charge of Congress. And that, despite cutting capital gains taxes!

ReplyDeleteBest blog on the internet!

ReplyDeleteExcellent observations.

Presidents dont matter very much for budgets and deficits. (Barack got ZERO votes for His budgets for years)

When PUBs control Congress, deficit/gdp ratios generally go down. Same for debt/gdp.

When DEMs control Congress, they skyrocket.

Stocks have a long way to go to make up for lost time over the past 30 years.

All spending bills must originate in the House.

@scott

ReplyDeleteyou incurred credit card interest expense?

Hi Scott,

ReplyDeleteWould you consider including more commentary or a follow-up post on deficits, debt and the risk of higher rates? As you pointed out, "Interesting to see so much concern about deficits."

It would be great to hear your thoughts on these subjects, under the higher growth and higher revenue scenario you mention, as well as other paths.

Hope the trip was enjoyable. Thanks.

I did incur credit card expense back in the early 80s when we were really struggling and I didn't know much about finances. No responsible person should have credit card debt, of course.

ReplyDelete+Well, I had credit card debt too, at least a little bit. About the only credit cards available back in those days were American Express and Diners Club, for which we had to pay a fee each year. Sears, JC Penny and a few other department stores offered revolving credit accounts that charged interest which was deductible on the 1040.

ReplyDeleteWhen in college I worked for a motel owner who one evening took 4 quarters out of his pocket and placed them on his desk. He took three away and told me the one quarter was all he got to keep out of his earnings. The rest went to the government.

That bothered me and it is a lesson I've not forgotten. I like the word "fair" and I do not think high taxes are fair to anyone. At the same time, I do not favor being able to deduct interest payments, not even mortgage interest. Lower the rates and eliminate deductions.

Thank you so much, Scott Grannis, for what you do in helping us understand and remain informed on the U.S. economy. I am delighted you and your lovely wife had a fantastic vacation in, where was it, New Zealand? Welcome back.

Benj, your comments were rather limited. Are you sick? Flu got you down?

ReplyDeletethey cynical bubble persists.

ReplyDeleteMarcus: Which is it? Panglossian or cynical? It can't be both.

ReplyDeleteRe: Spread of swaps spreads of a different durations.10y swap spread minus 2y swap spread used to be positive till 2008. Then it has inverted and stays like this till now. Is this worth looking at and try to draw any conclusions out of this in your opinion Scott?

ReplyDeleteAdam, re swap spread curve: I think the inversion of the swap spread curve can be explained by 1) there being a relative shortage of longer duration, risk-free assets, and 2) the fact that longer duration swaps can be used as a hedge without a balance sheet effect on a portfolio (i.e., you can buy long duration swaps without having to put up any money, whereas to buy long duration bonds you need the full face value of the bond). The world is still fundamentally risk averse, and buying Treasury bonds is a classic hedge to the risk of a recession. I have an equity portfolio and wish to hedge against the risk of a recession, I can either buy long duration swaps or buy long duration bonds. The former requires no up-front money, the latter does. Both have the same impact on a portfolio. Swaps aren't a perfect substitute for Treasury bonds, of course, because they do have some credit risk, but they are close enough to be popular.

ReplyDeleteScott,

ReplyDeletethat's an interesting strategy. I guess you were a prefessional bond trader?

Why do you prefer swaps over selling equity calls or buying puts?

And another stupid question:

ReplyDeleteWhy don't you simply use stop loss and close the positions? IMO the biggest advantage of the individual investor is that he is not a whale, but can act like a cheetah.

endzeit14: Swap contracts are used exclusively by professional bond and equity traders/investors. Swap contracts can be tailored to a particular need or situation, whereas calls and puts are not customizable.

ReplyDeleteThanks a lot.

ReplyDeleteNext one, on previous occassions you posted an Equity Eisk Premium chart.

Now we have 2019 EPS forecast for S&P of 190. To get ERP to 0, S&P have to get to 5400 (sic), assuming 10 y at 3,5%. (5400/190=28,4;1/28,4=3,5).

Say we see 10% rise in index each year next 2 years>3270, so if EPS will be flat, Equity Yield will be 5,8% i.e. ERP get to 2,3.

I am just doing simple math here to get some context on were we are.

One selfremark, we'd rather calculate this on DY basis, as this is real money flow to investors.

ReplyDeleteWealthMony:

ReplyDeleteHearty salutations to you. I am ok, and hope the best for you.

I do not think I have much to add on this.

We face a tidal wave of debt in the next 10 years, and that is if we are lucky and see no recessions. You know when you are down by six runs in the seventh inning?

I am hoping Japan is instructive, and national debt can be handled through central bank QE. It seems to work in Japan.

Another option is, during the next recession, refinancing as much debt as possible at near zero interest rates.

I guess I have this to say: If you think a recession is on the cusp, load up on US government bonds. They will appreciate, and carry you through until recovery.

@Scott

ReplyDeleteSwap contracts are used exclusively by professional bond and equity traders/investors.

Does that mean, what you are writing about, is not about managing your personal money, but only about OPM (other people's money)?

Wow, you're just another do as I say not as I do pundit.

ReplyDeleteMy reference to swap contracts has nothing to do with recommending that people use them or not. Theoretically the swaps market is open to anyone. In practice, only large-scale investors or traders use them. I cite them here and in many other posts because their pricing reveals important information about market assumptions and market conditions that is relevant to any investor, large or small.

ReplyDelete@Scott

ReplyDeleteYou wrote:

I have an equity portfolio and wish to hedge against the risk of a recession, I can either buy long duration swaps or buy long duration bonds.

Therefore I asked you why you as individual investor are using swaps as hedge, instead of S/L or puts/calls.

Sorry for not being explicit; I was speaking theoretically, from the point of view of a professional bond trader. Regardless, in theory there is no reason that an individual investor couldn't use swaps.

ReplyDeleteBig fan of the blog, and this is a great summation the current state of things (and echoes my personal bias!). Thank you for sharing.

ReplyDeleteOne small thought. I struggle with the concept of using swap spreads as a predictor/explainer given they are a significantly different beast now than pre-recession with the rules around mandatory clearing. While they may look like they operate similarly to prior cycles, it's no longer an expression of bilateral bank risk vs. the safety of cash treasuries. Just a thought.