North Korea remains the biggest threat to world peace, but markets remain nonplussed. Gold prices have inched higher, but are nowhere near levels that would suggest panic buying. The dollar has declined about 10% so far this year, but it is still trading above its long-term, inflation-adjusted average value relative to other currencies. Stocks show no sign of any significant correction despite trading near record highs. Sovereign yields are uniformly low, but still comfortably above their all-time lows of mid-2016.

Is the market overly complacent? Overly optimistic? Absurdly cheap or expensive? A great buy on dips? "No" is the best answer to all these questions, in my view. Nothing obvious is staring us in the face. I'm with Howard Marks in thinking that now is not a time to take on oversized risks, but neither is it a time to cash in all your chips.

I've been fascinated by the above chart for years. Why is it that the prices of two unique assets—gold and 5-yr TIPS—have been tracking each other for the past decade? The best answer I've come up with is that both are havens of a sort—safe ports in a storm. TIPS protect you against inflation and default, gold protects you from systemic collapse. At current levels they tell us that although conditions today are somewhat better than they were 5 years ago, investors are nevertheless still paying a premium for safety. The long-term average, inflation-adjusted price of golds is somewhere in the range of $500-600/oz., by my calculations; and in normal times the real yield on TIPS would be expected to trade around 1% to maybe 2%. Both are priced to a premium these days, which suggests risk-aversion is still alive and well in today's market.

The chart above shows that the real yield on TIPS tends to track the trend growth rate of the economy. With a real rate today of zero, the TIPS market seems to be expecting real growth of the US economy to continue to average about 2% per year, which is what we've seen for the past 8 years.

The value of the dollar vis a vis other currencies rose following the November elections, but it has fallen by about 10% so far this year. As the chart above shows, the dollar is still above its long-term, inflation-adjusted average against two baskets of currencies. No big message here, but it seems to rule out excessive optimism and excessive pessimism.

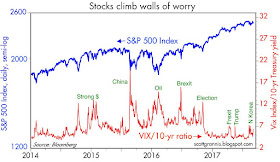

The chart above shows how the market has reacted to major events in recent years. The recent reaction to the heating up of North Korean risk is rather tepid, and significantly less than other episodes of panic attacks.

Last week's release of the ISM manufacturing indices for August was very encouraging. The chart above suggests that the new-found strength of the manufacturing sector points to overall economic growth of at least 3-4% in the current quarter. The Atlanta Fed's GDP Now forecast for this quarter currently stands at 3.2%, a bit better than the second quarter's 3.0%.

The manufacturing employment index was very strong, suggesting that manufacturers see improving conditions and thus plan to ramp up their hiring plans.

The upturn in US manufacturing mirrors a similar improvement in the Eurozone. Synchronized recoveries are always welcome!

Based on past correlations, the strength of the ISM manufacturing index says that revenues per share of major US corporations are likely to remain strong for the foreseeable future. Coupled with near-record profits, this provides a reasonable basis for a continuing rally in equity prices.

Not all industries are looking up, however. The August report on car sales was decidedly weak, as the chart above shows. Construction activity has softened in recent months, and bank loans to small & medium-sized businesses have been flat for over six months. Their are pockets of strength and weakness, and that probably means no boom and no bust, as I noted last month.

The US may be stuck in slow-growth mode, but emerging markets are on fire. Measured in dollars, the Brazilian stock market has climbed 150% in the past 20 months. It's still far below its previous highs, however. Brazil is hardly booming, though, but the outlook has changed from dire to somewhat promising. This is one of those cases where the market was expecting a disaster which has failed to materialize. Regardless, emerging markets are riding the crest of two powerful waves: a weaker dollar and rising commodity prices. There is reason to be optimistic about the outlook down south, mainly due to ongoing improvement in the outlook for fiscal policies and politics in general.

Industrial metals prices are up 66% in the past 18 months. This strongly suggests that global economic activity is picking up.

The fact that the dollar is now weakening as commodity prices rise (which is their natural tendency) suggests that the rise in commodity prices may reflect a weakening in the demand for dollars at a time when their supply is abundant, and that is a classic recipe for rising inflation. It's premature to make a big rising inflation call, however, since the bond market continues to expect inflation to be relatively low, in the range of 1.5-2.0% for the foreseeable future. As I mentioned last week, this is something to worry about, not a reason to panic.

So who (are what) is buying all of this 207 basis point 10 year US paper? I am not disagreeing with your premise, I just do not understand Mr. Market's risk for reward motivation for locking in such meager returns for a relatively long period of time. Unless, of course, the existing bond market status quo does what no one is expecting, and remains in place for the next decade or so.

ReplyDeleteThere are large pools of institutional money devoted to fixed income investment—many trillions. Demand for 10-yr Treasuries is intense; that is why yields are so low. No one is being forced to buy new Treasury debt, which is on track to being issued to the tune of $700 billion or more this year. That money chooses Treasuries instead of stocks that yield much more is prima facie evidence of risk aversion.

ReplyDeleteI understand there is intense demand for 10yr, but what is the risk of that "intense" demand becoming "moderate" demand. It seems that a marginal change could be significant. Some general questions: How much of that institutional money is forced to own treasuries because of various credit and liquidity requirements?

ReplyDeleteWhat is the risk of sovereign wealth funds reallocating?

What is the risk of European Growth changing the currency and interest rate spreads?

Portfolio rebalancing (away from bonds and into stocks) could be a trigger for higher yields. But anyone who practices portfolio rebalancing these days is more likely to want to reduce equity exposure in favor of bond exposure, because equity valuations are high (by some measures). But those same people are faced with the quandry posed by very low bond yields (and thus very high bond valuations). It's a big dilemma. Bonds have traditionally been hedges against recession, but there is a limit to how low bond yields can go, and we must be approaching that. Or are we? There are many who think the growth potential of the US economy is severely limited (the new-normal crowd), and thus 2% 10-yr yields are not necessarily unattractive. Why can't US yields fall to German or Japanese levels?

ReplyDeleteIn any event, there are lots of risks out there which could result in rising yields, but at the same time there is a lot of demand for safer assets like bonds, because there is a lot of concern that the economy is vulnerable. Those two forces are apparently in equilibrium these days. At the same time, implied volatility is low. The market is projecting a continuation of the current environment for the foreseeable future. The great risk therefore is that something happens that causes the market to change its expectations. We could go along like this for another year perhaps, but at some point I would expect to see some kind of a shock one way or another.

Nonplussed doesn't mean what you think it means (unless you are in the "informal" camp)

ReplyDeleteHello - Does that $19T in marketable US debt include Treasury securities held off the Fed's Balance Sheet?

ReplyDeleteThanks!

Here is the place to go to see the current debt: https://www.treasurydirect.gov/NP/debt/current

ReplyDeleteDebt Held by the Public is the only number that matters (now $14.6T). Total debt ($20.2T) is meaningless because it includes money borrowed from Social Security; that's money the government owes itself, an accounting fiction. Debt held by the public includes debt purchased by the Fed (now $2.5T).

Thank you. Your citation of the $19T then, does not include Treasury Debt as $14T would take up almost all that total of $19T you bring up?

ReplyDeleteThe 19T includes 14T of Treasury debt. The difference (5T) is an accounting fiction. Forget about the 19T figure, although you will see it widely cited.

ReplyDeleteSo sorry - I can see where the way that I asked the question created confusion!

ReplyDeleteHere is what I meant (my fault, apologies):

In your piece, you cite $19T of US marketable debt instruments.

My question: That $19T of marketable debt instruments does not include US Treasury debt, correct? By the time you include corporate debt, student loans, ABS, bank debt, etc etc that cannot be $19T-$14T = $5T. That's what I meant to ask about.

Thank you!

what post and/or what chart are you referring to?

ReplyDeleteI think I figured it out. The SA post has a % of World Capitalization chart that this post doesn't seem to. It said 19% - not $19T - were in US bonds. That's about $25T total, which I still don't really understand if $14T is Treasuries.

ReplyDeleteThank you, and sorry for the confusion.

This comment has been removed by the author.

ReplyDelete• Global Sector PMI: Financials, industrials lead global growth in Q3. The latest set of IHS Markit Global Sector PMI data signalled further broad-based growth of output in September.stock market tips

ReplyDelete