The first chart (above) compares the price of gold to the price of 5-yr TIPS, using the inverse of their real yield as a proxy for their price. The only thing these two assets have in common is their supposed ability to hold their value over time relative to other things: over very long periods, gold tends to track the rise in the general price level, while TIPS pay a real yield that is guaranteed by the U.S. government, thus compensating investors for the effects of inflation. Call them "safe-haven" assets of a sort. As such, it makes sense that their prices would rise and fall together as investors became more or less concerned with "safety." And in fact this is what has happened for the past decade: the price of gold and TIPS have tracked each other remarkably well. If they tell a story it is that investors were willing to pay ever-higher prices for safety for the first half of the past decade, while they have been ever-less willing to pay for safety in the past 5 years. This is another way of saying that markets were very risk averse in 2012 (when the PIIGS crisis was most acute), but have become gradually less risk-averse since then. Both assets, however, are still trading at prices that are relatively elevated compared to their longer-term history, which in turn suggests that markets are still struggling with risk aversion.

It's a well-known fact that the stock market tends to fall when investors' nervousness increases: stock prices tend to move inversely to the Vix index, a good proxy for fear. Dividing the Vix index by the 10-yr Treasury yield gives a number that tends to rise as fear rises and to rise more as yields fall—with yields in turn being a proxy for the market's confidence in the economy's growth prospects. What we've seen since just before the November elections has been a pronounced decline in fear, coupled with a modest rise in 10-yr yields, and that has coincided with a rather impressive rise in stock prices. Investors are a lot less fearful and somewhat more confident in the economy's growth prospects, and that has—not surprisingly—correlated with a rise in equity valuations. It's also the case that corporate earnings have stopped declining and are now starting to rise.

The American Trucking Association publishes an index of the amount of tonnage that is hauled around the U.S. economy by our massive fleet of trucks. As the chart above shows, this index tends to move by the same order of magnitude as the real value of the nation's largest companies (using the inflation-adjusted value of the S&P 500 index as a proxy). The economy is moving more goods today than ever before, and companies are worth more than ever before.

It's a well-accepted fact that interest rates tend to track inflation—except when they don't, as this chart shows. For the past 6 years, 5-yr Treasury yields have not tracked the course of core inflation very well. With inflation running at 2%, yields should be closer to 4% today, yet today they are just under 2%. This suggests to me that the market is still quite risk averse, since the market is willing to accept a very low (even negative) real yield on 5-yr Treasuries, presumably in exchange for their government guarantee. As a general rule, very low Treasury yields are symptomatic of very strong risk aversion. Consider: if people were wildly optimistic about the future, no one would want to hold a bond that paid a zero real rate of interest; real interest rates would have to rise considerably to compete with the generous returns expected of other assets.

The chart above compares the value of U.S. and Eurozone stocks. What stands out is the huge divergence between the two that began some 8 years ago. Since then, U.S. stocks have outperformed their Eurozone counterparts by over 40%. We know the U.S. economy is still mired in its weakest recovery every, so what this says is that the Eurozone economy is really in abysmal shape. No wonder the Brits voted to exit the European Union. I would not hold out a lot of hope for the future of the EU, but that's good news, in the long run, for Europeans. If they succeed in getting rid of an expensive, burdensome, and unproductive layer of government bureaucracy, European economies could be set up for a huge boom.

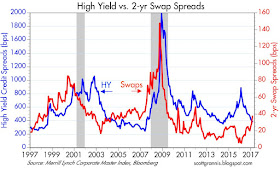

Over the years I've highlighted the key role that swap spreads play in signaling the health and future growth prospects of financial markets and economies. As the chart above shows, swap spreads (see here for a short primer on what swap spreads are) have tended to rise in advance of recessions, and they have tended to decline in advance of recoveries. At the very least swap spreads are good coincident indicators of economic and financial market health (i.e., higher spreads reflect deteriorating conditions, falling spreads reflect improving conditions), and they have often been good leading indicators. Swap spreads are far more liquid than high-yield credit spreads, so they tend to react quicker to changing fundamentals. That swap spreads have been rising of late while HY spreads have been falling is thus a potential cause for concern. What is going on? Swap spreads are still relatively low, so they are not necessarily forecasting a meaningful deterioration in the economic and financial fundamentals, but over the years I've developed a healthy respect for swap spreads, and so I'm reluctant to dismiss their somewhat troubling message today. Something is going on out there that is worrisome, so some degree of caution is warranted. Maybe that helps explain why 5-yr Treasury yields are as low as they are.

Over the past year or so, the Brazilian stock market has surged more than 145%. Wow. What this says is that a year ago Brazil was considered to be on the cusp of disaster. Instead of collapsing, Brazil is slowly getting back on its feet, having purged at least some of the government corruption that was plaguing the economy. It helps that commodity prices have surged over this same period as well, and despite the fact that the dollar has strengthened (a strong dollar has typically seen falling commodity prices and terrible news for most emerging market economies). Rather than signaling a boom, I think the surge in Brazilian equities is telling us that even though Brazil is still in lousy shape today, it is doing much better than most people expected a year ago. If the U.S. and Eurozone economies start picking up, Brazil's future could look very bright, with lots of upside potential.

The chart above compares the prices of the three major types of goods and services that comprise the U.S. economy. Services (which are mostly driven by wage costs) and non-durable goods prices (e.g., food, gasoline) have been rising more or less steadily since 1995, whereas durable goods prices have been steadily declining. It's not a coincidence that China first emerged as a major source of durable goods beginning in 1995. China has been a source of deflation, and that has helped to moderate the inflation that has persisted outside the durable goods sector. It's all been a tremendous boon to U.S. consumers. Service sector prices (mostly determined by wages) have risen by over 70%, while durable goods prices have fallen by almost one-third. An hour's worth of labor, in other words, today buys 2.2 times as much in the way of durable goods as it did 22 years ago. That's why nearly everyone is able to afford a smartphone these days. We have no reason to fear China. Are you listening Mr. Trump?

Warren Buffett says that the ratio of stock prices to nominal GDP is his preferred measure of stock market valuation. The chart above compares this measure (blue line) to the inverse of 10-yr Treasury yields, because I think that comparison adds value to Buffett's preferred measure. Stock prices, in theory, are the discounted present value of future profits, so it is not unusual to see, as the chart above shows, that equity valuations tend to increase as interest rates (i.e., discount rates) decline, and they tend to fall as interest rates rise. Valuations and yields are roughly the same today as they were in the late 1950s and early 1960s, and neither valuations nor yields appear greatly distorted relative to their historical relationships. Stocks are certainly not cheap at current levels, but neither are they egregiously over-valued. However, it is reasonable to think that unless the U.S. economy picks up and corporate profits resume their long-term rise, the stock market is going to run into trouble at some point. Stocks are also vulnerable to an unexpected rise in inflation, since that would result in much higher interest rates.

Great post.

ReplyDeleteGold prices are a cipher.

I suspect gold prices today are set by 2.5 billion Indians and Chinese who are earning more disposable income, and together who form the bulk of gold purchases. Central banks are buying gold too, both Russia and PBoC.

"over very long periods, gold tends to track the rise in the general price level" --Scott Grannis.

Well, but where? In Japan, China, India or the US? Gold is global commodity. Does this mean gold will revert to a mean price but based on a global inflation index?

What the definition of "very long'?

It must be longer than 40 years. Adjusted for inflation, gold was worth double in 1980 what is worth today, and it was worth about half of today's price in 2001. I am running out of years, so "very long" I guess will eclipse the lifetime of an even health investor.

Gold has been a roller-coaster through my adult life!

And what makes gold prices meaningful, but not platinum or silver prices?

My grandfather used to say, "All gold is fool's gold."

A nice sentiment, and maybe true for investors too.

Regarding the Relative Price Trends chart. Would be interesting to see a households weighted relative price trends chart. That is, what is the percentage of Services, for example, of household expenses?

ReplyDeleteDo health services costs included in Services, if not, under which category?

"China has been a source of deflation". Are they also the source of wages deflation for certain parts of the economy? China is a tremendous source of deflation due to astounding over capacity, this can most clearly be seen in recent commodities prices rally. Eventually it would reverse like it did before.

Insightful article.

ReplyDeleteScott, I have a question:

It's a well-accepted fact that interest rates tend to track inflation—except when they don't, as this chart shows. For the past 6 years, 5-yr Treasury yields have not tracked the course of core inflation very well.

Don't you think that financial repression is the reason why that occured and persists?

endzeit: There are many who would agree with you: namely, those who think the Fed controls interest rates and has firmly suppressed them for years. I'm in the camp that says the Fed is much more a follower than a leader; the Fed can't artificially suppress interest rates for years. The Fed and the market are always in a complicated dance, where one leads and the other follows, and vice versa. I think interest rates are very low because the market has been very pessimistic about the economy's prospects, and the market has been, until recently, extremely risk averse, preferring the safety of bonds to the risks of stocks.

ReplyDeleteScott, it would be helpful to all if you'd update the swap chart w/ commentary more frequently as things unfold this year. Always enjoy the posts.

ReplyDeleteScott,

ReplyDeleteRe: low real US5Y yields, and widening swap spreads.

The US Treasury just released data on maturity of the bonds held by the FED.2018: 106 $bn; 2019:431 $bn; 2020:340 $bn; 2021:230 $bn;2022:100$bn. Looks like, FED will take the passive stance and will allow those bonds to mature. In that process Treasury must issue new bonds to refund the old ones and sell them to the private sector.(here is the difference, because when bonds held by private sector mature, private sector just rolls the bonds).

So as peak supply is expected in 2019, we may see lower real yields till the market absorbes that tranche.

Regards

Adam, re Treasury supply: I don't think maturing Treasuries held by the Fed are going to have a meaningful impact on Treasury yields. The outstanding and liquid stock of marketable Treasuries is currently about $9.4 trillion. $431 billion maturing in '19 would be less than 5% of that amount, which is sure to be larger in two years. In any event, Treasury always "rolls" maturing bonds, no matter who holds them, unless there is a budget surplus. Relatively small additions to the outstanding supply of Treasuries can't meaningfully impact the much larger outstanding stock. Treasury yields are determined by the market's desire to hold bonds relative to alternative investments. Consider that there is about $12 trillion of liquid, high-grade corporate and mortgage-backed securities outstanding, and all are priced relative to Treasury yields.

ReplyDeleteScott - great post! Very interested in your continuing monitoring and view on the swaps spread more. In the middle market, seeing a lot of current strength since start of new year. Two concerns we have: 1) border tax adjustment and effect on trade, and 2) some pick-up in ill advised bank lending - leverage still good, but bad sponsors. Will be interested in your views as swap spread move develops - thanks!

ReplyDeleteI'm not sure of the credibility or seriousness but I read that subprime auto loans are back up to where they were pre-crisis.

ReplyDeleteScott,

ReplyDeletethanks for the answer.

As a counter argument I'd say the following: if the FED can't supress rates, it also can't push rates.

Then I'd bring up the 1980s interest rate increase by Paul Volcker. The 15% increased the cost of credit so much, that inflation was stopped.

Another Q: :)

re Treasury supply:

I don't think maturing Treasuries held by the Fed are going to have a meaningful impact on Treasury yields. The outstanding and liquid stock of marketable Treasuries is currently about $9.4 trillion. $431 billion maturing in '19 would be less than 5% of that amount

Treasury market is highly liquid, but most Ts are held till maturity. What I want to say: compared to the overall size in existance, the amount that is traded is small.

To me this seems similar to the gold market. Almost all gold ever produced still is there. But the rpice is determinded by the small amount (compared to that in existance) that is traded.

If all the stored gold would suddenly come onto the market, the price could fall incredibly low.

But also vice versa: despite being that much gold in existance, it can rise tremendously.

Why? Because not the theoretical stock of gold determines the price, but the gold that is available for the market.

Can't the same argumentation be made for treasuries?

The size is huge, but since most Ts are held till maturity by insurers and banks, and how much it will pay is known prior (if held to maturity), but the current price of them is determined by the "float" that is traded. And here comes the FED and the interest rate it sets into play: by setting the current price, the price not only of the float, but of all Ts in existence is determinded.

I don't say, that the FED's capabilities were without limits. Just like the gold market: a huge reservoir of supply, but that potential reservoir is not available for the market. There is a certain, quite big range, in which the FED can operate and set interest rates, before also the treasury "reservoir" would come onto the market (for example very high inflation, which would make holding to maturity devastating).

That's how I would argue, that the FED can keep rates below market prices, without triggering the huge T-supply coming onto the market.

Volcker did not push short-term rates higher. He acted indirectly on interest rates by reducing the money supply. Money became scarce, and thus more expensive (i.e., higher rates). Today's Fed can't do the same thing, because there is about $2 trillion of excess reserves in the banking system. Today the Fed acts on rates by adjusting the rate it pays on excess reserves. If that rate is too high or too low, the market will react and guide the Fed towards a rate that is consistent with its policy objectives. The Fed pays a lot of attention to the market's expectations of where future rates will be. Its a complex dance.

ReplyDeleteThere is plenty of active trading in the Treasury market, but the amount traded does not influence yields. Yields are determined by the market's desire to hold bonds relative to other assets. It's the outstanding stock of bonds and the public's desire to hold them that determines rates, not the flows on the margin. Same for gold: global annual production of gold is only about 3% of the existing stock of gold.

Re subprime auto loans. I don't have the exact figures with me, but these represent a very small part of the bond market and are thus not likely to produce a systemic collapse such as we saw in 2008. They can be symptomatic of other problems in the market, of course, but by themselves they are very unlikely to be the trigger for a systemic problem.

ReplyDeleteThanks for the answer on US bonds.

ReplyDeleteAnother brick in the wall of warry. :)

BBG is wirenig a story that Investment Banks start to expand their capacity in trading a single US companies Credit Default Swaps, i.e. there is a growing interest among market professionals to hedge the risk of a US companies corporate credit.

You othen show the graph with US corporate bonds yields spreads - which is (correct me if I am wrong) a coincidence indicator in nature.

Is there any simple and approximate forward looking indicator of a possibility of deterioration of a quality of a US corporate debt?

Regards.

Re "Is there any simple and approximate forward looking indicator of a possibility of deterioration of a quality of a US corporate debt?"

ReplyDelete2-yr swap spreads are the best forward-looking indicator of the health of the financial markets and the economy (and thus of the quality of corporate debt) that I'm aware of.

And in news that isn't really news, tax cuts fail to deliver in Kansas:

ReplyDeletehttp://www.motherjones.com/politics/2017/02/sam-brownback-kansas-tax-cuts-donald-trump

Funny how the trump tax cut aficionados fail to mention Kansas when making the case. Let me guess, it must be those darn regulations !

Credit default swap rates are found here:

ReplyDeletehttp://www.marketwatch.com/investing/cds-bonds-indexes

My caution is that markets tend to fracture like glass, not decompose slowly like old granite. Think 2008 and AIG. Real estate took a 50% hit not in five years but in five months or less.

There is an old saying: "You go bankrupt slowly, and then all at once."

I am not sure that is an analogy, but nobody predicted 2008 (well, the doom-mongers did, but every year is 2008 to them).

Recoveries are not living things, and can in theory last forever. We have a very long-toothed and very slow recovery underway.