So here are some updated charts that I find interesting, in no particular order, with some brief commentary below each one:

Industrial commodity prices are up 15% since last December. At the very least this suggests that global economic activity is strengthening on the margin. The Chinese yuan has been stable over this same period, suggesting further that conditions in China are not deteriorating as many had feared.

Commodities have risen in price in all major currencies since December. This is not just a dollar-driven phenomenon, and that reinforces the notion that rising commodity prices reflect improving economic conditions.

Oil prices have been much more volatile than other commodity prices (note the difference in magnitudes of the two y-axes). However, both have tended to move together. Oil prices are up an astounding 70% since their mid-February low.

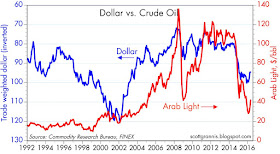

The dollar has been relatively flat since early last year, and this appears to have provided some important support to commodity prices of all types.

Housing prices have been rising for the past four years. In real terms, prices have tended to rise about 1.4% per year on average. Prices today do not seem to be out of line with historical trends. In the past four years, home prices on average have risen by an annualized 8%.

Fear has been an important source of stock market volatility in recent years. Fears have subsided of late, and that has allowed stock prices to rise.

Credit spreads have subsided as well as fear in general. Most of the fear was concentrated in the oil patch, and rising oil prices have brought a sigh of relief to the entire corporate bond market.

The number of active drilling rigs in the U.S. has plunged by almost 80% since late 2014, in direct response to lower oil prices. This illustrates the power of market prices, since lower prices have worked to discourage oil exploration and production while at the same time encouraging more oil consumption. Crude oil production in the U.S. has declined by7% since last June, after almost doubling in the previous six years.

Fixed mortgage rates are within inches of all-time record lows. There may never be a better time to refinance a mortgage or take out a new mortgage.

Applications for new mortgages have surged by almost 50% since late 2014, largely in response to low and declining mortgage rates. This reflects a significant improvement in housing market fundamentals.

The spread between the yield on MBS collateral and the 10-yr Treasury has been remarkably stable (70-80 bps) for the past several years. This stability suggests that the appetite for MBS has been relatively strong even as the demand for new mortgages has surged of late: borrowers are more willing to borrow, and lenders are more willing to lend.

According to Bloomberg's Financial Conditions Index, conditions are relatively healthy, though still shy of what they have been during earlier periods when markets were optimistic and economic growth was stronger.

U.S. equities have outperformed Eurozone equities by a significant and perhaps unprecedented margin over the past seven years. Eurozone equities have made no progress on balance since 1999, in contrast to the U.S. equity market which has attained new highs.

10-yr Treasury yields today are only 45 bps above their all-time record lows of mid-2012. Relative to core inflation, 10-yr Treasury yields are negative. Yes, negative yields exist in the U.S. The real yield on 2-yr Treasuries is now -1.4%! Yields are very low and even negative relative to inflation, relative to rising home prices, and relative to rising commodity prices. This encourages borrowing and speculation. In the late 1970s, negative real yields contributed to rising inflation. Some central banks have resorted to negative interest rates in an attempt to boost inflation. Since negative interest rates strongly discourage holding cash, they are inflationary since they weaken the demand for money at a time when there is an abundant supply of money, effectively creating an over-supply of money. To the central banks that are paying people to borrow money, I say "be careful of what you wish."

The chart above compares the price of gold with the price of TIPS (with the inverse of the real yield on TIPS being a proxy for their price). Both have been in a declining trend for the past several years. I've argued that this reflects a declining demand for safe assets and a gradual return of the confidence that was lost in the wake of the 2008 financial crisis. I think it also reflects less concern regarding the potential for QE to boost inflation. But the recent upturn in both prices could be an early sign that negative interest rates are beginning to bite: the market is now willing to pay more for the protection these two assets offer from rising inflation and general uncertainty. This may be the canary in the coal mine of rising inflation.

Even though 10- and 30-yr Treasury yields are very close to all-time record lows, the spread between the two is relatively high and rising from an historical perspective. This is the bond market's way of saying that short-term interest rates are quite likely to rise in the future, and it is also a sign that the economy is not on the verge of another recession (the yield curve typically flattens in advance of recessions).

Scott, re. China / commodities, some people see signs of a China-fuelled commodities speculation bubble: http://info.woodfordfunds.com/e/42952/bubble-trouble/4t44ry/571427258

ReplyDeleteAlso, re. upcoming election. IG Group, a very large (UK-based) financial betting company has the following prices for the contenders: Hilary is 74-78 (100 being she's won and zero, she's lost); next is Trump on 17-21; and both Sanders and cruz are on 0-2.5 !!

Money talks, BS walks, as you know .. financial betting stats say it is already game over, Hilary has it in the bag. I recall on a previous election where Obama won (again ?) and how surprised you were. Don't you think that once again your optimism may be blinding you to the election reality ?

i demand more qe

ReplyDeleteRob: It is indeed tough to argue with the message of betting markets. But if the collective wisdom has Hillary winning, then it's probably priced into the market. And as I see it, the market is not priced to much optimism, if any, about the results of the election. In any event, at this point I'm not forecasting any great improvement in the economy unless and until fiscal policy changes for the better. So maybe I'm a little optimistic because, unlike the market, I'm not convinced that Hillary will win.

ReplyDeleteOur filling stations are now charging a buck more

ReplyDeletethan just two months ago. I will now have to give

an extra Jackson to my gas pump attendant. (1st energy

responder)

There is a good likelihood, we shall be paying 3 bucks

before the end of the year.

Yes, the FRB or Fuel Rate Burn will cost struggling

consumers hundreds of dollars.

Great review.

ReplyDeleteThe Donald is amazing. Cruz picking Fiorina now looks like a concession speech.

Can Trump beat Hillary? The experts say no.

Call me a looney, but I sort of like The Donald. By the way, the US prospered under the greatest protectionist President since Hoover - - that was President Reagan!

On the other hand, the nation did great under President Clinton as well.

Well, Scott Grannis worked in his usual dark forebodings about inflation in this post.

I can remember in the 1980s and 1990s a lot of discussion about federal budget and trade deficits ultimately leading to inflation. Then it was monetary licentiousness that was supposed to lead to inflation. QE.

Butt inflation keeps going lower and institutional investors are willing to give money to the US Treasury for 10 years at less than 2%. In Japan investors are paying for the privilege of owning a 10-year government bond.

But someday....someday baby inflation.

BTW Q1 GDP at 0.5%.

Rob: I've been watching the gambling lines every week, as you have. I have been stunned by the bid for Hillary. It's unrelenting. But I think you overstate things when you say it's "already game over." The anti-Hillary bet is getting 3:1. Those are long odds but not THAT long.

ReplyDeleteBenjamin: You and I have been copacetic re: inflation for years, and still are. But things have changed a lot in the past four months. PCE is at 1.7% and rising as opposed to 1.2% and falling. Gold has recovered to a one-year high and isn't that far from a three-year high. TIPS spreads have widened...

ReplyDeleteMy fear is still overwhelmingly that the Fed fears inflation too much and wants to tighten at the first opportunity. (In this way, they'll perpetuate the pattern of being too tight, cause a mini-crisis, respond with liquidity, repeat.)

But for the first time in a long time, I'll acknowledge that the factors are more balanced.

I agree with the speculation that Hillary and Ryan could reach a grand bargain in response to the chaotic anger reflected in Drumpf and Sanders' rise.

ReplyDeleteThat would probably include corporate tax reform, infrastructure spending, and entitlement reform sweetened with some other boost in the safety net.

Matt: you are right...but I still say Wake Me Up when inflation is north of 3% and unemployment is south of 4%.

ReplyDeleteThose foreign election betting markets have become popular. Color me skeptical about their trustworthiness and true participation. If I were the presumptive DEM nominee with the world's largest war chest of corporate donations and CFR backing, I'd make sure there was a relentless bid under my name in those betting markets, too. DEMs don't like free markets, after all. Just the apppearance of free markets.

ReplyDeleteSelf-funded Trump has woken up a great "America-first" mindset. Hillary has zero accomplishments, and is dishonest, and incompetent. She will serve any industry or corporation who pays her fee. She will serve any despot who donates to her Foundation. How many Bernie Sanders voters will want to support the only Establishment candidate in the race, who is solidly in the pocket of those they protest? Turnout will be a problem for Hillary, just like it has been in the Primaries. Swapping her pantsuits for Hunger Games smocks ain't gonna help old GrandMao image.

Trump won every single county in every state that held a Primary this week. He's picking up steam as more people contemplate the malaise of another 2 terms of FDR.