In the seven and a half years that I've been doing this blog, I've been accused by many readers of being relentlessly and even dangerously optimistic (e.g., "do you ever seen any negatives?"). It's true that I have been reliably optimistic, even in the face of a series of selloffs and corrections. However, I've explained that my optimism is not optimism

per se, but optimism

relative to a market that has been generally pessimistic. Ever since early 2009 I've predicted that, while the economy was likely to grow, it would be a disappointingly

sub-par recovery, mainly because of headwinds like high marginal tax rates, "stimulus" spending, increasing regulatory burdens, Obamacare, anti-business sentiment, and uncertainty surrounding the Fed's monetary policies. Even though I foresaw sub-par growth, I thought that it made sense to be bullish because the market expected even less (remember all the "double-dip recession" calls and

ECRI's recession call in 2012?). So far, my optimism has been warranted.

Now, let me be specific about all the negatives I see out there, especially the relatively new ones. There are LOTS of negatives, but I'll try to be brief.

The biggest negative of them all is that the US economy is not nearly as large and as healthy as it could or should have been, had policies been better designed. This has been the weakest recovery in post-war history, and by a lot. If the economy had rebounded from the Great Recession with the same vigor it displayed in every post-war recovery, national income would be almost $3 trillion higher than it is today, as the chart above illustrates. Per capita income would be almost $9000 higher, and a family of four would be making $35K more every year. That's real money, and it explains why the electorate is so upset these days with the establishment.

As I noted some years ago, all the spending and borrowing that was supposed to "stimulate" the economy was essentially

flushed down the toilet. Since 2009 we've conducted a

laboratory experiment in the power of government spending to grow the economy by stimulating demand, and the result is proof that Keynesian theories are destructive, not stimulative. Neither government spending nor easy money has the power to create growth out of thin air, but politicians want to convince you that they do. The economy is weak today because we have wasted many trillions of dollars on transfer payments that only create perverse incentives to work less.

A few days ago, Treasury Secretary Jack Lew unleashed a regulatory broadside against large corporations seeking to become more competitive in an economy with an absurdly burdensome tax code. As Pfizer's Ian Read noted in today's WSJ:

This week’s Treasury action interprets the tax laws in ways never done before. This ad hoc and arbitrary attempt to single out and damage the growth opportunities of companies operating within the current law is unprecedented, unproductive and harmful to the U.S. economy.

The action was accompanied by much unfortunate rhetoric about tax avoidance. No one was shirking their U.S. tax bills. In a merger with Allergan PLC, an Irish company, we would have continued to pay all federal, state and local taxes on our U.S. income. All that these new rules will do is create a permanent competitive advantage for foreign acquirers. Simply put, there will be more foreign acquisitions of U.S. companies resulting in fewer jobs for American workers.

If the rules can be changed arbitrarily and applied retroactively, how can any U.S. company engage in the long-term investment planning necessary to compete? The new “rules” show that there are no set rules. Political dogma is the only rule.

Why punish our most successful companies, when it would be so much more reasonable to simply revise our tax code so that U.S. businesses are not double-taxed on their foreign income, and are not taxed at the highest rate in the developed world? If the objective is to have more money to redistribute to the "poor" it's doubly stupid, because income redistribution only creates perverse incentives. Unfortunately, we've been seeing a lot of stupid policies out of Washington, for about as long as I can remember.

Why tear down the rule of law upon which our country was built? As an aside: if Hillary escapes prosecution for what are almost certainly serial and willful violations of U.S. intelligence and secrecy laws, while the Clinton Foundation has every appearance of being massively corrupt, think of the example this sets. When rules are only for the little people, trust in government goes down the toilet almost as fast as government "stimulus" spending. Even Hillary

acknowledged this when she said "There’s no daylight on the basic premise that there should be no bank too big to fail, and no individual too powerful to jail."

And then you have the problem that there is way too much ignorance of the fundamental laws of economics these days, especially among the political class. How else to explain Trump's vow to impose huge tariffs on Chinese imports? Or California's decision to raise the minimum wage to $15/hour? Or the

$370 billion of M&A deals aborted on Obama's watch? These policies are virtually guaranteed to lead to perverse outcomes. It takes magical thinking to believe that a $15 minimum wage will do anything but shrink job opportunities for youth. At its worst, this exercise in hubris will lower living standards for all Californians, by sending jobs elsewhere and increasing poverty among the young. Raising the prices of Chinese imports will certainly be a negative for all consumers, but won't provide any guarantee of creating new domestic jobs.

And then you have the failure of our educational system, which has allowed a generation to grow up thinking that socialism is the wave of the future. How else to explain the huge popularity of Bernie Sanders?

I won't dwell on the Dept. of Labor's

new rules which will place more onerous requirements on private sector financial advisors and push more people into government-run savings plans. (Who in their right mind would trust the government to invest your money?) Or the ongoing failure of Obamacare, which has only

pushed up healthcare costs for everyone while restricting choice, all but ensuring that we will have a growing shortage of doctors in the future. Is it any wonder that the only two institutions that affect most everyone in the country and which provoke the most concern and frustrations—education and healthcare—are almost entirely under the control of government? If a private sector business delivered the miserable results that we find in education and healthcare it would have gone out of business a long time ago.

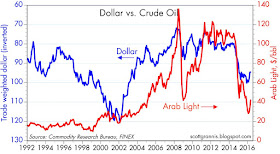

Then of course you have the problems of the slowdown in the Chinese economy and the collapse of oil prices, but these are problems which can presumably be solved if market forces are allowed to operate, as I've argued in numerous posts of late.

Now, of course none of this is a secret. The market is fully aware of all these problems, and anyone paying attention to quality news outlets and scouring the internet should not be surprised to hear it. There's lots of bad news out there, and that's why I think the market is still dominated by pessimism. The chart above makes my point: 5-yr real yields on TIPS are trading at levels which suggest that the market expects real GDP growth in the U.S. to be somewhere in the neighborhood of 1-2% per year for the foreseeable future. The market has been underestimating growth for years, and it continues to see weak growth ahead.

But it's not enough to be worried about the future, or to be optimistic. You have to match your knowledge and expectations against the expectations that are built into market prices. If you think the market is too pessimistic, as I do, then you should be optimistic, even though you don't expect real GDP growth to be more than 3% a year for the foreseeable future, and you fully expect the economy to be stuck in a slow-growth rut until policies change for the better.

I'm still optimistic, mainly because there are so many problems out there and because expectations are so dismal. But here's the kicker: if we could just fix a few things that are so easily fixable (e.g., the tax code, burdensome regulations), the potential for an upside growth surprise could be gigantic. How hard can it be to do the right thing?