Once again, the world is in a tizzy as falling oil prices threaten the profits of the energy sector, which in turn sparks fears that this could spread to the rest of the economy. Once again, I think these fears are overblown. Putting things in perspective, oil prices in real terms are only slightly below their long-term average. The energy sector has taken a real hit, but the evidence of contagion is still hard to come by. Swap spreads remain low, and that suggests that markets are liquid and systemic risk is low, so even though the pain and suffering is acute in the energy sector, the rest of the economy looks fine.

Credit spreads in the high-yield energy sector are quite high, suggesting a meaningful risk of widespread defaults. The average bond in this sector has suffered a 25% drop in price, erasing a total of about $40 billion of the sector's value. That's not chump change, but neither is it an existential challenge to a market (high-yield corporate bonds) with a total market value of $1.3 trillion. Meanwhile, the market value of investment grade corporate bonds is about $5.4 trillion. So the losses in the HY energy sector represent about 0.6% of the value of all traded corporate bonds in the U.S.

The decline in oil prices in the past year has been deep and precipitous, but when viewed from an historical context, all that has happened is that oil has gone from being very expensive to about average.

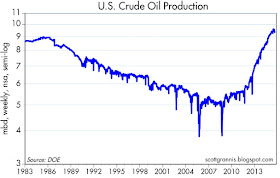

The chart above suggests that the main reason for the decline in oil prices is a giant increase in U.S. crude oil production. When greater supplies result in lower prices, that is a very good thing for consumers.

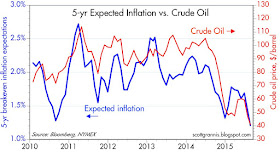

As the chart above suggests, monetary policy is not the main culprit behind lower oil prices. We're not talking about a generalized deflation which is the by product of overly-tight monetary policy. The dollar is trading at very close to its long-term average, and so is crude. The dollar has been relatively stable for most of this year, even as oil prices have gyrated. The Fed is not about to "tighten" monetary policy anytime soon (one or two hikes in short-term rates doesn't equate to a tightening—it's just the Fed making policy less accommodative), so there likely is no fundamental shortage of dollars in the world, and no reason therefore to think that all prices are at risk of declining.

Corporate credit spreads in general are elevated, but still far less than they were during periods of recession.

The difference between junk and investment grade spreads is also elevated, but still relatively low compared to periods of great financial and economic stress.

The chart above is key: while credit spreads have risen meaningfully, swap spreads have remained in "normal" territory. Real problems happen when swap spreads rise by a lot, at the same time other credit spreads rise. That's not the case today. Swap spreads are not confirming the supposed contagion risk of defaults in the energy sector. They are saying that the contagion risk of lower energy prices is well contained.

In the chart above we see that 5-yr swap spreads are also quite tranquil, even though spreads in the high quality industrial sector have jumped.

So the current bout of fear and trembling is likely to pass. The market is once again climbing a "wall of worry," worrying about something that has a low likelihood of become a serious problem. This is most likely a correction, not the beginning of another recession.

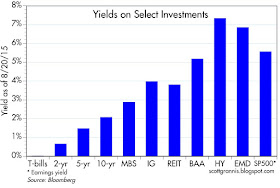

Those who worry about the value of risky assets must forgo a considerable amount of income in exchange for the safety of cash, as the chart above shows. This is symptomatic of a market that is still quite fearful in general. In effect, the market has priced in a substantial amount of bad news already.

The main impact of lower oil prices has been on inflation expectations, as shown in the chart above. This is how it should be.

For all the fear and trembling out there, gold prices have only managed a minuscule bounce, and real yields on TIPs have been in a rising trend for several years. This chart is not signaling any major problems.

Most importantly, rising real yields and very low swap spreads suggest that the economic fundamentals are improving, not deteriorating.

UPDATE: Here's what the "Wall of Worry" chart looks like as of 10 am PST Aug 21:

We've climbed walls of worry like this one before. I suspect we'll do it again.

Great post... except the Fed is not being "accomodative."

ReplyDeleteIf you believe the Fed is accommodative today, then you also believe the Bank of Japan was accommodative from 1992 to 2012. Interest rates in Japan were basically at zero that entire time yet the yen appreciated radically.

In a modern economy, to avoid passive tightening, a central bank may have to persist in QE.

ben, I always enjoy your responses but I wonder if you don't sit by your computer waiting for scott to post!

ReplyDeleteScott writes a great blog. I look for it every morning with coffee. Now, if I can just get Scott into the Market Monetarist camp where he belongs....

DeleteI think that directionally it would be a mistake to raise the Fed Funds rate. I understand the desire to get closer to historical normalcy with respect to rates. But then why aren't we discussing why it is we're still paying interest on excess reserves? It is nothing more than an especially toxic subsidy to the largest banks. And it has the additional negative effect of reducing the money supply at the margin at a time when we clearly do not need that. In what has become a rhetorical knife fight in the media about whether the Fed should raise rates or not, it is unbelievable to me that the issue of IOER hasn't entered into the conversation.

ReplyDeletei've been randomly reading your "economics" blog for over 6 years since the crash. i have never once seen you ever say there is a real concern. its always rosy rosy rosy. don't you ever get sick of yourself? there are real and important risks that most likely will ripen into a major crisis. stop misleading people.

ReplyDeleteMatthew - YES! How many people even know what IOER is? How many understand why we aren't seeing high inflation? How many understand the direct ongoing subsidy to banks? How many understand the MOST important tool the Fed will utilize during the next downtown? It seems very few people even know IOER exists, much less the implications of raising/lowering the rate itself.

ReplyDeleteMarcus - The optimists have reaped the benefit over the past 6 years. The Fed still has relatively easy monetary policies in place. Valuation with interest rates and inflation in mind are relatively low. Investor psychology looks good. There are risks, but those that have been shouting about risks and gold for the past 6 years have lost over that time frame. Eventually those shouting about risk will be correct, but how long do they have to wait? Timing is everything in managing the probabilities of tail risk. I do agree that tail risk probabilities are increasing as we progress through this growth cycle, but that is true this far along into any growth cycle. Your portfolio should reflect increased tail risk at this juncture, but also realize that the fundamentals favor growth over the short/medium term.

Benjamin - QE isn't the end all be all. The ammo is ready in the form of excess reserves. The Fed just has to put that ammo to use by lowering IOER. We aren't ready to use that built up ammo supply yet. The time is approaching, but not yet. More QE just adds more ammo, which seems unnecessary at this point.

Scott - Good article on the Canadian Oil Sands a couple days ago. Please see http://www.wsj.com/articles/oil-sands-producers-struggle-1440017716

Rig count and shale output are declining. This is expected with decreased oil price. The concern I see over oil isn't necessarily domestic, it is in the international markets. Check out the "fragile 5" Algeria, Iraq, Libya, Nigeria, and Venezuela. Could also see a lot of negative pressure out of Brazil and Russia. May begin to see increased instability in parts of the Middle East. Increased dollar strength will only exacerbate the problem.

Thinking hard---it would be interesting to cut IOER by a basis point per month...but I doubt it would boost lending much...

ReplyDeleteSome people postulate that low interest rates cause otherwise rational people to engage in poor business practices---in short, low interest rates will collapse the fragile free enterprise system.

But maybe eliminating IOER will help...

If ever anyone feels the need for negative/bearish commentary, do visit www.zerohedge.com

ReplyDeleteIt's all bearish, all the time.

its not about bearish or bullish. its about fair and balanced. just stop the cheerleading and report the analysis.

ReplyDeleteI have been reading your blog for about five years, and I think you are great. But I'm parting ways on this one.

ReplyDeleteThe bursting of the commodity and EM bubbles will have a major effect on the world economy...

- It reduces purchasing power and thus purchases for about three billion people.

- It destroys the value of trillions in credit. Most of this is outside the US. Unlike 2008, the Fed cannot step in and bail this credit out. Nigeria, S. Africa, Glencore, the Shale Patch, etc. will have to reliquefy the old fashioned way, by default.

- It reduces the amount of petrodollars and sovereign wealth funds. You can say that this is actually a redistribution from them to us. Nonetheless, these guys were a big buyer of risk assets. They are now sellers.

Lower commodity and energy prices hurt producers but benefit everyone else. The global economy will be stronger, because there are many, many more consumers of commodities and energy than there are producers. How can cheaper prices for essential stuff be bad?

ReplyDeleteThe very long-term trend for commodity prices is down in real terms. This has been a boon to the global economy.

Credit default losses suffered by energy bonds in the U.S. are less than $50 billion.

Okay forget my opinion---but what does the Fed do when the Dow does the Shanghai Slide?

ReplyDeleteRaise rates? Why?

To marcusbalbus...

ReplyDeleteWould love to hear from marcusbalbus which facts Scott Granis has wrong. This blog is logical, fact-based analysis, and it's damn good, because it's been right. For years, it's been right. I think it's one of the most USEFUL perspectives I've come across. Scott seems to emphasize what's most important in a timely manner, and doesn't dwell on the rest. I like to hear about the things Scott notices. It's always interesting, and he writes in such a clear, conversational manner. He explains complex concepts as clearly and simply as I've ever seen. Plain English. Nobody explained QE better, for instance, and he got it exactly right.

I've never seen Scott "cheerleading" on here. Cheerleading for whom? What do you mean, exactly? Back up what you say, Marcus. Which part is not "fair"? Which part of Scott's analysis is flawed? The part where he keeps repeating that this is the worst recovery in modern U.S. History? Or the part where he points out the current trillion dollar shortfall in economic output caused by bad tax and regulation policy? We know all that. Now what do we DO with those facts? If an investor actually listened to Zero Hedge, he'd be in the poor house. Scott has given me perspective that has preserved and built wealth. That's a just fact. Proof is in the pudding. This may not be intended as an "investment" site, but it damn sure is. Scott is great at pointing out what should cause concern, and what shouldn't.

Thank God Larry Kudlow steered me to this site years ago on his show. (I sure do miss that show.)

I have nothing but respect and gratitude for Scott and the things he shares here. It's one of my favorite things to read every week. Scott Grannis has helped me immensely and is an essential read.

Thank you, Johnny.

ReplyDeleteJBD: ride your positions on scott's "advise" and economic "analysis" and you will surely be impoverished soon enough.

ReplyDeletelook at his absolutely inane statements about commodities above. gee scott, why not have all prices fall, why just commodities? won't that help everyone. get a real job scott. stop posting drivel.

Regards commodities if prices are plunging- isnt the concern that it indicates either weak demand or fallout (of some kind) from years of ZIRP? ZIRP is 'uncharted waters' as are this commod plunge. Hard to be sanguine. However as Scott points out, gold move has been rather minor. Watch gold going forward seems to make sense here?

ReplyDeleteScott,

ReplyDeleteGiven the accelerated decline in the market since you wrote this piece would you update it fairly soon at least the part on credit default spreads/ systemic risk? Thanks

marcusbalbus, quite a vitriol there buddy. while scott certainly sees things with a glass half full, you can always balance that against your more lugubrious blogs-and there are plenty of them. btw, I know very few successful pessimists.

ReplyDeleteRe the "plunge" in commodities prices

ReplyDeleteCommodities (ex-energy) hit very low levels in late 2001. They then almost tripled to reach a new all-time high in 2011. That's right: commodities prices essentially tripled in 10 years. Since 2011 they have declined, but today they are still double what they were in 2001.

Kenneth: I will do my best to update

ReplyDeletesteve: no vitrol. just think the blogger here is way off. price declines are only good when its from innovation/productivity or supply shock. the blogger here repeats drivel about "savings" from price declines rooted in financial dislocation. because he's blinded by the addiction to cheerleading

ReplyDeletemarcusbalbus,

ReplyDeleteSorry but are incorrect in your comment about vitriol. You are certainly entitled to your opinion and to state your disagreement with Scott's assessment, but you cross the line when you call his comments drivel and tell him to stop posting. Cripes man, it's his blog.

MR. Grannis, I ditto Johnny BeeDawgs comments. Keep up the good work and thank you for your time and effort.

This comment has been removed by the author.

ReplyDeletemarcusbalbus: I'm not a cheerleader for anything, because I don't work for anyone, I don't charge people to read my blog, I don't have advertising and I'm not a card-carrying member of any political party (actually I'm a Libertarian). My only interest in doing this is to share my knowledge and experience with others, because I have learned much from others and because I think the internet is a wonderful and unique medium for spreading knowledge and opinions. I don't stand to gain or lose anything if my readership declines or increases, or if my view on the market proves correct or wrong.

ReplyDeleteYou are free to disagree with my interpretation of events and my understanding of economics and finance. However, it would be nice if you were more civil; facts and logic are preferable to ad hominem attacks.

There are so many commentators out there but how many of them don't have an agenda whether it be marketing themselves land their firm or promoting their own investments just to name a few. And if they are economists they often aren't even true to their profession because their views are distorted by politics. Is there another profession so biased? And how many of them do their work simply because. They love it and without charging a fee? The only person I know of is Scott Grannis and in my forty plus years as an investor I can't think of anyone else I can say the same thing about. And by the way Scott has an outstanding track record. So Mr Marcusbalbus don't attack Scott as you did. You don't know what you are talking about. Just go away.

ReplyDeletekenneth: what is the frequency? if you have been investing for 40+ years and find this blog impressive, you must be a species of madoff. perhaps you should go away.

ReplyDeletebobbob: one post is sufficient, but from you we would prefer 0.

mr grannis: this is not ad hominen. in fact it is the opposite. i attack your positions and postings, not you as a person in any way. perhaps there is a line where that blends, but it is not in my comments. please look up the word. and furthermore, your protestations that you are just the noble philosopher pundit is drivel too: you post to enhance your reputation and to wallow in the praise of the ill informed and uncritical.

Scott: I would just like you to know that I very much enjoy reading your blog. Your postings have been nothing short of inspiring. You have greatly helped me form a backdrop for the analyses I do, of the markets and of the global economy. The fact that you don't have an agenda, nor do you receive payment for the service you provide just makes what you do all the more compelling.

ReplyDeleteI would like to think I'm an informed critical thinker but, unlike marcus, I know there is much I don't know. It is for this reason I keep coming back to your blog! I also enjoy the majority of the commentary. Please don't let the asinine words of marcus affect you and the terrific work that you do.

All the best,

MG

Scott,

ReplyDeleteThank you You and Benjamin for doing an excellent job in enlightening us on the economics of life..

Please continue to share your opinions... I will continue be reading...and passing on to others..

God Bless you and your families...

Marcusbalbus:

ReplyDeleteDid you ever take the time to look up the meaning of "ad hominem attack"? Might be an eye opener for you.

There was nothing factual in your post, whatsoever. There were only personal attacks on the host of this blog. Its quite remarkable to see your disconnect.

When you get a chance in your busy schedule, you may be interested to look at a chart of gas and oil production for the past few years. You used "supply shock" in a sentence. If you have even more time, you could 'cipher a lil bit on what your term "supply shock" might actually mean, as you stated it. Another disconnect.

Words matter. Don't ever change. Luv ya!!

Definition of troll: make a deliberately offensive or provocative online posting with the aim of upsetting someone or eliciting an angry response from them.

ReplyDeleteBest defense to trolls in the online world is to ignore them.

A troll posts here.

JBD: here's ad hominen for you: you're a vile and irregular-looking mole rat of dubious lineage and education.

ReplyDeleteTH: definition of fraud: a specimen such as you to aver you have every thought hard, or indeed have the capacity. how's that for ad hominem.

the author of this blog knows i am right; he just cant' find the strength to break free of his ego indulgence.

Marcusballbust: But my mama loves me, anyway!!

ReplyDeleteYou get a chance to check that energy production chart? Or crack open that dictionary?

No??

The FRB now admits it has no idea whether the QEs worked or not !!

ReplyDeleteIt is making their supporters look stupid.

http://news.investors.com/blogs-capital-hill/082015-767516-federal-reserve-official-says-no-proof-45-trillion-qe-program-did-anything.htm

Johnny how sure are you?

ReplyDelete"Nobody explained QE better, for instance, and he got it exactly right."

In my five years of following Scott Grannis' excellent BLOG, 33 heart felt comments must be a record. In those five years I have learned a lot from Scott. I haven't found any BLOG with better data analysis, charts, insight and commentary than Scott's.

ReplyDeleteAlthough I have a different interest (portfolio investment) and sometimes a different investment conclusion, I have found Calafia Beach Pundit an invaluable resource.

Thank you Scott and Best Wishes,,,William

Oooof.

ReplyDeleteLooks ugly out there today.

Copper down 33% last 12 months, back to 2006 levels.

Oil may crack $40...on the downside that is. I can remember oil selling for $40 a barrel in 1979.

Shanghai off 8% today. Nikkei off 3%.

Good luck everybody.

Note to Hans: There are some Fed officials dubious about QE. That does not mean all Fed officials or staffers.

I will concede an exasperating aspect of macroeconomics is that any idea anyone has is both supported and contradicted by "experts."

So the expert I believe is Milton Friedman, a full-throated advocate of QE.

I bet my expert can beat up your expert....

BC, you know not of what you speak re MF and QE.

ReplyDeleteCan't find and haven't seen a better economic blog than this one. Not one pundit who's better at analysing and putting things in perspective.

ReplyDeleteFor that thank-you Scott Grannis, I will keep reading you for as long as you write.

JPD

I second that. This blog is a gem among hidden valuable gems.

ReplyDeleteI've been reading for a long, long time, and will continue to read and study it for as long as possible.

The problem the equity markets have is: where is the growth going to come from. Previous to a few weeks ago they clung to the story that it would come from EM. That seems less likely now. Since a large part of the return on stocks come from increasing earnings over time, and earnings will grow more slowly, this is a true negative.

ReplyDeleteI'm not saying that there will be a zerohedge-type crash. But returns over the next years will be much less. In the meantime, we have a lot of spec positions to work off, especially in bio and TMT. So I'm not going back in for awhile.

This is the first post I've commented on in years. Are there always these jerks trolling around?

Love this blog, as always.

Mr. Grannis,

ReplyDeleteYou are the only economics blogger I know that does a wonderful analysis of federal government finances with thoughtful charts and graphs. I believe the health of our nation is measured by how much debt we are accumulating year over year at the federal level. In the long term the market will always go up either by inflation or by organic growth. The rest is just noise and bad policy

If you could can you add a chart that shows how fast private sector GDP has expanded per quarter. I believe the rolling average right now is 3.1% without the drag of government.

I also agree with Benjamin that QE is beneficial if done right. The Fed is allowing the treasury breathing room to refinance the debt into longer term treasuries at lower interest rates, while at the same time refunding whatever it receives to the treasury on it's treasury holdings. That takes a tremendous burden off our nation, but if done long term it could resort to outright monetization of the entire debt.

Thanks for the commentary and please keep blogging,

William

https://research.stlouisfed.org/fred2/graph/?g=1GhQ my preferred measure if anyone is interested.

ReplyDeleteBen Jamin, my expert has only one arm!

ReplyDeleteIt is still damming that a "high" ranking member of the FRB considers

not only the acts of QEing as a failure but also it's theory.

Have you seen how horrible the FRB's projection of GNP are? Yet they

continue to have supporters.

It is empirical, that a governmental agency can not manage a 18 trillion

dollar economy.

Good luck Hans.

ReplyDeleteIn Oct. 1987 the market sank 20+% in one day, so we have seen worse than this.

Thanks, Ben Jamin, I am planing to short the market today.

ReplyDeleteGood observation, as a lot of talking heads missed that most

dreadful event.

BTW, I was surprised at your response to one of the FedHeads

stating the QEs were a failure..After all, how many times

have you pointed out the fact (and rightful so) Nippon's multi

decade of failed QEs.

Hans...you think the Fed is a government agency?

ReplyDeleteDawg, it is a non-profit, just like the SIPC..

ReplyDeleteHowever, they have some form of governance from either the Prez or CONgress.

The more the mandates, the less their independence..In the beltway, the policy

has always been - come along to get along, for the past three generations.

Johnny, without a question, the FRB has been politicized...What form or

shape that takes is immaterial..

Seven years of Fedzero, would lend credibility to the argument...The

FRB past 15 years has done little to stimulate growth or employment..

In fact, they have been more of an obstacle than promoting progress.

They have aided and abetted the marginal growth of America.

This comment has been removed by the author.

ReplyDelete