The recovery from the Great Recession of 2008-09 has been the weakest ever, and that has a lot to do with the fact that this has also been the most risk-averse recovery ever. Households have deleveraged like never before; the world has stocked up on cash and cash equivalents like never before; banks have accumulated trillions of dollars of excess reserves; and business investment has been exceptionally weak despite record-setting profits. Contrary to popular perception, these facts suggest that the real function and purpose of the Fed's Quantitative Easing program was to satisfy the world's voracious appetite for risk-free, safe assets, which in turn was a by-product of the scariest recession ever. The reason QE has not boosted the economy is because QE has only served to treat the symptoms of risk aversion that have held the economy back. With QE now winding down, and risk aversion beginning to decline, the economy is facing reduced headwinds and growth could therefore begin to pick up.

Why so much risk aversion? There are undoubtedly lots of reasons, but the obvious ones are 1) the profound shock that accompanied the Great Recession, as the global economy and financial markets teetered on the brink of disaster; 2) the great uncertainty that has accompanied the Fed's unprecedented foray into Quantitative Easing (you can see that uncertainty reflected in the surge in the price of gold to $1900/oz.); 3) the increased regulatory burdens imposed by Dodd-Frank and Obamacare; and 4) the trillion-dollar deficits that arose from a massive increase in government spending in 2008 and 2009.

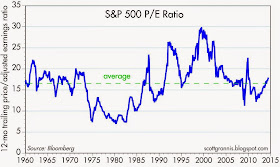

Many of these problems are still with us, but they are fading. The federal deficit has plunged by fully two-thirds, to only $490 billion in the 12 months ending last May. The Fed is tapering QE and should finish within a matter of months. Obamacare is slowly but surely imploding, and market-based reforms are the only viable and sensible solution. Global equity market capitalization has reached new highs, and this surely reflects at least a decline in pessimism if not the return of some optimism. Swap spreads in most major markets are at very low levels, suggesting an almost complete absence of systemic risk. PE ratios are now at above-average levels. As risk aversion declines, risk taking increases, and that is an essential ingredient for healthier economic growth.

The chart above shows the leverage of the household sector, which I've calculated using the Fed's Flow of Funds data through Q1/14. Total liabilities as a % of assets have fallen by almost 30% in the past five years years, taking household leverage back to levels last seen in the early 1990s. In the past 70 years there has never been such a dramatic deleveraging of household balance sheets. This has come about as a result of an unprecedented five-year decline in total liabilities (from a high of $14.6 trillion to $13.8 trillion), and a five-year rise in total assets (financial assets rose by $21.4 trillion and real estate values increased by $4.1 trillion).

The chart above shows another way of looking at households' leverage. It compares monthly debt service and financial obligation payments to disposable income. By this measure, households currently have the lowest financial burdens in the past 30 years. We've never before seen such a significant decline in financial burdens. Households have seriously hunkered down, which is not surprising given the unprecedented financial and economic turmoil unleashed in the Great Recession. Once burned, twice shy, as they say. Of note, however, is the fact that financial burdens are relatively unchanged over the past year, which in turn suggests that households' deleveraging is nearly complete. Risk aversion, by this measure, may have run its course.

The pronounced deleveraging of the household sector has predictably resulted in a huge improvement in households' financial health. The first chart above shows the average delinquency rate on credit cards and all consumer loans as of Q1/14. Both of these measures of the health of household finances have fallen dramatically since the Great Recession, to the lowest level in decades. As the second chart shows, credit card debt outstanding has plunged by almost 25% since late 2008. Banks' profit margins are up, thanks to more responsible risk-taking on the part of both banks and households.

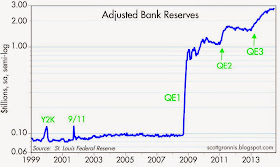

Since late 2008, the Fed has pumped up the supply of bank reserves by over $2.6 trillion through its purchases of Treasuries and MBS. About 94% of those additional reserves currently are held by banks in the form of "excess reserves." As I explained over a year ago, banks have essentially used strong inflows of savings deposits to purchase bonds, then sold those bonds to the Fed in exchange for reserves which they were content to hold. Banks have in a sense been "investing" their deposit inflows in bank reserves, which are functionally equivalent to T-bills. The public's demand for the safety of savings deposits (which carry a government guarantee but yield almost nothing) has been very strong, and banks' demand for reserves (which have an implicit government guarantee and pay almost nothing) has also been very strong, and both reflect lots of risk aversion. The Fed's massive purchases of bonds have only served to satisfy the world's massively increased demand for safe, risk-free assets. The world's demand for money has been extraordinarily strong, and that explains why bank lending has been relatively weak. (Strong demand for money is the opposite of strong demand for credit; significant increases in bank lending reflect a declining demand for money.)

As the chart above shows, bank credit has expanded at a very slow rate since late 2008, even as banks' ability to make new loans has become virtually unlimited as a consequence of the Fed's prolific supply of bank reserves. This can only mean that a) banks have tightened their lending standards, and/or b) businesses and households have been reluctant to take on more debt, preferring instead to deleverage. No matter how you look at it, this is powerful evidence of risk aversion across the entire economy. I would note, however, that bank credit has been accelerating of late: total bank credit grew only 1.2% last year, but grew at an 8% annualized rate in the first six months of this year. This is a good sign that risk aversion is beginning to decline, to be replaced by more risk taking. On the margin, banks are more willing to lend, and households and businesses are more willing to borrow, and this points to less risk aversion, more confidence, and more investment in the future.

As the chart above shows, savings deposits at U.S. banks have soared by over $3 trillion since late 2008. Banks have been the recipients of a virtual flood of new savings deposits from consumers and businesses, even though the interest rate on those deposits has been the lowest in modern banking history. Meanwhile, banks have been content to hand over almost all of their deposit inflows to the Fed in exchange for risk-free bank reserves that pay only 0.25%.

Most of the increase in the M2 measure of the money supply since the onset of the 2008 financial panic has come from a $3.4 trillion increase in bank savings deposits. There's also been a substantial increase in currency in circulation, which has been driven in large part by strong overseas demand for U.S. currency. Both of those are symptomatic of very strong money demand: the world has been pouring money into bank savings deposits despite extremely low interest rates, and the world has been craving U.S. dollar cash, even though it pays no interest at all and has been losing about 2% of its purchasing power every year.

Think of M2 has a handy measure of the economy's cash on hand—readily available, spendable cash. Think of nominal GDP as a proxy for the economy's annual income. The ratio of the two, shown in the chart above, is similar to the percentage of the average person's income that he or she wants to hold in cash or cash equivalents (checking accounts and savings deposits). The demand for cash relative to incomes has never been higher than it is today, and it has risen by about 30% since the onset of the 2008 financial crisis. The world has been stockpiling liquidity instead of spending it. The Fed's expansion of the money supply has only accommodated an increased demand for that money; that's why it hasn't been inflationary. But this should soon start to reverse, if the other indicators mentioned above are any guide.

The two charts above illustrate just how risk-averse the corporate sector has been in this recovery. The first chart shows that after-tax corporate profits have tripled since the end of 2000, and have increased by much more than nominal GDP. Yet as the second chart shows, capital goods orders—a good proxy for business investment—are only moderately higher today than they were prior to the 2001 recession, and are still significantly lower in real terms. We see the same story with private sector jobs, which today are only about 1% above their pre-recession high. Businesses have been extremely reluctant to reinvest their soaring profits.

For their part, investors only recently have been willing to pay above-average multiples to own equities, despite record levels of profitability, record-low interest rates, and an expanding economy, as the above chart shows. Everyone has been very risk averse, but risk aversion is declining, and the outlook is therefore likely to improve in the months and years to come.

Scott - any knowledge of the rehypothecation issue going on in China and the global risk associated with it?

ReplyDeleteIs it a real story or scare mongering by the likes of the Zerohedge crowds?

"...the world has been craving U.S. dollar cash, even though it pays no interest at all..."

ReplyDeleteI find it odd that with this foreign demand and also foreign investment in US equities the US dollar hasn't appreciated more. Obviously there is also massive selling of the US dollar by some entities - perhaps US investment overseas.

In your third from last chart, "Corporate Profits as a Percent of GDP" (red line) has just begun to plunge. What explanation can you proffer, Scott?

ReplyDeleteRe the drop in corporate profits: I'm not completely sure how this works, but it looks to have a lot to do with 1) the decline in inventory investment in the first quarter, and 2) the expiration of bonus depreciation. If that is indeed the case, then it should be a one-time event, and not necessarily the beginning of a major decline in profits.

ReplyDeleteSee one explanation here:

http://www.bea.gov/faq/index.cfm?faq_id=1002

Interesting article in the NYT entitled: "Welcome to the Everything Boom, or Maybe the Everything Bubble

ReplyDeleteIt discussed the high prices being paid for various assets; point being that nothing anywhere in the world truly cheap. Blackrock's chief investment strategist is quoted: “If you ask me to give you the one big bargain out there, I’m not sure there is one.”

Near the end, there is a discussion of the concept of a global savings glut which was discussed a decade ago. Then Bernanke is:

“I may have made a mistake in trying to assign a name,” Mr. Bernanke, now at the Brookings Institution, said in an interview. “A glut means more than is wanted. But it doesn’t necessarily arise because people want to save more. It can be because they invest less."

Then the author raises this possibility: "What if the problem is not too much savings, but a shortage of good investment opportunities to deploy that savings? For example, businesses may feel that capital expenditures are unwise because they won’t pay off."

Scott do you have any thoughts about this? Maybe today its not risk aversion like a few year ago but "a shortage of good investment opportunities" at reasonable prices.

I've argued before (can't remember where though), that it makes no sense to say we have a global savings glut. The problem is risk aversion. There is a shortage of investment opportunities clear the risk/reward hurdle for the majority of people. It's hard to set up a business; taxes are very high, regulatory burdens are extreme, uncertainties abound. People are willing to pay an extremely high price (e.g., accepting zero interest rates on savings) in exchange for security.

ReplyDeleteThank you Scott.

ReplyDelete"Welcome to the Everything Boom, or Maybe the Everything Bubble"

ReplyDeletethanks to a fed which has literally forced investors into risk assets and an admin that has a low growth growth agenda, owners of those assets have reaped huge gains and are bidding up EVERYTHING. ironically, in the meantime, the bottom 90% are struggling. I'm pretty sure that in the history of this country, never has an admin pursued policy that has been so antithetical to wealth and happiness of those they are ostensibly trying to help and so beneficial of those they are trying to penalize.

Well, I think there is a global capital glut, for non-markrt reasons. Bain & Co. says so too. You havd fotced saving in China and hugr Mideat soveriegn wealth funds. Public pension programs mandated to grow etc.

ReplyDeleteObams has been mediocre, but we have global markets now.

If you look at inflation for the last 30 years, you see huge secular decline. Central banks beat inflation. You do not get that result with loose money.

The problem is, central banks cannot change. Once they beat inflation they start rhapsodizing about deflation.

Demand is the problem today. The central banks need to become growth oriented--and the federal government too.

"The central banks need to become growth oriented--and the federal government too."

ReplyDeletedon't hold your breath

Steve--

ReplyDeleteCall me Blueface.

ReplyDeleteThe recovery from the Great Recession of 2008-09 has been the weakest ever, the reason being that the nature of money changed with the provision of the Greenspan Put, which became the Ben Bernanke QE1.

From 2008 onward, the Fed’s policy no longer came from the Humphrey Hawkins dual mandate of employment and growth, and thus have not provided economic recovery. The Global ZIRP monetary policies of the world central banks were designed to change the primary function of money to serve as the basis of fiat wealth investment; and thus birthed the investor, and investment gain, as the centerpiece of economic activity, with the result being the creation of awesome fiat wealth inflation, rather than much of any employment gains.

The US Federal Reserve's money printing operations can be seen in the tremendous swell in M2 Money, defined as cash on hand, readily available and spendable cash.

The Fed's massive purchases of bonds of all types has served to underwrite the US Dollar Hegemonic Empire, and cause a fantastic Global Credit Bubble, which finally burst on July 1, 2014, as the Bond Vigilantes began calling the Interest Rate on the US Ten Year Note, ^TNX, higher from 2.49%.

Now, the June 5, 2014 Mario Draghi ECB Mandate for NIRP and Targeted LTRO, together with the June 21, 2014, Mario Draghi ECB Press Announcement Calling For Shared Sovereignty, address secular stagnation, defined as low growth, low employment, and low inflation; and introduce the new empire, that being the Ten Toed Kingdom, with a miry mixture of iron and clay, forming toes of diktat in regional governance and clay in totalitarian collectivism.

These mandates serve as the EU Economic Manifest, that is the Charter and Club, for Eurozone regional governance, and have birthed the debt serf and debt servitude, as the centerpiece of economic activity, and will become ever more apparent and defined, as the call for shared regional sovereignty becomes ever more trumpeted, as economic deflation worsens when investors increasingly derisk out of debt trade investments and deleverage out of currency carry trade investments.

The Business Cycle is one of investing, and its nascent entrance into its final phase, that is Kondratieff Winter, is seen in trade lower in European Financials, EUFN, on June 24, 2014, which is the result of a trade lower in the Euro, FXE, beginning in early May 2014, and its full entrance with the failure of credit, seen in Aggregate Credit, AGG, trading lower in value on July 1, 2014. Formerly, investment was the way of life; now disinvestment is the way of life.

Scott- Can you explain the relationship between corporate profits and GDP both nominal and real?

ReplyDeleteWhat are the reasons for corporate profits growing faster than GDP (nominal or real)?

I assume one is by reducing costs faster than GDP growth?

Thanks

Re: corporate profits and GDP. Think of the ratio of profits to GDP as a proxy for the average corporate profit margin. Nominal GDP is a proxy for total sales. Corporations can increase their profit margins by cutting costs, producing things more efficiently, and innovating. This is what usually happens during the early stages of recoveries. This becomes harder to do in the later stages of recoveries because competition is more intense and real interest rates (which increase the cost of debt relative to sales) are usually very high.

ReplyDelete