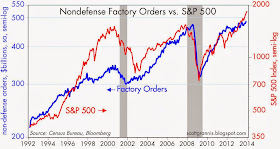

The above chart has a lot in common with the chart featured in last week's post "The economy keeps on trucking." Both show that the progress of equity prices is related to growth of the physical economy. Last week's chart showed how equity prices are ultimately grounded in a measure of total truck tonnage; this week's chart shows how equity prices track factory orders. Both charts suggested that equity prices "overshot" the progress of the physical economy around 2000, and both suggest that equity prices are now reasonable (or "fair") given the progress of the physical economy.

Nondefense factory orders are now at a new all-time high, having risen 5.1% in the year ending November 2013. Total factory orders are up almost 5% over the same period, and the gain in November was about as expected (+1.8% vs. +1.7%).

This is still the weakest recovery ever, but it is nevertheless a recovery, and more and more measures (e.g., truck tonnage, rail traffic, factory orders) of the size and strength of the economy continue to improve. So it is not surprising at all that equity prices should also be breaking new high ground.

Coming tomorrow: "The Economy Keeps on Trading."

ReplyDeleteSince QE3, the economy has been growing moderately, no inflation, good equity and property markets. Maybe the Fed should taper up...

ReplyDeleteEconomist Ed Yardini Blog:

ReplyDelete"The WSJ ran an article at the end of last year (12/25) titled, “Companies Binge on Share Buybacks.” For the past couple of years, this has been a story I've often told to explain what’s driving the bull market. Recently released data show that S&P 500 companies repurchased $128 billion of their shares during Q3. They paid out $79 billion in dividends during that quarter and a record $85 billion during Q4. The $207 billion sum of buybacks and dividends for Q3 is just shy of the $233 billion record high during Q3-2007.

Since the start of the bull market during Q1-2009 through Q3-2013, share buybacks totaled $1.6 trillion and dividends totaled $1.2 trillion, summing to a whopping $2.8 trillion! Corporate cash flow rose to a new record high of $2.3 trillion (saar) during Q3. Yet non-financial corporate net bond issuance totaled a record $665 billion over the past four quarters through Q3, with issuers using some of the proceeds to buy back their shares.

Buybacks are likely to remain strong in 2014. Now imagine the melt-up potential of the stock market if the Great Rotation by retail investors from bonds into stocks continues to build momentum. And by the way, January has a history of being a good month for inflows into equity mutual funds.

http://blog.yardeni.com/2014/01/buybacks-great-rotation-and-melt-up.html

!!! CHECK OUT THIS CHART !!!

ReplyDeleteI'm not sure to what extent, but we should consider that most "consumer durables" (e.g., mobile phones, tablets, laptops, washing machines, refrigerators, etc.) are manufactured overseas and imported into the US -- I am interested in comparing the orders for consumer durables with import figures -- nevertheless, increased orders for consumer durables is good news -- I am just concerned that these orders are not domestically manufactured -- I'll have a look...

ReplyDeletePS: On a separate note, watch for malls across the US to collapse by 2015 -- Sears and JCP are on the ropes and clearly being harvested in preparation for sunsets -- the mall in my town is essentially vacant except for Korean food joints and third-party reverse logistics liquidators -- may malls in the US are already rubbling their interior stores in an effort to convert their flagship stores into stand-alone facilities with greater parking -- but again, Sears and JCP are not going to make it through 2014 in their current form -- Main Street USA is reducing retail capacity at alarming rates, while Amazon takes over the retail space -- again, keep an eye on malls in 2014-2015.

ReplyDeleteFor the year 2013, liberalism’s peak fiat wealth came on December 28, 2013, as currency traders drove the Euro, FXE, strongly higher to 136 and the Yen, FXY, lower to 93.

ReplyDeleteThis was perverse, as earlier, destruction of fiat money had commenced on October 23, 2013, with the a strong sell of Credit, AGG, as well as a strong sell of Major World Currencies, DBV, and Emerging Market currencies, CEW, as the bond vigilantes began to call the Interest Rate on The Ten Year US Note, ^TNX, higher from 2.48%.

European Financials, EUFN, drove Eurozone Stocks, EZU, to their rally highs, and US Regional Banks, KRE, and the Too Big To Fail Banks, RWW, drove US Stocks, VTI, to their rally highs.

Thus, strong currency carry investing, seen in a higher Dollar Yen cross, USD/JPY, and in a higher Euro Yen cross, EUR/JPY, together debt trade investing, seen in Junk Bonds, JNK, and Ultra Junk Bonds, UJB, closed 2013 at a six month rally high, which drove World Stocks, VT, Nation Investment EFA, and Global Financials, IXG, to their six month long rally highs, at the end of December 2013, producing Liberalism’s peak wealth.

Then, an epic reversal in fiat wealth commenced January 2, 2013. Jesus Christ acting in dispensation, that is the administration of all things economic and political, a concept presented by the Apostle Paul in Ephesians 1:10, had begun to PIVOT the world from the paradigm and age of liberalism, into that of authoritarianism, on the death of fiat money, on October 23, 2013, as investors deleveraged out of Credit, AGG, and Currencies, DBV, CEW, on fears that the world central banks’ monetary policies of investment choice and credit stimulus, have crossed the rubicon of sound monetary policy, and have made “money good” investments, such as the Emerging Markets, EEM, bad. And then, He then fully PIVOTED, the world from the paradigm and age of liberalism, into that of authoritarianism, on the death of fiat wealth, that is World Stocks, VT, on January 2, 2013.

Tuesday January 7, 2013, with the S&P 500, SPY, 0.6%, the Russell 2000, IWM, 0.8%, Regional Banks, KRE, 0.9%, and the European Financials, EUFN, 2.0%, and Greece, GREk, 2.7%, presented a great short selling opportunity emerged, as in a bear market one sells into pips, just like in a bull market one buys into dips.

Perhaps one might find my Stockcharts.com Chartlist ..... http://tinyurl.com/lcl9c8y ..... helpful, where I provide a list of ETFs for a Margin Portfolio, which include, STPP, HDGE, XVZ OFF, JGBS, EUO, HYHG, SAGG, SLV, and GLD, as well as a number of Bear Market ETFS for one’s consideration.

For a full presentation of concepts pertaining to Dispensations Economics theory, one might visit here ....

http://tinyurl.com/m4xpge3