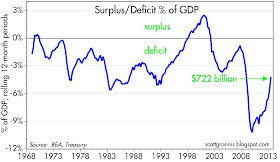

In today's WSJ, Steve Moore echoes my thoughts from last month on the incredible shrinking federal budget deficit. Yes, "The biggest underreported story out of Washington this year is ... the federal budget ... shrinking ... much more than anyone in either party expected." And with the July numbers released today, the story hasn't changed, although the 12-month deficit inched up from $694 to $722 billion. The progress is mostly due to a pronounced slowdown (and even a recent shrinking) of federal spending. At the same time, a growing economy, rising incomes and corporate profits have boosted revenues to new highs.

Spending has dropped almost 4% over the past year, while revenues are up almost 13%. As the second chart above shows, revenues have been higher than their year-ago level every month for the past several years; this is not just the front-loading of incomes that happened last December in order to beat higher expected tax rates—this is ongoing and likely to continue. It's the sort of thing that happens in every recovery. But we've never seen a slowdown in spending since WW II. That is big news.

The budget deficit is now down to only 4.2% of GDP. Just a few years ago we were all worried that the runaway budget deficit would be the ruin of us all. Now the deficit is back down to levels that are easily manageable. To be sure, entitlement spending promises to reverse this in coming years, but for now things are under control and entitlements are not cast in stone.

This is very good news because it all but eliminates the rationale for higher tax rates, and it has resulted in a serious shrinkage of the relative size of the federal government, from a high of 24.4% of GDP in 2009 to only 20.7% today. That's a whopping 15% reduction in the size and burden of government in just under four years. This gives the private sector some badly-needed breathing room, and that's a good reason to expect somewhat stronger economic growth in the years to come.

Derivative math. Sinking into the abyss more slowly is not swimming to the surface.

ReplyDeleteKudos for having been well ahead of the curve on this, Scott.

ReplyDeleteCheers,

-Bill

so in other words, drowning at a level of three feet beats drowning at a level of nine feet. we're still ADDING to a prodigious debt load but more slowly and this is GOOD news? I will not celebrate.

ReplyDeleteAt 300% increase in Federal spending in 22 years or 7.3% per year; and that the budget spending has been retarded for one year is not something to be proud of...

ReplyDeleteThe only question is how to bailout Detroit, Stockton, probably Chicago, and who knows who else -- Federal spending and revenues is not the whole story -- far from it...

ReplyDeleteGood news.

ReplyDeleteBut remember, it is not just entitlements, but also federal agency spending that is sucking too much out of the pockets of productive businesses and citizens.

Right now, federal income taxes raise about $1 trillion.

The budgets of just three agencies---Defense, the VA and Homeland Security---are more than $1 trillion.

In other words, every income tax dollar you send to DC goes into the warfare state.

It is payroll taxes that largely fund the oversize Social Security and Medicare programs. I recommend a 10 percent across-the-board cut in SS payments, and then raising the retirement age to 70.

The Veterans Department alone is now a $150 billion program, totally unfunded, with zero beneficiary contributions, and doubling every 10 years. Beneficiaries can received lifetime pensions and medical care after 20 years of service---benefits that would make a French railway worker blush.

In the next 10 years, income taxpayers will send $2 trillion to the VA. That's about $6,000 for every man woman and child in the United States.

But, there are a lot of votes attached to the VA.

Thus, I have little faith in the right-wing or the left wing to bring the federal budget monster under control.

On the federal budget, we have met the enemy, and he is us.

To be sure, entitlement spending promises to reverse this in coming years

ReplyDeleteThat is certainly not cast in stone. Medicare/Medicaid spending (expressed as transfer payments)relative to GDP is flattish since the 2009 recession trough.

In other words, every income tax dollar you send to DC goes into the warfare state.

ReplyDeleteDead on. Stiglitz was way ahead of the curve (sorry Bill Luby, Grannis was way behind the curve on federal spending) the unfunded $3 Trillion Dollar War.

Ben Jamin, I love how you always leave out the Department of Welfare or HHS, close to a trillion dollar budget.

ReplyDeleteIt is not great after FIVE YEARS, we are now seeing a declining federal deficient! Perhaps a NoBell praise for home economies is in order.

As Mr Moore has noted, this decline of the deficient comes after exploding spending from Bushneck, BOCO and CONgress.

Hats off also, to Mr Moore, for not using the misused word - austerity...

http://www.heritage.org/research/reports/2012/10/federal-spending-by-the-numbers-2012

ReplyDeleteSorry, left out the link!

Sorry, left out the link!

ReplyDeleteYou certainly did. According to Heritage, DoD and VA spent $982 billion in 2012.

Income security, transportation, fed.gov retirement & benefits, food stamps & other nutrition, unemployment benefits, K-12 & vocational education, international affairs, administration of justice, other educational training and employment and community and regional development was $973 billion.

The war machine sucks up personal and corporate taxes.

I'll wager a guess. Federal spending as a percentage of GDP under Obama will be lower than Reagan when the history books are written

Marmico, whatever it is, it is too high, whether it is Raygun or BOCO.

ReplyDeletehttp://www.deptofnumbers.com/misc/debt-revenue-and-expenditures-as-a-fraction-of-gdp/

We are over the debt limit; "No we are not" said a spokesperson from the Treasury Department...

ReplyDeleteWho do you believe?

http://cnsnews.com/news/article/treasury-ran-98-billion-deficit-july-debt-stayed-exactly-16699396000000

And why do they still call it the Treasury, when in fact it has none?

Please, I ax my fellow cohorts to read and debate this subject.

ReplyDeleteFigures lie and liars figure.

http://www.acting-man.com/?p=25310#more-25310

This comment has been removed by the author.

ReplyDelete