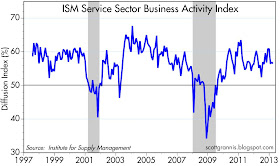

Today's release of the March ISM survey of the service sector shed no new light on the economy. It's slow and steady as she goes. The economy is probably growing at a 2-3% rate.

In the above chart of the ISM survey of service sector business activity, there is no sign of any pickup, but no sign of distress either. This would be a yawner if not for the fact that risk-free interest rates are extraordinarily low. THAT is the real story.

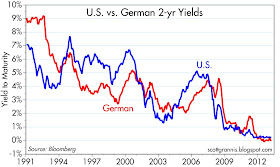

Today the yield on 2-yr German bonds is -0.01%. Call it zero. It's not strange that short-term rates in the Eurozone should be extremely low, since the Eurozone economy has been in a recession for more than a year, the Cyprus banking crisis has given rise to new fears of a Euro breakup, and the Club Med economies of the Eurozone are really struggling. On the other side of the world, 2-yr Japanese bonds pay only slightly better: 0.07%. There's talk of Japan finally defeating deflation and starting to grow again, but as yet little evidence.

The yield on 2-yr Treasuries is 0.23%, which is less than the 0.25% interest the Fed pays on bank reserves. That's better than what's on offer in the Eurozone and in Japan, but not by much. Especially considering that the US economy has been growing for almost four years and shows no sign of an impending recession. And considering that the S&P 500 index has outperformed its Eurozone equivalent by over 60% since the recession lows. And considering that Japan's economy has been mired in a deflationary/recessionary quicksand for most of the past decade.

From a long-term perspective, 10-yr yields in Europe and the U.S. have been converging in seemingly inexorable fashion with those of Japan. U.S. and German 10-yr yields are only separated from those of Japan by a mere 100 bps, equivalent to today's dip in equity prices. Is the message here that we are all doomed to a decade of Japanese-style deflation and zero growth?

That's the same message you find in the 5-yr real yields on TIPS, which—at -1.8%—are now guaranteed by the U.S. government to rob you of 1.8% of your purchasing power every year. In the chart above I show how the real yield on TIPS tends to correspond to the real growth rate of the U.S. economy over time. In the late 1990s, when the economy was booming along at 4% growth, investors weren't interested in TIPS unless they could compete with the growth outlook, which back then called for 4% growth and a booming stock market for as far as the eye could see. Today the outlook for growth is dismal, so people are willing to accept a very low or even negative real yield on TIPS because they fear that the risk of owning alternative assets is even greater. The chart suggests that TIPS investors are bracing for zero real economic growth in the U.S. over the next 2 years. Zero growth for the next several years would indeed be very bad for a lot of risky asset prices.

Sovereign yields throughout the developed world are extraordinarily low, and that can only be explained by understanding that the demand for relatively risk-free assets is extraordinarily strong. By the same logic, the demand for risky assets is unusually weak, and that in turn reflects the widespread view that the world's developed economies are fundamentally weak and unlikely to improve much, if at all, for the foreseeable future.

So it is noteworthy that there are so many signs of ongoing growth in the U.S. economy: strong auto sales; rising housing starts; ISM indices over 50; 2.5% growth in industrial production; rising factory orders; 4.6% growth in retail sales; 200K per month jobs growth; very low unemployment claims; record corporate profits; double-digit growth in bank lending to small and medium-sized business; healthier consumer balance sheets; soaring crude oil production; and very cheap and abundant natural gas, to name just a few.

Conventional wisdom explains this disconnect—so many signs of growth, yet widespread fears of stagnation and decline—by first pointing to the Fed. Zero interest rates don't reflect a strong demand for safe assets, they are simply the by-product of the Fed's massive money printing. Interest rates would be much higher, and consistent with the evidence of continuing U.S. economic growth, if the Fed weren't pegging them at zero via its Quantitative Easing efforts. Housing would be collapsing if the Fed weren't propping it up via its purchases of MBS. And what this means, as the theory goes, is that it will all end in tears. If the Fed ever tries to raise rates, the economy will then surely crash, snuffed out by tight money the same as has happened with every recession in modern times. In the meantime, the Fed is seriously distorting the capital markets and fostering malinvestments (aka "bubbles") that will inevitably lead to a bust. The Fed's flood of excess money will eventually collapse the dollar, followed by a hyperinflation that will inevitably lead to the destruction of the world as we know it. In short, conventional wisdom holds that the Fed can't do what it's doing without there being huge downside risk.

But of course, this logic leads to the conclusion that the world is doomed no matter what, and that is consistent with my interpretation of why sovereign yields are so low.

The inescapable conclusion, regardless of your assumptions about the Fed or the economy, is that today's extraordinarily low interest rates are symptomatic of a world that is very risk averse.

How else to explain why the earnings yield on the S&P 500 is substantially higher than the yield on the average BAA corporate bond? Investors are willing to give up lots of yield and potential price appreciation for the relative safety of corporate bonds because they fear that corporate profits, now at record-high levels, are at great risk. The last time we saw this behavior was in the late 1970s, when global economies were beset by high and rising inflation and collapsing stock markets—a time of great pessimism.

How else to explain why the price of gold today, in inflation-adjusted terms, is almost as high as it was at the height of the inflationary panic of early 1980, and almost three times higher than its average real price over the past century? If gold has one message for the world, it is that there is a tremendous demand for its supposed safety.

No matter how you look at it, today's market is effectively priced to the expectation that some kind of economic calamity is in our destiny. Against that backdrop, today's ISM service sector release was very reassuring.

With growth at >2% and inflation at <2%, there's no reason why the government can't make additional adjustments -- for example how about a %5 across the board cut in Federal salaries (?) -- Pres Obama has already announced he is cutting his own pay by 5% -- cutting Federal salaries would send a strong message to the private sector, likely leading to another rally on Wall Street -- yes, now would be a great time to implement an across the board Federal salary cut of at least 5%...

ReplyDeleteWell, I am not sure today's markets anticipate collapse, as much as zero-lower bound and slow growth, or Japanitis.

ReplyDeleteAnother forgotten fact: Stocks used to offer yield, higher than that of safe bonds.

We might be going back to that, but that requires lower stock prices than otherwise.

Also low bond yields and ZLB may reflect the huge amount of savings the globe is generating. The market is trying to send a signal----we don't need your savings----but people are saving anyways, often for sensible reasons like retirement, home buying, security.

The answer is for the Fed to print money to the moon.

I see the Bank of Japan is promising something like that.

In Scott's world, the S&P 500 Index at all-time highs equals "economic calamity priced in". Makes sense.

ReplyDeleteScott, great post, and thank you for sharing your thoughts and supporting data with us.

ReplyDelete