These two measures of housing prices show that prices rose between 7-12% last year, and are relatively unchanged for the past four years.

In real terms, the Case-Shiller measure of housing prices rose 5.5% last year, after falling over 40% from its early 2006 peak. This is how markets clear: as time passes, prices fall until the supply and demand for homes reaches a new equilibrium and prices stop falling. By all measures, there has been plenty of time and price adjustment for this market to clear. We therefore are most likely entering a new phase of the housing cycle, in which prices will tend to rise even as new supply comes on the market.

A different version of the Case-Shiller data, going back to 1987 but covering fewer markets, tells the same story. After a huge decline from the 2006 high, inflation-adjusted prices today are only 15% higher than they were in 1989, 23 years ago.

This chart of real median home prices goes back even further and tells the same story. From an historical perspective, inflation-adjusted home prices are only slightly higher today than they were many decades ago, yet interest rates are much lower. Homes have never been so affordable. As buyers become more confident that prices are not going to fall and are more likely to rise, demand for homes will continue to rise. Sellers, meanwhile, will be less anxious to sell as they see that prices are firming. The millions of homeowners who are still "underwater" will also become less anxious about their plight as prices rise. In short, the market has lots of room and time to recover. Housing is now a "sellers' market" in many areas of the country.

As the chart above shows, housing prices are much more affordable today than they were in 1989, because real incomes are up and borrowing costs are down. 30-yr fixed rate mortgages were 8% in 1989, and they are less than 4% today.

There has been a significant decline in the number of vacant homes for sale. Banks may still be holding back lots of inventory, but what is coming on the market is selling. The vacancy rate today is not unusually high at all, from an historical perspective.

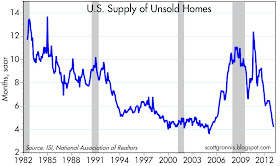

These charts make it clear that there is a shortage of homes for sale. The supply of homes for sale, relative to the current sales pace (which itself is very depressed) is about as low as it has ever been.

New home sales (today's big news release) were up over 15% from November to December, and they rose almost 30% last year. But they are still extremely depressed compared to the pace of the past two decades. With housing starts up over 60% in the past two years, new home sales are almost certain to post very strong gains this year.

A strong housing market is going to provide good support for the economy in the years to come.

Ultra-low rates led to the last housing bubble. This won't happen this time, right?

ReplyDeleteScott, what happens when…???

ReplyDeleteAfter watching Helicopter Ben today, it seems all this QE has been good for the Treasury…to the tune of some $80+ billion a year! He said this would most likely decline in the near future.

So what happens when interest rates start to rise and the Fed stops buying and starts selling? Won’t that result in a loss to the Fed? If so, aren’t those potential losses huge? Would money start flowing FROM Treasury to the Fed to cover? Or do they just hold the bonds to maturity resulting in only paper losses?

PS Great housing charts today! Thanks.

Re: another housing bubble. If the Fed doesn't reverse QE in timely fashion, this could lead to another housing bubble. The Fed was complicit in the last housing bubble, but more so Congress, Freddie Mac, and Fannie Mae, all of whom tried very hard to extend credit to anyone who could sign their name.

ReplyDeleteIn any case, another housing bubble is many years away. It will take years of artificial credit creation and speculative home building to create the next housing bubble.

Re: what happens when interest rates start to rise?

ReplyDeleteThe Fed's holdings of Treasuries and MBS will suffer a decline in price, but they will continue to earn interest and will eventually mature at par. I'm not sure the Fed needs to mark everything to market, or whether they can just sit on the securities until they mature and suffer a temporary "paper" loss. But it is clear that the Fed will be remitting a lot less to Treasury in a rising rate environment, since it will be paying a higher rate of interest on bank reserves and the difference between the yield on its securities holdings will be narrowing.

If rates rise fast enough, the Fed may end up paying out more on bank reserves than it earns on its securities (in what would be an inverted yield curve environment), in which case it would suffer net losses.

It all depends on how things play out. It could be bad, but no one really knows since it is very time- and path-dependent.

The Fed has promised not to end QE3 until well after employment, growth, and inflation targets are fully and demonstrably recovered -- said another way, QE3 will continue until well after the US employment to population ratio has topped previous highs, growth is robust, and inflation sustains the Fed target -- we are many years from those critical nation-building goals for the US -- the austerity hawks are no longer taken seriously at this point by either economists, the public, or policy-makers -- we all need to gear up for eventual inflation, yes, but we should also be gearing up for monetary expansion, which is underway and unstoppable at this point -- the lesson learned for investors is to deal with fiscal and monetary policy as they are, and to quit trying to influence these policies, which is futile -- the Fed and administration will do whatever they will -- the goal of investors is to make money regardless of the monetary and fiscal policy situations.

ReplyDeletePS: Scott is right about hitting the bottom in housing -- best to acquire those last minute real estate deals now before it is too late -- record low interest rates and prices will not last forever -- QE3 will ensure that -- again, acquire rent-earning real estate now while the good deals last...

ReplyDeletePPS: The name of the game for investors is maximizing RENTS and DIVIDENDS -- forget about growth for now...

ReplyDeleteI loved as much as you’ll receive performed right here. The caricature is attractive, your authored material stylish. nevertheless, you command get bought an nervousness over that you want be turning in the following. in poor health unquestionably come more beforehand once more as precisely the similar nearly very frequently inside of case you defend this increase.

ReplyDeletesell my house fast austin