December's jobs report provides yet more evidence that the economy continues to grow, probably at a 2-2.5% pace. That's a only little less than its long-term normal growth rate of 3%. The private sector has increased the number of jobs by about 2% over the past year, and that is similar to the growth we saw during the the growth phase of the last economic cycle (2004-2007). The problem with the economy is not a lack of growth, but a lack of recovery to previous levels of activity. It should have been growing much faster.

The chart above compares the level of real economic activity with its long-term trend. By my calculations, the economy is about 13% below where it should be. In every other recession/recovery cycle, growth has rebound rapidly after the end of the recession; this time it has not.

For the past three years, most observers have lamented the pitiful growth of jobs. But as the chart above shows, private sector jobs (according to both the household and establishment surveys) have been growing steadily, and at a reasonable pace. In fact, the establishment survey has found 5.3 million new private sector jobs since the post-recession low in early 2010, which works out to about 155K per month on average. This is more than enough to keep up with the natural growth of the population.

As this next chart shows, public sector jobs have suffered the most in the current recovery, having declined by about 675K from their recession-era peak. That's held back overall jobs growth, but it's a healthy development since the public sector was arguably way too big going into the recession, having grown much more than the private sector in the previous decade. Municipal defaults and widespread budget problems at the state and local levels in recent years attest to that.

As the chart above shows, the pace of private sector jobs growth is similar today to what it was in the last business cycle expansion. Not terrific, but not miserable either, and there is no sign of any deterioration: unemployment claims are very near their post-recession lows.

The main reason for the economy's relatively low level of growth is the lack of growth in the labor force. Over 5 million people have "dropped out" of the labor force, having decided either to retire or just stop looking for a job.

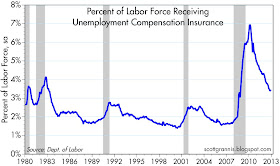

Generous unemployment benefits (which began in 2008 with the creation of Emergency Unemployment benefits) likely explain much of the lack of growth in the workforce, as does the relaxation of food stamp eligibility in early 2009, and the strong growth in the ranks of the disabled. In short, government policies have made a significant contribution to slowing the economy's recovery, because the government has been paying people to not work.

Fortunately, the labor force is beginning to grow again, rising almost 1% in the past year, which is roughly equivalent to its long-term average growth rate. This recovery coincides with a 50% decline in those receiving emergency unemployment benefits over the past two years. Unfortunately, Congress' decision to once again extend unemployment benefits for another year will probably act to slow the growth in the labor force and retard overall economic growth going forward. When you pay people to not work, you ought to expect to find fewer people willing to go back to work. Another source of headwinds this year will be the increase in taxes on high-income earners, the increase in payroll tax deductions for nearly everyone.

Taken in isolation, today's jobs report would be considered to be only slightly weaker than normal. That people continue to complain about miserable jobs growth is only because we would all like jobs growth to be much stronger, in order to "catch back up" to where the economy could or should be. Until government policies become more jobs- and growth-friendly, however, that's not likely to happen. But there's no reason the economy can't continue to grow, in spite of all the headwinds. It's been my experience that you can never underestimate the ability of the U.S. economy to overcome adversity.

Things could be better, but they could also be a whole lot worse.

My neighbor also looked like he was in great shape. New car, expensive vacations, home remodel... then he lost his job and got foreclosed. He had HELOC'ed every single cent of equity out of his house. But, of course, you don't see that from the outside. Just like the US economy.

ReplyDeleteAre you actually trying to make a case that the estimated 2013 cost of $30 billion in emergency and extended unemployment benefits is retarding a $16 trillion ($8.6 trillion employee compensation) economy?

ReplyDeleteSomeone who "prides" himself at the margin certainly lacks comprehension of orders of magnitude.

marmico,

ReplyDeleteI think what he is saying is that the $30bil becomes a disinsentive to work for many. And that can be a drag on the economy. Key word here, "drag".

Geez Bob, even if $10 billion of $30 billion cost is the disincentive effect (and there is no empirical evidence of same) of unemployment benefits, it is a rounding error.

ReplyDeleteRecipients of unemployment benefits just burn the cash to stay warm in the winter and cool in the summer?

The CBO estimates the multiplier at 1.6.

Do you notice that Grannis never supports his opinion with evidence? It is Club for Growth talking points crap.