For those considering an escape to a less-unfriendly business climate such as Australia's, an important caveat: the Australian dollar is very expensive and the U.S. dollar is very cheap. Selling here to move there is therefore an extremely expensive proposition.

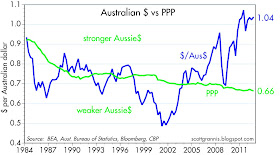

The above chart compares the Aussie dollar exchange rate to my calculation of its Purchasing Power Parity with the US dollar. (PPP is the exchange rate that would cause US visitors to Australia, and Aussie visitors to the US, to conclude that most prices in the two countries were roughly the same.) I estimate that the PPP exchange rate today is about 0.66 dollars per Aussie dollar. But since the current exchange rate is 1.04, that implies that, from the point of view of a U.S. expat or a U.S. tourist, the average price level in Australia is more than 50% higher than in the U.S. Ouch. Moreover, the Aussie dollar has almost never been so strong. Lots of things are going to have to continue to go right for the Aussie dollar to remain at these lofty levels.

This next chart of spot commodity prices suggests that a big reason the Aussie dollar is so strong is that commodity prices—commodities are Australia's major export—are very strong. There is a very strong tendency for the Aussie/US exchange rate to track changes in commodity prices. Rising commodity prices bring a flood of new money into the Australian economy, and that tends to bid up the value of the Aussie dollar.

As this chart of the real, trade-weighted value of the dollar shows, the US dollar has almost never been so weak. It's not hard to understand why: monetary policy is extremely accommodative, the U.S. economy has never experienced a weaker, more disappointing recovery, federal deficits are extraordinarily large, entitlement programs are long overdue for reform, and regulatory burdens are very high and rising (e.g., ObamaCare). In contrast to conditions in Australia, lots of things need to continue to go wrong in the U.S. economy for the dollar to remain this weak.

For the time being, leaving the US for greener pastures overseas is in general a very expensive proposition.

I'm open to suggestions. My tax rate is going from 15% plus MN 8% to 39.8% plus 3.9% (obamacare) to 15% Minnesota. That is 23% to 59%!!!

ReplyDeleteAs one of the wise economic minds on the web, what are your suggestions??

For starters, consider moving to a state with lower tax burdens. According to The Tax Foundation, here are the 10 states with the lowest overall tax burdens (as of 2010):

ReplyDeleteAlaska 6.97%

South Dakota 7.58%

Tennessee 7.72%

Louisiana 7.75%

Wyoming 7.77%

Texas 7.93%

New Hampshire 8.11%

Alabama 8.18%

Nevada 8.24%

South Carolina 8.37%

For purposes of comparison, MN ranked 7th highest with 10.79%, California 4th highest with 11.23%.

http://taxfoundation.org/article/annual-state-local-tax-burden-ranking-2010-new-york-citizens-pay-most-alaska-least

Scott, thanks so much for this post. I actually have no choice but the escape to Australia, being the spouse of an Aussie. We have done well in Australian dollars thus far but I have made the decision not to buy Australian real estate until the washout, which I expect some time soon. Have you looked at the Australian super-annuation scheme put into place by a labor government that now, 20 years later, is the toast of the intellectual academic crowd down-under?

ReplyDeleteThe last time I was in Australia was about 6 years ago. I recall being quite impressed with the superannuation schemes. Western Asset managed money for several.

ReplyDeleteWe were looking at Ecquador (not too seriously, however), after learning how the cost of living is very low, and the medical help is represented to be as good as here in the U.S.

ReplyDeleteAs the present U.S> situation has created millions of sturdy beggars and a slow growth economy, why not move to the same economic situation, at much a much lower cost of living?

Enjoyed this post, but not sure about the putatively "low" exchange rate of the US dollar.

ReplyDeleteJapan and Europe have been practicing economic asphyxiation by tight money.

If the central banks of Europe and Japan are "too tight"---and certainly a powerful case can be made to that effect---then I want to see the exchange rate of the dollar go down.

I agree that holding down federal, state and local government outlays is important. The pension systems of public employees, especially those in uniform, would make a French railway worker blush.

It would be great if all those unwilling to pay their fair share of taxes would move to Alaska in order to join like-minded people (Sarah Palin).

ReplyDeleteJeff -- Good job quoting your marginal rates. What do you average? Do you not have a tax advisor?

ReplyDeleteI've never come across a U.S. individual paying that much in average taxes.

Dive into the fascinating world of Australian currency with our comprehensive article on Currencies of Australia.' Explore the rich history, intricate designs, security features, and cultural significance of Australian banknotes and coins. Gain insights into exchange rates, digitalization's impact, and future trends, showcasing Australia's dynamic financial landscape.

ReplyDelete