First-time claims for unemployment have averaged (on a seasonally adjusted basis) 375K per week this year, and the latest tally was 382K. The bottom line is that claims have been flat this year. No signs of any deterioration in the labor market, and no signs of any meaningful improvement either. The outlook for the economy remains rather dull and uninspiring.

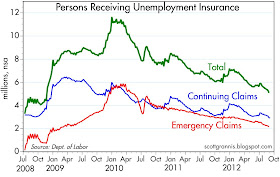

What has changed meaningfully, however, is the number of people receiving unemployment insurance. Over two million people have dropped off the dole so far this year. Since the ranks of the employed have increased only by 1.1 million this year, that means there are an additional one million people out there not working and not receiving unemployment compensation. Presumably, those folks are increasingly eager to get back to work. I count that as a positive change on the margin, since it means that employers ought to find it easier to hire people. The one ingredient that is missing, of course, is more employers willing to hire people. The problem is not that the economy is losing jobs, it is that the economy is not creating enough.

That's the sort of thing that can only be addressed by fiscal policy. The Fed pumping more reserves into a banking system that is already sitting on $1.5 trillion of excess reserves is not going to create more jobs. If the additional reserves are going to make a difference, banks have to decide that they are going to deploy those reserves; they need to lower their lending standards and seek out borrowers more aggressively. By the same token, borrowers need to be more willing to borrow. For both of those things to happen, we need more confidence in the future. That in turn must come from fiscal policy, which must somehow avoid the looming "fiscal cliff," and avoid raising marginal tax rates on those who are most able to create jobs (if you increase taxes on job creators, you are very likely to get fewer new jobs as a result).

In the meantime, the economy looks like it continues to grow slowly. That's disappointing, but it's a whole lot better than an economy that is slipping into another recession. Holding on to cash—there is a whopping $6.4 trillion sitting in bank savings deposits earning nothing—only makes sense if there is another recession around the corner; so every day that we avoid another recession is another day that holding cash becomes embarrassing. The Fed is trying very hard to encourage people to take on additional risk—to leave the comfort of cash by spending it or by investing in something, or to take on additional debt. So far they haven't been very successful, but the passage of time has. The longer we go without another recession, the more people are going to be encouraged to leave the comfort of cash and take on more risk.

So even though there is disappointment to be found in many areas, the economy is still likely to slowly improve. That's a good reason to reduce your cash holdings in favor of just about anything else (except Treasuries, where yields are so low that it would take an outright and painful recession to push them lower).

The monthly financial statement summary report from the California controller shows just how much people want to save. July and August showed an increase in personal income tax revenue up 8% over a year ago. But sales tax receipts were down by 25%.

ReplyDelete"which must somehow avoid the looming "fiscal cliff"

ReplyDeleteLast year, the teabagger cult had very different view on the debt ceiling. They held the country hostage and caused huge damage to the economy. Real human suffering was secondary to their ideology.

Amusingly, that led to the raise of the idiots from the other side the 99 percent!

It would have been much more fun if both groups were put into a large steel cage. Instead of negatively impacting GDP, these two group could have provided some positive entertainment value.

Sorry, Constable, those numbers don't compute. Ssles tax receipts can't possibly have fallen 25%.

ReplyDelete