M2, arguably the best measure of the amount of readily/easily spendable cash in the economy, has now surpassed the $10 trillion mark, a milestone of sorts. M2 has grown about 6% per year on average for a very long time, but over the past year it's grown at a 7.7% annualized rate. That's not exactly what you would expect from what many consider to be the Fed's massive money-printing operations. It's hardly enough to wreak inflationary havoc in the economy. As the second chart suggests, this extra growth probably reflects some capital flight out of the Eurozone.

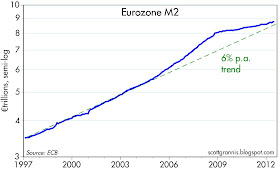

For all the talk of capital fleeing the Eurozone, their measure of the M2 money supply has not declined at all; it has grown at a 2.8% annualized pace for the past two years. As the chart above suggests, the extra money accumulated in the Eurozone in the years leading up to 2008—when the Eurozone was considered to be more attractive than the U.S.—has now largely been reversed. In any event, Eurozone M2 has grown by about the same rate as U.S. M2 over the long haul. Perhaps it's not a coincidence that inflation in the Eurozone has been substantially similar to that in the U.S.

One source of the increased amount of M2 money is Commercial & Industrial Loans, which have increased by almost $270 billion in the past two years, and are currently growing at strong, double-digit rates. This is good evidence that banks are relaxing their lending standards and that businesses are more willing to borrow, both signs of increased confidence and thus a portent of stronger growth to come.

On balance, it's hard to find anything scary in these charts. Money is not in scarce supply, and indeed it is probably just sufficient to satisfy the demand for money. If there is something to worry about, it is the mountain of bank reserves that sit idle at the Fed, some $1.5 trillion worth. To judge from the relatively tame inflation rate and the strong demand for money, the world's demand for idle bank reserves is strong, and so the Fed's creation of those reserves was apparently what was needed to restore needed liquidity to the system. We are in a sort of equilibrium for now, but that could change if the demand for safe dollar liquidity should decline. If the savers start spending the cash they have stuffed into bank deposits, and if banks start using their idle reserves to make new loans, then we could see a tsunami of money introduced to the system which would likely boost nominal GDP by a substantial amount. The biggest monetary risk we face is not knowing whether the Fed would be able to reverse its massive creation of bank reserves in a timely fashion should money demand fall, in order to prevent a significant surge in inflation.

If the savers start spending the cash they have stuffed into bank deposits, and if banks start using their idle reserves to make new loans, then we could see a tsunami of money introduced to the system which would likely boost nominal GDP--Scott Grannis.

ReplyDeleteThis is not something to worry about, but to fervently solicit the Economic Gods to make so.

Such problems we should have.

As for inflation, I know of no business person anywhere who contends they have pricing leverage. Unions are in retreat (in the USA). Trade is global, as is movement of capital, goods and services. (Labor was fluid in the USA, until we started policing our borders).

Yet even with closing our borders, we see unit labor costs falling or flat. Commercial rents of all kinds are vert squishy.

It will take years of robust growth to bring about any sort of demand-pull price inflation.

Bring to me such problems.

" - - -the strong demand for money."

ReplyDeleteScott is confused: if demand for money were strong there would not be $1.6 Tr in excessive reserves sitting in the banks -- as he points out elsewhere in the same article.

The Fed is over-issuing money reserves (the proceeds of their QE's) which are not being loaned out by the banks because of LACK OF demand for money. And corporations are also sitting on record amounts of their own cash which is not being invested.

The table has been set by the Fed, what is lacking is aggregate demand.

@Ed R, I agree that aggregate demand is chronically low -- I suspect that both Republicans and Democrats will seek to fix that by getting America into a world war on the other side of the planet that will instantly require that all of America's resources be invested into the military industrial complex -- for example, if every able-bodied person between 18 and 35 were immediately conscripted into the military, the effect would be to reduce unemployment -- moreover, an order for say 250,000 F-35 fighters would certainly require that factories be built across the USA -- world war is very much on the radar at this point by both Democrats and Republicans -- all of our nation's cash and human capital resources will be put to full use once that war is underway -- without a war, I see no chance of a robust or even a meaningful recovery in the next 1-15 years -- in fact, without a world war, the US as we know it will likely not survive as we know it -- Federalism will lead the US into world war if only to save Federalism from itself...

ReplyDeletePS: Most of the members of Congress have been bought by the military-industrial complex and banks already, so the war-mongers are already in power -- now is the time to invest in cheap defense stocks...

Ed R,

ReplyDeleteExcess reserves are a function of the Fed's balance sheet. The banking system has very little control over its aggregate level. You cannot deduce much from the level of excess reserves about money demand.

AD is low, and Milton Friedman said if that is the case (and you are at zero bound or close), then have the central bank buy more bonds.

ReplyDeleteSome say this will just add to bank reserves and have no effect on the GDP. If so, we have a tremendous opportunity to wipe out government debt. The Fed can buy Treasuries with printed money, and hold until maturity while funneling interest to the Treasury. Any smart business guy would seize such an opportunity, but sadly so smart business guy runs the federal government.

More likely (says Friedman), and that with serious QE we first get robust growth then inflation (several years out).

Even some added inflation will be good (as Allan melter once pointed out for Japan) as it makes some sour property loans turn okay, and will help deleverage the nation.

Interestingly, the Romney economic team is mute on monetary policy (although Ryan is a gold nut). Taylor has given good review to a book that advocates Market Monetarism. I suspect that if Romney wins, then Taylor and Romney will embrace a more bullish, growth oriented monetary policy, similar if not identical to Market Monetarism, but using a different name perhaps, like "GOP Growth Monetarism," or some such label.

So why is the Romney economic team mute on monetary policy? Orthodoxy calls for the usual calls for a "strong dollar" and tight money etc. Of course, you can say anything in a campaign and then do a 180 after election day (remember, "no nation building" from Bush jr.?).

But I am hopeful that Romney is growth oriented, and so will embrace Market Monetarism. As an investor, he surely does not mind some inflation after he makes an investment.

@Benjamin, Mitt Romney understands that the value of labor is about $15-30/day by international standards -- his only choices are to allow labor costs to regress to the international norm, thereby enabling exports, or to disengage the US economy from the international markets via some artificial means such as world war and transition to a wartime economy and domestic defense spending -- my hope is that labor costs in the US will regress to international norms -- my fear is that some alternative such as war will be invoked by the powers that be -- we live in terrifying times -- nevertheless, investors stand to win big if either labor costs regress to international norms, or world war emerges -- now is the time to buy into that reality -- but make note, inflating the US economy does not fix the labor cost differentials between US workers and foreign workers -- add to the labor costs the matters of corporate taxes and regulation, and simply put, the US has no chance of competing globally except in military actions -- the US economy is going to transition, one way or the other -- the future of America is beholden to the reality of either long-term declines in labor costs, or expansion of the military-industrial complex -- that's life -- the only question in my mind is how to exploit that situation in order to grow my own estate -- hope is not a method (as in significant monetary expansion) -- conversely, investing into dividends and growth is a method that has worked for since the enlightenment arrived -- my advice to everyone is still, invest into world-class skills, acquire equities over your lifetime, keep a long-term perspective, or give-up and take cover...

ReplyDeleteI am calmed thinking about how deftly Ben Bernanke managed to get things settled down. Not too much inflation, not too much deflation. Not too much stimulation, not too little. Benjamin and Dr. McKibbin, you exhaust me.

ReplyDeleteCongress has to fix things now, the electorate permitting. Otherwise, tough. We suffer.

And now that smart diplomacy didn’t work with the Middle East (because it couldn’t work), we will start to disengage as we become more oil independent. The intermediate range missiles in the Middle East is a problem for the free loaders in Europe. Besides, the Europeans voluntarily imported tens of millions of Middle Easterners. We will let them deal with it if we can get oil independent and concentrate on making the U.S. economy vibrant without massive credit growth.

@Squire, the fastest way for the US to "disengage" from the world is to go to war with the world, which is my worst fear -- I would rather see US labor costs decline to international norms and watch exports rise -- however, I simply do not care how the US fixes its economy, but only that the US does much more to ensure I get exciting earnings on my investments.

ReplyDeletePS: Thank you for the opportunity to comment -- I have become adicted to Scott's blogging, which I find enticing as a Libertarian myself...

This is why I am not persuaded by those people who say that hyperinflation in the United States is inevitable. I don't think it is. I think default is inevitable, but I don't think it needs to be default by hyperinflation. That is because the government cannot get out of its obligations by fiat money. It cannot default by using hyperinflation, because hyperinflation will only last a few years, but the obligations last for the next 75 years.

ReplyDelete$15.00 $13.00

In other words, the default will be much more open. The government is going to have to renege on promises made to the vast majority of people who are now dependent on the federal government for their retirement income, and it will also default on the workers who are still in the workforce, who are paying each payday into Social Security and Medicare.

Anyone who makes the case for inevitable hyperinflation needs to present evidence on how hyperinflation will enable the US government to escape the political obligations of the promises that it has made to retirees.

If Congress nationalizes the Fed, then we could get hyperinflation, just to meet present bills. But this will not solve the long-term problem: government unfunded liabilities. After the currency dies, the debt will still be there.

http://mises.org/daily/6159/Hyperinflation-Is-Not-Inevitable-Default-Is