Friday, October 21, 2011

The market is up, but still terrified

The stock market has made a nice comeback since the gut-wrenching lows of October 3rd. Are we out of the woods? Not yet. We still need to see what happens in the aftermath of the inevitable Greek default, and many are not convinced at all that the U.S. economy is going to avoid a double-dip recession. The following charts recap just how nervous the market still is. The rally this month has not been driven by optimism; equities are up because things haven't been as bad as the market had been expecting.

This chart shows the consensus 1-yr forward PE ratio of the S&P 500. Multiples are almost as low today as they were during the total panic that gripped the market in the fourth quarter of 2008. By this measure, the market is still terrified of the future.

The first chart above shows the ratio of the Vix index of implied equity volatility to the 10-yr Treasury yield. The second shows the Vix Index in an historical context, and the third chart shows the 10-yr Treasury yield in an historical context. The Vix index is a good proxy for the market's fear and uncertainty about the future, since it measures how cheap or expensive it is to buy options that limit one's risk. At today's level of 32-33 it is not hugely elevated, but it is almost three times its long-term average. 10-yr Treasury yields are only inches from their all-time low, and that is a good proxy for the market's expectations of future economic growth—which are just plain dismal. The ratio of the two shows that fear is high, uncertainty is high, and economic growth expectations are extremely low.

This long-term look at the Vix/10-yr ratio sums it up: at today's value of 15, the psychology and expectations underlying the market rank right up there with the worst we have seen in the past 20 years.

High-yield, option-adjusted credit spreads are about 150 bps off their recent highs, but as this chart shows, they are still very elevated from an historical perspective—still consistent with levels that have been associated with recessions in the past. The market, in other words, is braced for a recession. By this measure, however, the expected recession is not nearly as bad as what was feared at the end of 2008. This provides some solace, but it remains the case that the market is priced to very bad news.

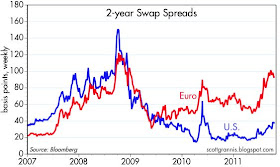

As the first chart above shows, 2-yr swap spreads—an excellent and forward-looking indicator of systemic risk, market liquidity, and financial market health—are up a bit from their recent lows, but from a long-term perspective they are still within the range of what might be considered "normal." This provides a huge measure of comfort in my view, since it means that our banking system and financial markets are still fundamentally healthy. As the second chart shows, however, swap spread in the eurozone are still very high. Eurozone financial markets are extremely worried about the solvency of their banking system, and about the fallout from one or more sovereign debt defaults. As I have been arguing for many months, Europe is the primary source of the fears that are weighing so heavily on U.S. markets.

So it's all a big waiting game right now. When will Greece finally default? How will it be managed? Will other countries be tempted to follow suit? Will European bank balance sheets and capital ratios be able to withstand the losses? Will there be a contagion effect to U.S. banks and to other financial markets around the globe? Will economies take another nose-dive?

No one has the answer to these questions of course. But markets are braced for a very unpleasant and possibly catastrophic outcome. If the denouement of the sovereign debt crisis results in anything less that a deep and prolonged global recession, the chances are good that risk markets could stage an impressive rally. And anyway, the world has been worrying about this for the past 18 months, so it can't possibly be the sort of "black swan" event that comes out of nowhere and catches markets completely off guard. I think there is still lots of room for optimism these days, considering the rampant pessimism that is still pervasive in almost every market.

I suppose if the market doesn't get exactly what it wants out of the summit this weekend it will collapse next week.

ReplyDeleteEven zombie banks are stuffed with Fed cash and govt guarantees. Does the level of the 2YR swap spread signal what it used to or is the direction more important?

ReplyDeleteNovember should be interesting with respect to the "SuperCommittee." Will they punt and let the automatic across-the-board cuts take hold?

ReplyDeleteWill K Street neutralize itself?

Lots of uncertainty here. Watch out!

Scott,

ReplyDeleteAlways appreciate your thoughts. Wondering if I can diverge from this subject and ask how you think Apple, Inc will fare without Steve Jobs? More often than not the departure of a company's founder who has been credited with as much as Steve has marked the beginning of declining performance. Do you think that will happen to Apple? Tough to know of course but you seem to have a deeper understanding of the company than most observers. Thanks,

Kenneth