Call it "panic exhaustion." The Vix index has been trading at elevated levels for almost three months now, and that's a long time. Hedgers get tired of paying huge premiums for options that don't pay off, while sellers of options feel better and better as time passes and they collect their option premiums. Taking risk becomes more attractive that avoiding it. Fear continues to run high, and that is depressing the prices of most risk assets, but the passage of time without the fears being realized is the enemy.

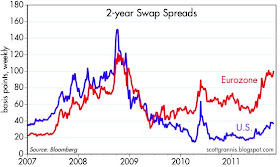

Eurozone swap spreads have been trading between 90-100 bps for almost two months, while U.S. swap spreads remain at levels that are more or less "normal." There has been no contagion to date, and the U.S. economy continues to slowly improve.

Copper futures sold off in September as everyone rushed for the exits, but prices are coming back as economic life goes on and underlying demand remains relatively strong.

Same goes for crude oil futures, which have rebounded by a hefty 20% since the peak of the panic (October 3-4).

Superb...your explanation of panic exhaustion is on the mark...

ReplyDeleteThis comment has been removed by the author.

ReplyDeleteI also like the "panic exhaustion" insight.

ReplyDeleteThe increasing receptivity in the econosphere to the market monetarists may also be increasing hopes the Fed and ECB do not re-do the 1930s response to bad times: tight money.

Still we are getting Japanned right now. Tough to figure out where to put your dough. Sheesh, real estate is el cheap-o.

Morgan Stanley published a report which predicted mass debt defaults in the US and Europe over the next couple of years. Do you really think there is any evidence that countries will be able to deal with the massive debt burden hanging over them, given how polarized leaders are today? MS recommends selling into any short term rallies.

ReplyDelete50% haircut on Greek debt plus 1.4T into fund - see if it works if it doesn't????

ReplyDeleteI'm going to hazard a guess: the 50% haircut is insufficient, since it is less than current market pricing which expects a 65% haircut, and since the haircut only applies to private investors (not the ECB's holdings, nor the holdings of Greek pension funds, which together total about $150 billion of Greece's $490 billion of debt). But the mere fact that a sizable haircut has been agreed should be enough to reassure markets that an eventual solution is possible. Making the unknown (the size of the haircut) known is better than postponing the inevitable.

ReplyDeleteScott, Scott, Scott

ReplyDeleteEurope is fixed my man, they said so early this morning. How can you doubt the resolve of Europe's leader to take decisive action in solving the crisis.

[Sarcasm implied]

BTW, last night saw the death of sovereign CDS product