Friday, July 1, 2011

ISM survey beats expectations

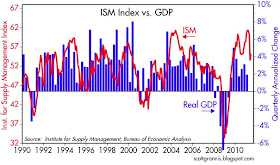

The Institute for Supply Management's June survey produced better-than-expected results, adding to the market's growing perception that the economy's recent slowdown was probably limited to the knock-off effects of the Japanese tsunami and the April spike in energy prices, and not the start of a double-dip recession. Progress towards a Greek bailout has also helped sentiment, but since a bailout only buys time and in the meantime weakens the eurozone economy (by pouring good money after bad, and failing so far to result in any meaningful reduction in Greek public sector spending), I don't think that's as powerful an impetus as the more numerous signs of an easing in supply-chain disruptions and a moderation in energy prices.

The export orders subcomponent was the only area that showed further deterioration, but trade often lags.

The prices paid index fell further, reflecting the recent decline in energy and commodity prices, and this represents a source of relief to many manufacturers. Still, it remains quite elevated, suggesting that inflationary pressures continue to percolate throughout the economy.

The employment index rose, and remains one of the brightest spots in the manufacturing universe. Firms haven't been this eager to hire since late 1983, when the economy was just embarking on a boom. Very impressive.

This number was a hard one for the bears to swallow...

ReplyDelete