Politicians just can't leave well enough alone. Once again we hear the drumbeat of concern over the alleged fact that China's has "manipulated" its currency—by keeping it too weak—and how that harms the U.S. economy. Yet nothing could be further from the truth.

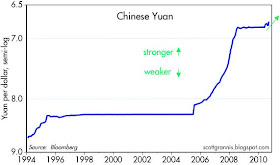

To begin with, the Chinese yuan has appreciated by 23% since China's central bank first decided to peg the yuan to the dollar at the beginning of 1994—almost seventeen years ago. The Chinese economy has had plenty of time to adjust to its current currency regime, and if that weren't enough, the currency has appreciated significantly in the interim. Moreover, the Chinese have recently committed to allowing the yuan to appreciate even further, as suggested in the above chart.

Leaving aside the issue of whether they have kept the yuan artificially weak or not, China's monetary policy (which is driven by pegging its exchange rate) has been successful at delivering relatively low and stable inflation: since 1996, in fact, Chinese inflation has been substantially similar to that of the U.S (actually, it has been a bit lower—2% vs. 2.5% per year). This fact alone is almost proof that they haven't been keeping the currency artificially weak. (I'm leaving out 1994-95 since inflation in those years was temporarily boosted due to the 50% devaluation of the yuan that preceded its being pegged to the dollar.) In other words, our price level has risen about the same as the Chinese price level for the past 15 years. If the yuan had been chronically undervalued during that time, then Chinese inflation would most likely have been higher.

But let's suppose that the currency was "too weak" when they first pegged it in 1994. If that were the case, then it is certainly a lot less weak today, since it has appreciated by 23%. If the currency were just about right in 1994, when Chinese/U.S. trade was still in its infancy, then it is arguably "too strong" today. If the currency were too strong in 1994, then of course it is even stronger today. In short, it's difficult to make the case that the yuan has been kept artificially weak.

And even if the yuan were chronically "too weak", what's the problem anyway? If the Chinese want to sell us cheap goods, that's to our advantage. True, some manufacturers here might go out of business as a result, but all consumers would benefit. Why should we pursue a policy—forcing the Chinese to appreciate their currency even more than they already have—that would disadvantage every single one of us—because a stronger yuan/weaker dollar would make Chinese imports more expensive—in order to protect a small number of businesses that are forced to compete with Chinese imports?

Mark Perry has a wonderful way of "rewriting" incoherent and uninformed policyspeak coming out of our government and our mainstream media. Here's how he corrects an article in today's Washington Post. It's a jewel:

This week, committees on both sides of Capitol Hill will plumb the conundrum of Chinese currency manipulation. The conundrum isn't that -- or why -- China is manipulating its currency: By undervaluing it, China is systematically able to underprice its exports, putting American (and other nations')manufacturingconsumers and businesses that purchase China's cheap imports at a significantdisadvantage. The conundrum is why the hell the United Statesisn't doingthinks it should do anything about it.

There are certainly plenty of senators and congressmen -- andMain Street AmericansU.S. producers that compete with China -- who'd like to see the White House place sometariffstaxes on American consumers and businesses who purchase theunderpricedlow-priced Chinese imports. If the administration doesn't act, Congress may just consider mandating sometariffspunitive taxes against American consumers and businesses on its own.

If we outsource all of our manufacturing in return for lower prices, won't we eventually fall behind on technological advances in those industries + the positive spillover into other areas? Especially when we are swapping manufacturing for service oriented jobs?

ReplyDeleteI sat next to a nice crane salesman on a flight home from Portland the other day. He's spent 30 years selling cranes.

What was interesting from the conversation was he said German engineering is so far ahead of America, there really isn't any American crane manufacturers left.

Even more interesting was his reference to the superior steel and composite construction, not just the bludgeoning of making heavy machinery. These are multi-million dollar cranes, not your garden variety toys either.

Eventually the manufacturers become the thought leaders if you give them enough time and tools.

I have for many years subscribed to Scott's view on our trade relationship with China (and others as well). Lately however I find myself more sympathetic to Pub's point of view. Intellectually I understand the law of comparative advantage and how it works to make everyone more prosperous but part of me is saddened deeply for what we lose by forever following the yellow brick road of globalization. Sometimes I think its mankind's best hope to avoid devastating wars if international trade makes us so dependant on each other that it becomes unthinkable (for leaders that do think) to embark on them. And other times I think we should at least attempt to compete in areas where we can, and keep as many critical skills at home as possible, given the fact the genie of internationalism has left the bottle and putting him back is not possible without severe global economic disruptions. It is a thorny problem that deserves the debate it is and will continue to get. I am sympathetic to both sides.

ReplyDelete"And other times I think we should at least attempt to compete in areas where we can, and keep as many critical skills at home as possible"

ReplyDeleteHow about we start with energy production. Huge, huge benefit with crucial reduction in trade deficit; reduction in defense budget; create jobs here. Nuclear, the Pickens plan, etc. Unfortunately the argument is too polluted by lobbyists for oil, defense, ethanol (corn), and on the other side the green energy idealists.

The USA is still the top manufacturer in the world. China is second but closing. But they have 5 times the people!

ReplyDeleteThe only reason China is manufacturing our tape dispensers and calculators is cheap labor. Remember when everything was manufactured in Japan? Now nothing cheap comes out of Japan. It's all moved to China and Korea. Japan's cost have gone up.

Now even Korea is getting more expensive so manufacturers are moving to places like India and Vietnam. When those place get more expensive, they'll move elsewhere.

But the problem with US manufacturing is NOT China, it's unions and government! The auto bailout was not to save auto manufacturing in this country. There is a prosperous auto manufacturing base. The bailout was to save UNION auto jobs!

Get government off the backs of manufacturers(regulation, taxes, mandates, unions, et al) and it won't pay as much to move operations over seas.

Randy,

ReplyDeleteI agree. Energy production is something the US does very well. It is painful to me to watch this government SHUT DOWN an industry (deepwater drilling) killing tens of thousands of highly skilled jobs producing domestic oil while we import it from Venezuela, and the middle east.

Our energy secretary gave a speech recently lamenting our dependece on foreigh energy and touting wind and hydro. Wind and hydro. In fairness he also mentioned coal. But (as far as I can tell) he did not mention natural gas or domestic oil.

There is no question in my mind that large portions of this government's core constituency absolutly HATES the oil and gas industry in this country. Nothing would please them more than to shut it all down. While I do not think they will succeed, it tells one there are many jobs the government does not mind seeing leave.

This comment has been removed by the author.

ReplyDeleteRandy,

ReplyDeleteWe should already have energy independence. Look at Brazil. You do not need to keep drilling for oil to become energy self sufficient. Instead, we let the oil lobbyist dictate what our energy policy has become.

If Brazil can do it, surely we could have/can invest what it takes to move away from middle eastern oil, no?

How can it be argued that inflation in China is the same as the U.S. when China's growth rate is so much higher? China's growth rate is reported at 10.3% but its inflation rate is only 3.3%. There are many recent reports that can be found at SeekingAlpha.com that food prices are soaring in China.

ReplyDeleteHow can it be argued that only a small number of U.S. businesses is harmed by the hard yuan/dollar peg? This seems to be a hardening stance against those who produce in the U.S -- especially for export.

The argument that the yuan "manipulation" is beneficial to U.S. consumers does not consider the harm to Chinese consumers. Imports of food into China would greatly lessen the reported high food inflation. As long as imports are suppressed in China the consolidating of government ownership of business in China will be fortified.

The lack of a market in yuan has consequences that are profound for the market economy in the U.S. and in China. The capitilist U.S. exporter and the consumer in China are being harmed by the market suppresion that is intensifying.

If there should be markets in everything then it should start with the yuan.

Scott, love and appreciate your blog but I can't agree with this post.

Buddy: a good part of the reason that China is growing so strongly is the gradual deregulation of its economy over the years. This process is ongoing, and authorities are relaxing capital controls as well. I agree that China is not a free market, but it is getting freer all the time. Plus, the rising yuan translates into rising purchasing power for all Chinese consumers. Things could be better in China, to be sure, but they are not as bad as you make them out to be.

ReplyDeleteScott says "[Low Chinese inflation] alone is almost proof that they haven't been keeping the currency artificially weak."

ReplyDeleteAlmost proof, maybe, but not quite. The above statement leaves out one link in the chain between Chinese currency policy and Chinese inflation. When the Chinese central bank (PBoC) adds dollars to its reserves in an effort to keep their currency from appreciating, they pay for the dollars with newly-created yuan. Other things being equal, those yuan would add to the Chinese money supply, which, in turn, would add to inflationary pressure. That is the basis for the valid part of Scott's reasoning.

Here is the missing link, though: When the PBoC intervenes, it "sterilizes" its intervention by selling its own PBoC bills. Doing so soaks up at least part of the newly created yuan, and prevents, or moderates, inflation.

Because of sterilization, then, low Chinese inflation does not prove that there was no currency manipulation. It only proves that the sterilization operations were successful.

Chinese inflation is rising now, which suggests to me that sterilization is approaching its limits or losing its effectiveness. See this related post on my blog: http://dolanecon.blogspot.com/2010/10/how-successful-is-chinas-currency.html

One simple explanation for why Chinese inflation is accelerating is that the dollar (to which the yuan is tied) is depreciating. If China wants to keep inflation low, it will need to allow the yuan to float up against the dollar.

ReplyDelete