Saturday, August 14, 2010

Earnings yields tower over bond yields

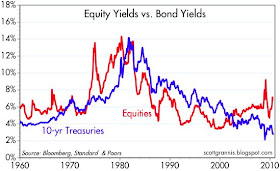

With yields on 10-yr Treasuries falling to 2.7%, a level which is reminiscent of the depression and deflation of the 1930s, I thought it fitting to once again compare the earnings yields on equities with the yield on 10-yr Treasuries. Rarely have equities yielded so much more than Treasuries. The current situation is very similar to what we saw in the late 1970s and early 80s, just before Treasury yields exploded to the upside and equities began a rally that would extend for many years.

Faced with the choice between equities yielding 6.8% and Treasury bonds yielding 2.7%, a rational investor would choose bonds (and I note that bond funds are receiving strong net inflows, while equity funds are experiencing net outflows) only if he thought that equity yields were only temporarily high, and corporate earnings were about to collapse (ignoring the fact that S&P 500 earnings per share have risen at a 45% annual rate in the past six months, and are now back to the levels of July 2008). Thus, the gap between stock and bond yields is a good indication of the tremendous amount of fear, uncertainty and doubt that plagues the market these days. The stock market is priced to something a lot worse than a double-dip recession.

Since I don't see a double-dip on the horizon and I continue to believe that the economy can grow 3-4% for the foreseeable future, then I conclude that equities are extraordinarily cheap.

In the olden days, people used to by stocks for the dividend yields, a practice now nearly forgotten--but you can see vestiges of that ancient practice in the chart, before 1970.

ReplyDeleteDividends went out of fashion, though never with me. Why? As Vigilante/Redleaf point out, public ownership of companies is weak ownership. Management may prefer to build empires, or take fat salaries, than build earnings.

M&A is mania at all times--even though most mergers in fact do not work out for shareholders (Time Warner AOL anyone?).

A focus on delivering real yields to shareholders keeps management on target and accountable by a meaningful metric.

Sadly, the dividend era has passed away.

What the chart shows now may be incipient deflation. Your stocks may be worth less in the future, but your bonds more. Ergo.

In Japan, deflation shrunk shareholder value by 75 percent over two decades, and property value too.

Maybe bonds is the way to go.

Benj,

ReplyDeleteNo indicator is perfect...but I have always believed the perfect is the enemy of the good...and the odds on equities are good.

VERY good.

John-

ReplyDeleteI sure hope you are right.

No one will benefit in a deflation, and no one benefits from a sick economy.

I was optimistic about our recovery until recently, and I observed Federal Reserve board behavior.l They think they are still fighting inflation.

No less a light then Milton Friedman said the Great depression was caused by tight money.

This is an old chart put out by

ReplyDeleteLouis Navellier care of Ned Davis. It ends on 7/25/08...

http://www.navellier.com/downloads/SP_500_Historical_PE.pdf

It shows the difference between

the S&P 500 GAAP earnings yield and Moody's Baa yield,,,,today stocks are at a positive 40 bps to

Baa yields....I would love an updated chart...if anybody knows a

source or gets Ned Davis Research

please let me know....

S&P 500 on 4/03/1998 1122

ReplyDeleteS&P 500 GAAP Earnings Yield 3.93%

Moody's Baa Yield 7.21%

S&P 500 on 1/05/2004 1122

GAAP Earningd Yield 4.87%

Baa Yield 6.68%

S&P 500 on 8/06/2010 1122

GAAP Earnings Yield 5.94%

Baa Yield 5.85%

As of Friday's close....GAAP earnings Yield...6.23%...Baa Yield....5.78%

Beware the Eurozone; another crisis might be brewing:

ReplyDeletehttp://market-ticker.org/uploads/2010/Aug/eur-usd-2010-0813.png

This was in combination with bad news from Greece, Spain and Ireland this week.

It seems to me that some of the S&P 500 pricing is due to the uncertainty of dividend taxation. If dividend taxation policy goes forward with 20% or less then the S&P should price upwards from present levels.

ReplyDeleteI don't think that bond price risk is being factored also. A one percent move in interest rates would shock a lot of bond portfolios. I do think that dividend yields should be aquired via S&P companies and not lesser equities vs. quality bonds.

A 1% move in long term interest rates means we are getting nominal

ReplyDeletegrowth...which I suspect would be greatly welcomed by the equity markets....

Buddy,

ReplyDeleteI think you are correct re dividend taxation. We need some clarity there...as well as other places. I also agree that bond risk is being mispriced. As soon as institutions start experiencing losses on their bond portfolios there likely will be a realignment of assets into other classes (equities). That will be a huge source of fuel for the market. It's unlikely though, until the bond move runs its course.

Mr. Kowalski,

I have no doubt that the bears will ressurect the 'Euro debt crisis' again with the least little excuse they can muster. However, once a crisis breaks, is addressed, and left behind by the market it loses its ability to frighten as it did previously because people have seen it before and have made their adjustments. Not saying it can't be a problem, just that it may need to have a different twist to generate the same level of fear.

There is a huge amount of fear and uncertainty priced into the market now. And there are always 'problems' out there that one can say 'might' pop up. If one waits for a 'no problems' environment one 'might' never deploy one's cash into risk investments. Also, if one waited for the 'no problems' environment to do so, I strongly doubt there would be many bargains.

Thank you for your posts. I enjoy reading your perspectives.

John speaks with the wisdom of many years in the market. If you want to wait for all the problems to go away and for the coast to be clear, then you will most likely find that the opportunities have disappeared.

ReplyDeleteBuddy,

ReplyDeleteMcDonalds sold 10 and 30 yr bonds recently at a small spread to treasuries. I think the 10 yr rate was 3.8% or so.

Doug Kass was on 'fast money' the other day and asked the question:

"Why would one accept 3.8% interest from McDonald's when the stock yields 3.1%, and the dividend is raised 8 to 10% every year?" (this may not be a word-for-word quote but it is representatiove of the question).

This goes right to heart of the valuation disconnect the 'momentum of fear' is bringing to this market, and what Scott is addressing in this topic. These drastic imbalances rarely last...the incentives to the institutions that move these prices are too great to maintain the imbalance. Therin lies the opportunity for those willing ignore the vast army of pessimists bombarding the media and accept some risk for the promise of an unusual reward.

I believe the adjustment is already beginning. High quality dividend paying stocks (like McDonalds) have begun lifting in recent weeks, meaning institutions are seeing the disconnect and are shifting assets. I think this is likely to slowly continue and will become a rush once bond prices begin a corrective phase.

Fear creates bargains. If one waits for the fear to subside, so will the bargains.

John-

ReplyDeleteThat is interesting about McDonalds. And, I suspect (w/o any research) and outfit like McD will be able to maintain divvies, even in a down economy--after all, they sell food cheaply.

You know, some people are floating out idea that our nation is overindebted, in part because interest is tax deductible for businesses and homeowners. Maybe they are right.

If investors would covet dividend stocks again, it would allow Corporate America to raise capita with incurring debt. That, and eliminate tthe homeowner mortgage interest tax deduction, and we might put our nation on footing to lower debt levels.

As stated, I have long preferred dividends, and corporate policies that clearly state a goal of rising dividends.

After all, sooner or later, every corporation will become worthless--wiped out by creative destructionism. Even GM fell. IBM had to become a different company (services). I think I see distant writing on the wall for Microsoft--software will be free and great in 20 years, and perhaps cloud computing the norm.

That's fine--that's capitalism. So, you might as well earn a divvie along the way.

On the flip side of the pessimists is James Altucher, who thinks the S&P will rise to 1500. Is that just as ridiculous as believing the DOW will fall to 1000?

ReplyDeleteBill,

ReplyDeleteIf you think about the examples you are suggesting for just a few moments the question answers itself.

Benj,

ReplyDeleteIf one taxes something more, one gets less of it. If one taxes it less, one gets more of it.

Right?

WSJ online reports last week was a record for junk bond issuance.

ReplyDeleteQuoting 'Dealogic', $15.4 Billion of sub BBB grade bonds were issued last week...an all time record for one week. The average total for the month of August, a quiet month, is $6.5 billion over the past decade. So far this August, a total of $21.1 billion has been issued. There are still two weeks+ left in the month. Some of this is pent up demand from May-June during the "Euro collapse" panic when issuance was delayed.

So far this year, a total of $155 billion has been issued, easily on pace to equal the $164 billion issued in 2009.

This is making it easier for many corporations to refinance their debts on favorable terms. Demand for yield is high since treasury and high grade corporate debt yields are so low.

The capital markets appear to be functioning smoothly...good for the economy.

Bill: re the S&P 500. It is almost certain that the S&P 500 will reach 1500—the only unknown is when. But for the Dow to fall to 1000 is to predict the end of the world as we know it.

ReplyDeleteI'm from Singapore. I'm fascinated with GM and Ford, so far, how they have recalibrated themselves and become profitable. The industry auto practices is now a lot more disciplined rather than suicidal. I read that K-Mart yanked out thousands of products after the crisis and now looking into reintroducing them again. Good news isnt it? My question: How is corporate restructuring itself? How's the progress? Thanks.

ReplyDeleteSorry, but I am showing a 2% dividend yield on the S&P 500. Where are you getting the 6.8%? Thanks.

ReplyDeleteThe "earnings" I'm referring to are total after-tax profits. That is a much bigger than the dividend yield; dividends are only a part of corporate profits.

ReplyDeleteI see. Thanks.

ReplyDeleteToo bad earnings yield does not translate into realized gains in your pocket.

ReplyDeleteI would even guess a good many of the CEO's do not even know what a dividend program is or how to enact one. Dividends are not in their toolkit.

Buy back your stock via debt to cash out rich. Now that is in their toolkit!

The way to understand a man is to understand his incentives. Dividend policy was tossed by the waste side over a decade ago because management cannot lever it up and make boat loads of money.

In addition, investment banks are not going to pitch management on sound dividend policy. They won't make any money either!

Corporations will continue to amass war chests filled with money yet shareholders will barely see a lick of it.

BTW Scott the Nikkei is down 75% over the past few decades. The DOW at 2,000 is hardly a far stretch.= all things considered. It may be the black swan you are unwilling to let enter your models.

It does not need to be a dramatic drop to much lower levels either. A good long decades worth of grinding can eat away plenty of illusory profits.

ReplyDeleteI suspect many people cannot envision going from 10K to 2-3K because it seems like such a massive society wrenching journey. However, if you chip away at it with unsound money policy form the central bank, you can get there in due time.

No theatrics necessary.

Public Library-

ReplyDeleteMature publicly held companies should absolutely think dividends.

But usually, they thik M&A. The M&A route usually fails--but seems like "doing something." Feels dynamic.

Standing your ground and sending money to shareholders--not so exciting.

Being on the selling end might make sense--if someone wants to overpay for your company, then sell. Again, not in management interest.

BTW, I have run small businesses. There is no way a buyer can ever know 1/10th as much as the seller about a company. So, why ever be a buyer?

Not to mention in competitive bidding the buyer pays the highest price or is in essence, the losers.

ReplyDeleteThink about how foolish millions of Americans must feel for entering bidding wars on now underwater properties. What a joke.

As I have said before, I would rather buy a house when rates are at 8% and the bank requires 20% down. You won't find half as many weak borrowers under those conditions in a normal economic environment.