Wednesday, June 16, 2010

Housing market is still in a slow but uneven recovery

There are two ways to tell the story behind today's release of May housing starts: 1) (from Bloomberg) "Builders broke ground on fewer U.S. homes in May than anticipated after the expiration of a tax credit, indicating the real estate market will struggle without government incentives." 2) (from me) Despite an unexpected decline in May, the pace of new home construction was up at an annualized pace of 24% relative to its all-time low in April '09, while building permits were up at an 8.5% pace relative to their March '09 low, suggesting that the housing market's recovery from its unprecedented collapse will be uneven.

In any event, I'm having trouble connecting the May weakness in housing starts to the April expiration of the tax credit. Seems to me that the only way to take advantage of the tax credit would have been to start construction long before April—as far as I know, we have not yet returned to the days when home buyers were so desperate to buy that they would sign a contract as soon as ground was broken. If the tax credit expiration were to have had a big impact on starts, we would have seen starts decline early this year, but they didn't. What we have is a typical pattern for this series, which is almost always volatile from month to month.

To me its clear that the outlook for the residential construction market has improved dramatically over the past year or so, and that view is confirmed in this index of the stock prices of 18 leading home builders, which is up 110% from its March '09 low. The "worst nightmare" collapse is a thing of the past, and now the issue is how fast the pace of recovery will be. For quite awhile I've expected to see a slow but gradual recovery in residential construction, and so far that's what it looks like. And it's important to recall that the current pace of home construction is still far below what is needed to keep pace with ongoing household formations, so for the foreseeable future the economy's pent-up demand for new homes will be rising every month.

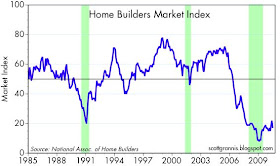

UPDATE: The above charts and conclusions I believe are consistent with the weakness reported in the NAHB release for June that was reported yesterday, and is charted here:

BTW, cover business section Los Angeles Times today refers to 7.2 percent hike in Southland home sales, on a 22 percent hike in prices, y-o-y.

ReplyDeleteMy own take is that home sales in Los Angeles are chugging along, and people like the prices (way down) and interest rates (low).

The low interest rate environment, in my opinion, is permanent. Lenders will swamp quality borrowers for decades.

I suppose eventually home prices will become relatively high again.

wow again!

ReplyDelete