Thursday, June 17, 2010

Household financial burdens continue to decline, and that is good

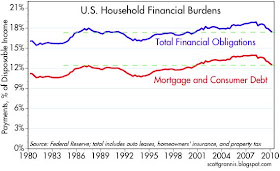

The Federal Reserve today released their estimates of households' financial burdens, and the news continues to be good. The chart shows two measures of financial burdens: mortgage and consumer debt payments as a percent of disposable income (red), and total financial obligations (mortgage and consumer debt payments, auto leases, homeowners' insurance, and property tax) as a percent of disposable income. By either measure, financial burdens are no greater today than they were in the mid- to late 1980s. There is no evidence at all to support the notion that households are over-extended or at risk.

Households have been hard at work deleveraging their finances since the peak of 2007, but they were never seriously at risk to begin with. I've been showing this chart since Dec. 2008, when I argued that "once the financial system finishes writing down the value that has been lost to plunging housing values and collapsing commodity prices, we will discover that the basic economy (the consumer) is still in reasonably good shape." And so it appears today.

I would also point out that while so many commentators fret that deleveraging poses a serious threat to the economy's ability to grow, that is not the case at all. Consider that there has been considerable deleveraging since 2007 (as shown by the decline in financial burdens in this chart), but meanwhile the economy hit bottom about a year ago and has been growing ever since. Economic growth can be facilitated by increased debt, but debt is not essential for growth, nor does declining debt mean that growth must reverse.

Household Debt service to GDP is now 9.46% the lowest since 2nd qtr 2001.As a point of reference it was 8.8% in 1990. The high was 10.28% in the 4th qtr 2006.

ReplyDeleteOn the face of it, lower debt burdens are exceptionally good news. Statistics can, though, be deceiving. I hope not in this case, but it would be interesting to see the historical numbers for different income levels. If the reduction is largely due to the wealthy paying off mortgages and boat loans, that's not quite as helpful. That's not to minimize the trend, it is certainly good news. The federal reserve data doesn't seem to have more detail.

ReplyDeleteScott,

ReplyDeleteI believe that you've done a great job showing how the debt payment burdens are reasonable and not a threat to the economy. (I really enjoyed the article showing household's fixed and variable assets and liabilities. It countered very nicely the argument that rising interest rates would crush consumers.)

However, that being said, there has been a dramatic increase in both private and total debt relative to GDP over the past 30 years. Do you think that there are no consequences to that level of debt. As you know, many economics use that ratio to argue that we are in the Great Depression II, showing how the debt levels were also quite high in the late 1920s.

Again, I tend to side with you in that the cost of servicing that debt simply isn't abnormal. But it's hard to look debt to GDP levels and not be a little concerned.

However, I again side with you in that even if consumers decide that they want to reduce their debt levels - which many people argue will depress spending and thus drag down the economy - they will pay that money to somebody, most likely banks. Well, that banks can't sit on that money for long; they have to do something with it, probably make loans, which is what banks do.

However, if businesses don't want to expand because consumers aren't buying and consumers don't want to buy because they are deleveraging, I'm not sure to whom to the banks lend the money they get from the consumer deleveraging.

You often mention that one man's interest and debt is another's income and asset and thus if the first man pays the debt off early, it's a wash because the second man will use that money to buy things. But when you throw banks into the mix, that's not exactly true. The banks get the money, but they can't lend if no one wants to take out a loan or if people don't qualify as a good risk. In that case, the deleveraging does cause a drop in demand and thus slower economic growth.

How do you deal with that argument?

Thanks.

Mortgage and consumer debt is at least 1% of income higher than in 1983 and 1993 - similar points in the business cycle to where we are today. On top of this, inflation was reducing debt burdens in those earlier years. I don't think that consumers are finished deleveraging.

ReplyDeleteAs far as absolute levels of debt are concerned, this is a very difficult number to analyze because every debt is someone else's asset. In 1982, my level of debt was about 100% of my income. Today, it is 200% of my income. In 1982 my financial situation was precarious. Today, I am on the verge of retiring comfortably and securely. No doubt much of my 401k money is invested in consumer debt just like the debt I owe. There are obvious reasons why I don't pay off my mortgage tomorrow and some reasons that are not so obvious. These reasons apply to many others at my stage in life.

The ratio of debt to GDP must have some significance for the economy but it's not really clear what it is. I imagine it has to do with the costs and uncertainties that arise when a chain reaction of bankruptcies and liquidations is triggered.

CFP, EA: Consumers and businesses are deleveraging and reluctant to borrow, but our government is quite eager to borrow these days. It is not unusual at all for government borrowing to rise at times that private sector borrowing declines. The problem, of course, is that government tends to use borrowed funds very inefficiently (if not corruptly), and that squanders the economy's growth potential.

ReplyDelete