Monday, May 3, 2010

Consumer spending is on the right track

As a supply-sider I tend to ignore consumer spending, since I think the major drivers of growth can instead be found on the "supply-side" of the economy: e.g., jobs, hours worked, capital spending, and industrial production. Normally, you can't have an increase in spending without first having an increase in jobs and production. But this recession/recovery cycle has been a bit different from the norm, since it was largely panic-induced. Fears of a global financial meltdown caused consumers everywhere to shut their wallets in an attempt to boost their holdings of cash. A massive increase in the public's demand for money caused a dramatic and sudden decline in spending. As I've been documenting over most of the past year, the level of panic has gradually subsided, confidence is slowly returning, and money that was hoarded is beginning to be spent. So an increase in spending is a good sign, this time, that the outlook for the economy is improving. With spending up, jobs are likely to follow.

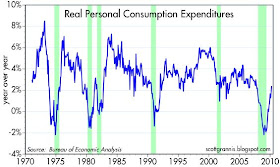

The chart above is just one more example of how spending has come back to life. The decline in real consumption spending was quite pronounced, and while the rebound was not sudden and sharp, the recovery pattern we are seeing is not greatly different from what we have seen in other modern-day business cycles.

PCE might be up, but that is being financed by government transfer payments. On the income side, check out how bad personal income less personal current transfer receipts looked. Up 0.3% annualized in March. That is a horrible number. 41% of incremental personal outlays for March were funded by Social Security, Medicare, unemployment benefits and other transfer payments (assuming a marginal propensity to consume of 100% of this income). I thought this was a particularly low-quality report.

ReplyDeleteDon't forget, however, that economic activity and spending in general were most likely quite depressed in March due to bad weather. Also, it's very important to remember that transfer payments don't create new demand, they simply shift demand from one person to another. So I don't think you can easily dismiss this report.

ReplyDeleteDale,

ReplyDeleteThis is purely anecdotal but I believe it is representative of what is happening with the consumer.

My younger brother is an executive with the largest wholesale plant nursery on the Gulf Coast. They sell to all the major retailers such as Lows, Home Depot, Wal Mart and literally hundreds of smaller retailers from Texas to south Florida. He told me yesterday they had their best month EVER in April. He said the increases did NOT come from landscapers (they WERE part of the mix) but from individual consumers going to Lows, etc. and buying plants.

If I tried to tell him his sales were coming from food stamps and government transfer payments I think he would get a pretty good chuckle.

If the southern consumer is confident enough to go out and spend money on house and yard plants, he/she will also go out to eat, buy a new lawn mower or grill, and plan a summer vacation to the beach or mountains. I think Scott has it right. Its going in the right direction and its a trend that is not going to reverse anytime soon. Its strickly a matter of the size of the increases.

Scott,

ReplyDeleteTransfer payments rose 13.3% MoM annualized. Without that government-funded income, personal incomes would have been up 0.2% annualized. If that income and presumably consumption are debt-financed by the government, it transforms non-consumption from the saver to consumption by the borrower (the US government). Technically, this isn't consumption by the government, since it's transferred from the government account to the PCE account, but let's just call it what it is: consumption financed by the government. The real wage and dividend-earning economy out there hardly grew its income last month when you adjust for the surge in transfer payments.

John, thanks for the info. My point isn't that all spending is coming from food stamps. My point is that a large portion of incremental PCE is. I would add it's also coming from people saving less. I agree there is momentum in the economy.

Here are the primary data:

http://tinyurl.com/373agn2

Dale,

ReplyDeleteSorry, your link does not work.

I see your point about the 'transfer payments' now. You don't think the spending is legitiment because our government runs a fiscal deficit. Thats fine. But the fact remains that personal consumption is up and the economy is improving.

If you are suggesting we may pay dearly down the road somewhere because we are borrowing too much money I am with you. I just don't see it happening soon. But as I have posted before, nobody KNOWS if or when the world's investors will lose their confidence in our currency and economy. We have problems but so does everyone else (see Europe's current troubles).

Hello, I am the webmaster of the site following

ReplyDeletehttp://weinstein-forcastinvest.net/

I found your site a very good level and I look every day

I commend you for your work

Excuse me for my English, I'm French speaking Belgium

Is it possible to exchange our respective links?

John,

ReplyDeleteSorry about that. Here is the longer link to the BEA website:

http://bea.gov/national/nipaweb/TableView.asp?SelectedTable=76&ViewSeries=NO&Java=no&Request3Place=N&3Place=N&FromView=YES&Freq=Month&FirstYear=2010&LastYear=2010&3Place=N&Update=Update&JavaBox=no

Yes, I am only pointing out the government funds a large part of marginal economic activity, not that consumption is not growing. I don't have any opinion as to when that must end or whether it must end. I just think personal income is an important part of the overall P&L for households and I like to break that down further into personal income not funded by transfer receipts. That's the revenue line for householders. That they are spending is indubitable; how they are funding it is suspect to me right now.

DaleW: Some portion of the spending in the past year may indeed be coming from transfer payments that in turn were financed by government borrowing. But as I said earlier, and as I've said since early last year, I don't believe (and neither do a lot of economists) that government transfer payments result in any meaningful boost to economic activity. Borrowing money from Paul and giving it to Peter cannot possibly result in any net increase in overall demand. It may change the pattern of spending, since Peter's propensity to consume may be greater than Paul's, but it doesn't change aggregate demand. Furthermore, it is a slippery slope to argue that deficit spending and transfer payments make an economy stronger. It only gets you as far as Greece, and then you have to pay the piper.

ReplyDeleteBut as I said earlier, and as I've said since early last year, I don't believe (and neither do a lot of economists) that government transfer payments result in any meaningful boost to economic activity.

ReplyDeleteSo the 13.5% annualized increase in personal current transfer receipts in March did not boost demand in the US? The MoM annualized increase in personal current transfer receipts accounted for 77% of marginal DPI. Personal outlays rose by $60.6B annualized in March while DPI ex personal current transfer receipts rose by $7.4B, or 1.0% annually. Given the marginal propensity to consume transfer receipts is probably 100% (either because people live on it exclusively, it's provided to them in kind, or through cashless transfers), I would say the rise in transfer receipts explains about 41% of incremental personal outlays while transfer receipts only account for 20% of DPI.

I'm not claiming it makes the economy better. I'm just saying "here's the incremental income and here are the incremental outlays. Let's try to understand how those work together." I make no doctrinaire claims here, but to me, the macro theory you present doesn't foot with the actual data that is coming out in real time. You are saying the strength of growth in personal consumption is happening independent of the huge incremental injection of personal income into the economy that came from the US government. I apologize if I don't understand your point, but that does not make sense.

Dale: it is easy to see transfer payments to individuals and compare that to the rise in spending. But it is not easy to know what happened on the other side of the ledger. The money the government borrowed had to reduce someone else's spending power. Maybe some people found it harder to get a loan to buy something they wanted. Maybe some foreign countries bought Tbonds instead of buying more of our exports. Maybe some busineses and individuals decided to spend less and save more because they were concernoed about deficits leading to higher taxes, or just worried that big government is not a good thing in the long run. Whatever the case I just don't see how transfer payments can make the economy grow.

ReplyDeleteScott,

ReplyDeleteHave you seen the flow of funds data? Flows to fixed income from equities are huge. I agree perhaps someone is deferring consumption to acquire treasury bonds, but there is an equally strong hypothesis to be made they sold stocks and went to fixed. What about the reserves that have been created in the system? Banks have every incentive to buy treasuries when the Basel II weighting on a US sovereign is 0% and they can generate NIM on such a steep yield curve.

Trading partners don't have to buy our exports. They can just sell dollars. In fact, that's what happens with most revenue from the sale of oil.

Whatever the case I just don't see how transfer payments can make the economy grow.

I think it's a bit of a stretch to see transfer receipts go up $25B, DPI go up $32B, and personal outlays go up $61B and believe the huge increase in personal income due to personal current transfer receipts had nothing to do with it on a short-term basis. Maybe the rest of the economy adjusted in real time by pulling back consumption or investment such that incremental personal consumption and GDP were not effected. One can sell an existing portion of outstanding securities in an economy and buy newly-issued treasury debt, however, without forgoing one's own investment consumption and still give rise to new consumption through the funding of personal current transfer receipts. That can happen either directly or through the liquidity that has been built up at the banks, especially when you can leverage US sovereigns at 20x in the US banking system. If you doubt that, take a look at the Japanese banks' balance sheets. Many of the money center banks have 6-8% tier 1 capital and TCE of 1.5% to 2.0%.

This should read: One can sell an existing portion of outstanding securities in an economy and buy newly-issued treasury debt, however, without forgoing one's own investment or consumption..."

ReplyDelete