Monday, January 4, 2010

ISM: what deflation?

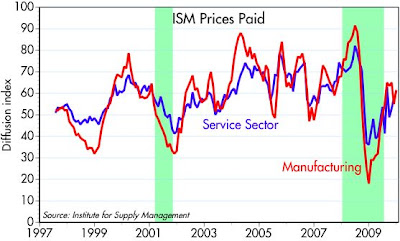

This charts shows the results of a survey of purchasing managers from manufacturing and service sector industries regarding how the prices they are paying compare to the prior month's prices. Today's reading of 61.5 for the prices paid by manufacturing industries implies that 61.5% of those surveyed reported paying higher prices in December.

This is most definitely not the stuff of which deflations are made. Despite the huge amount of "slack" that supposedly exists in the manufacturing sector (capacity utilization rates, according to the Fed, are only 71.3%, a level that was exceeded only in the depths of the 1982 recession), a clear majority of firms are seeing, and paying, higher prices for their inputs.

I still see great numbers of analysts worrying about the risk of deflation, despite the Fed's extraordinary efforts to avoid such an outcome, and despite mounting evidence that a lot of prices are rising. I would strongly recommend scratching deflation from your list of things to worry about. Doing so reveals a distribution of expected returns for all manner of risk assets that is strongly skewed to the positive.

sorry but deflation is defined by "prices received" and not by "prices paid". So no connection

ReplyDeleteIf a majority of manufacturing firms are paying higher prices for their inputs, then there is certainly no deflation for the sellers of those inputs.

ReplyDeletewhat relevance does it have for inflation/deflation defined as CPI which goes into Taylor rule used by Fed and so on? Your assumption of stable or increasing margins is just that - assumption.

ReplyDeleteDeflation properly defined is a decline in the general price level. Most, if not all, prices fall in a deflation. What we see instead is that almost all commodity prices are rising (strongly), the majority of manufacturing firms are paying higher prices for their inputs, corporate profits are rising (suggesting rising margins), and incomes are rising (i.e., labor costs are rising). Plus, monetary policy is extraordinarily easy, real interest rates are very low, and the dollar is weak (suggesting an abundance of money supply relative to demand, a necessary condition for inflation). This goes directly counter to the theory that a large amount of economic slack such as we have today should lead to deflation. In my view all of the above effectively rules out the likelihood of deflation.

ReplyDeleteeverything you cited is not the driver of prices though might have correlation with them. Prices are defined by equilibrium between demand and supply. Supply side is in abundance atm, demand side is missing and in fact is still in destruction mode due to increasing unemployment, rising savings, deleveraging and all talk about scary budget deficits. All this means to me that any conclusion about inflation/deflation is way too pre-mature but I see more signs in favour of deflation than inflation.

ReplyDeleteMoreover, commodity prices (due to cheaper dollar) and corporate profits (due to cost cutting) are largely one-off events and can not qualify as inflation/deflation which is a continuous process

Supposedly, we are enjoying rather large gains in worker productivity (esp. in manufacturing). Even if there are wage increases (and that is dubious), they will be mitigated.

ReplyDeleteFactory rents are very soft (they'll give space to you in many regions of the country).

Utility prices stable.

Equipment prices are soft.

Hard to see inflation in this mix, at least in manufacturing sector.

If volume increases, we may even see lower prices, as fixed costs get spread around larger unit volume.

Services?

Outside of military hardware and services, and healthcare, what inflation?

Everybody is crambling for work.

Sonme surveys seem to be a litle off. This one seems off.