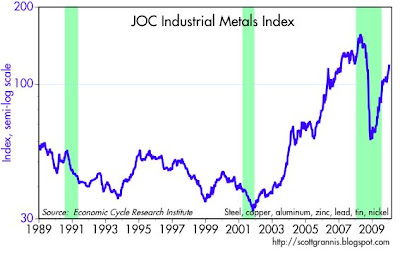

The extreme volatility of industrial metals prices in the past two years compels me to feature this chart, which shows the metals subindex of the Journal of Commerce commodity index. Since the end of the 2001 recession, industrial metals prices have risen fully 250%, yet they are still 23% below their high of April '08.

Other important observations: It cannot be a coincidence that the long slide in commodity prices which started in 1996 and ended in Nov. '01 occurred during a period in which U.S. monetary policy was unusually tight. This shows up in the second chart as a real Federal funds rate that averaged about 4%. During this same period, the U.S. economy was for the most part unusually strong. Since 2001, monetary policy has been erratic but generally accomodative, while the economy has not been particularly strong, and in fact suffered one of its most painful recessions. Yet commodity prices have surged.

The conclusion I draw from this is that monetary policy has had a very important influence on commodity prices. As long as monetary policy remains accommodative, commodity prices are likely to continue to rise, especially if the U.S. and global economies continue to gain strength. Commodity prices are not yet in bubble territory, by my estimation, but they could well be the next bubble to form.

Scott, I don't see the correlation as proven by your charts. For example, how do you explain 1991-1993 and 2005-2007?

ReplyDeleteIf there were a way to link Fed policy and commodity prices in a scientific fashion, the person who could do it would become fabulously rich. As it is, I think it is an art more than a science. But there does appear to be a connection, and it operates with a lag. The early 90s were characterized by soft growth and the lingering effects of the tight money that caused the recession of 90-91. So commodity prices were weak. The '05-'07 runup in commodity prices had a lot to do with a significant pickup in global growth, as well as the lingering effects of the very easy money in the preceding years. That's the best I can do to answer your question.

ReplyDeleteScott, I love your blog. you've persuaded me that the U.S. economy is a slot stronger than many people think. The one major concern I have is that China will implode. My concern is based on stories and videos I've read/seen about over-building and over-capacity. Do you agree that this a material risk? If so, does that argue for a more conservative approach to investing (e.g. limiting exposure to equities)?

ReplyDeleteI've seen lots of scary commentaries on China. I'm certainly no expert on the country, but I find it hard to believe that it is going to implode. China has a massive population that is very eager to catch up to the rest of the world's living standards. The country is likely to experience strong growth for a long time. Of course there will be problems along the way. The government can't possibly do everything right, but they are gradually lifting controls and allowing free market forces to work. One important point: I don't see the currency as being "manipulated." Pegging the yuan to the dollar is a perfectly reasonable monetary policy and needn't produce undesirable outcomes. The problem today, however, is that the dollar is very weak, and this makes the yuan weak, and that in turn increases inflationary pressures in China. Allowing the yuan to revalue against the dollar mitigates that problem.

ReplyDelete